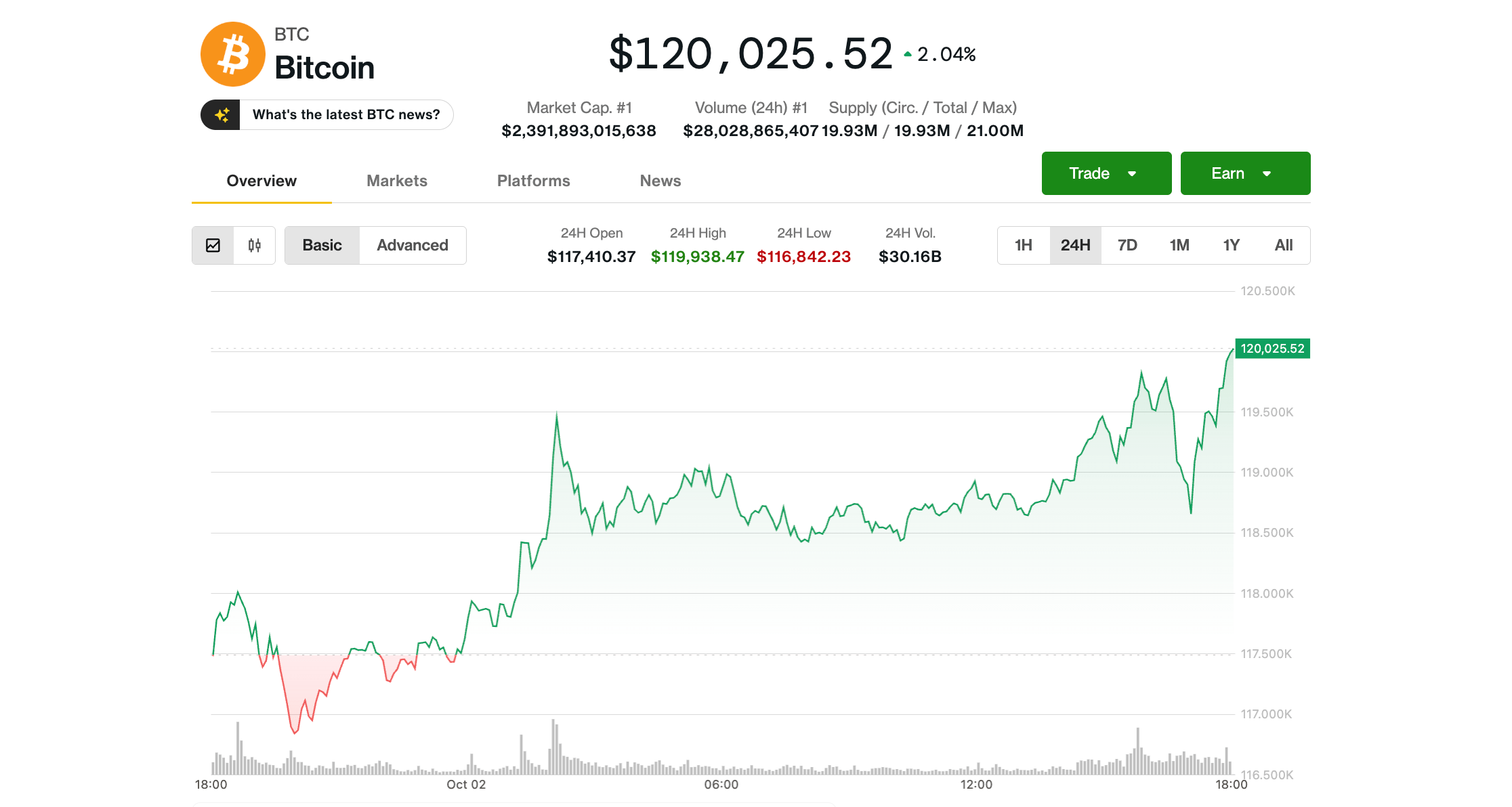

Bitcoin Broken above $ 120,000, a level not seen since mid-August, because traders position themselves for a bullish October for risk assets.

The token has climbed regularly in the last five days, recalling a decline at the end of September. Analysts highlight a renewal of optimism around macroeconomic tail winds which could increase risks of risks in the last quarter of the year.

On the derivative market, BTC’s term contracts flash up bulls with open interests reaching a record summit of $ 32.6 billion, which suggests that traders position themselves for more increase. The chain analyst said that short positions are also accumulating, which could create an opportunity for short pressure.

Traders will be particularly focused on the next Fed meeting at the end of this month, which could occur without access to a new job report in the middle of the government’s closure. The Treasury Secretary, Scott Bessent, told CNBC on Thursday that the closure could further weaken the economy

“We could see a success in GDP, a growth stroke and a success to work in America,” he said.

Although historically the impact of a government closure on the economy was a minor, the threat of President Donald Trump to draw around 750,000 federal workers could have an effect in the current climate.

The appetite for the crypto could also be fueled by hopes for an incoming Altcoin season, because several applications for the funds (ETF) linked to Altcoin in exchange (ETF) will probably see approval once the government will reopen.

The FNB Litecoin of Canary Capital is due to an answer today, others being faced with deadlines between October 10 and 24. The Securities and Exchange Commission (SEC), however, confirmed on Wednesday that it will not review any request when closing.

Similar to Bitcoin, altcoins were negotiated in the last 24 hours, directed by Which was up almost 3%. The Coindesk 20 index, which follows the performance of the 20 largest cryptographic assets, is 1.5% higher over the same period.

Paul Howard, principal director of the Crypto Winccent Commercial Company, was skeptical earlier this week about Bitcoin’s rebound, but he overthrew the strength of the advance of the last days.

“With $ BTC exchange at levels for the last time in mid-July, total market capitalization is again greater than 4 billions of dollars,” he noted. “We have seen a higher version higher exceeded $ 115,000, indicating that we are now more likely to stay above this level, with a CME deviation to be locking in the ground at $ 110,000.”

“I think we are now ready to see a sustained rally over $ 120,000 in the coming weeks,” he added.