Bitcoin (BTC) continued to fight on Thursday while he was fighting to stay above $ 80,000. The largest cryptocurrency by market capitalization is currently down 3% compared to the day. It decreased by 13% in the first quarter and is around 30% reduction on its top of all time from January.

According to Glassnode data, short -term holders – investors who have Bitcoin for less than 155 days – are mainly considered as speculators who tend to enter the market during pricing or euphoria periods on the market. Since February, they have sold more than 100,000 BTCs (about 8 billion dollars at current prices), a sign that they seek to reduce losses (or lock profits) before prices drop further.

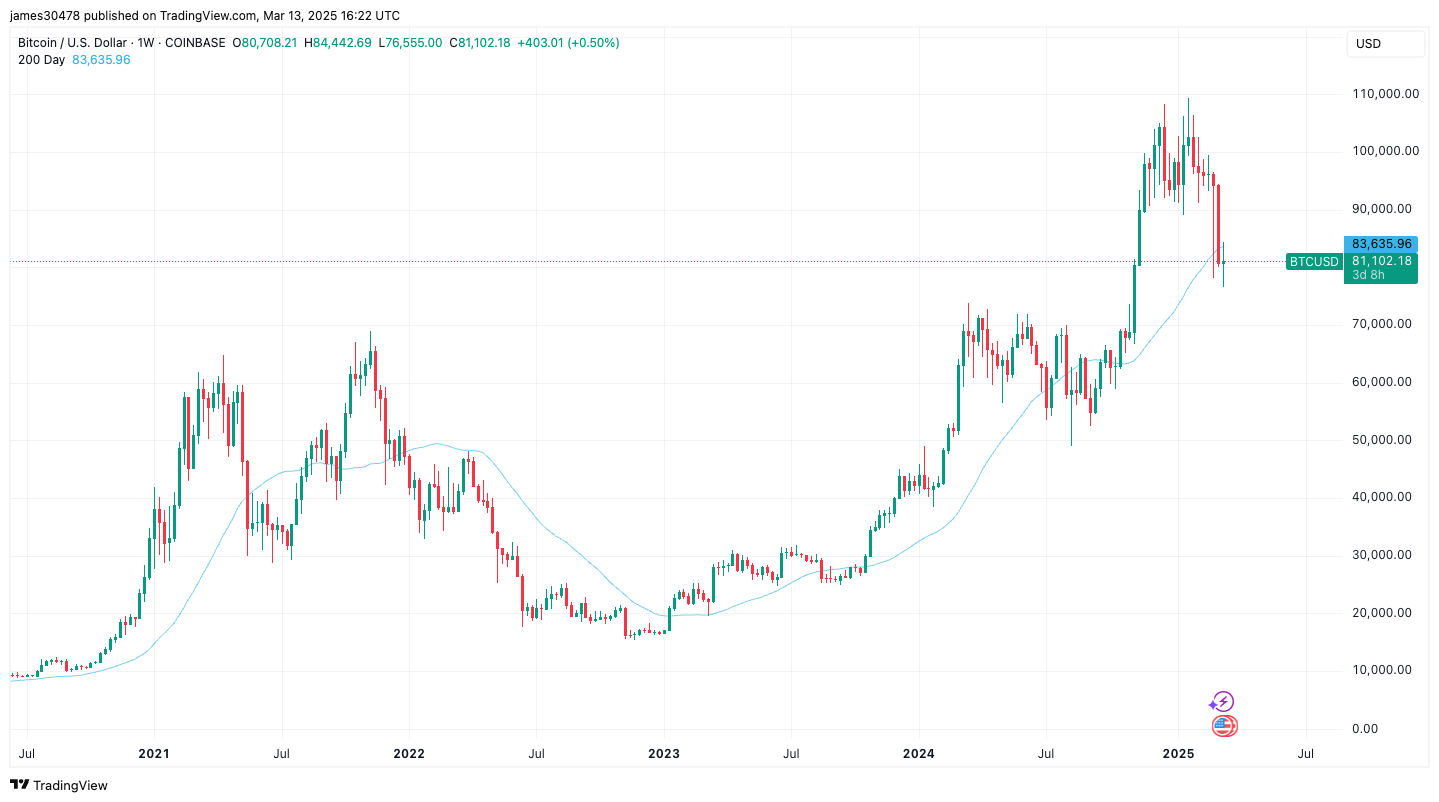

The decline pushed the price of Bitcoin below its 200 -day mobile average of $ 86,300. The average is an important metric for long-term market trends, and the BTC is not the only risk investment to drop below.

American actions, measured by the S&P 500, have also lost this level. The index is currently about 5,537 while the 200 days average is 5,738.

According to Joe Carlasare, a salesperson supporting Bitcoin, when the S&P 500 has trouble recovering the 200-DMA, the story suggests that lower prices are in sight.

“The S&P 500 continues to fight to recover the 200 days,” he wrote on X. “If we cannot get a big rally above soon, it is logical to expect at lower prices, look historically what is happening when we lose the 200 days.”