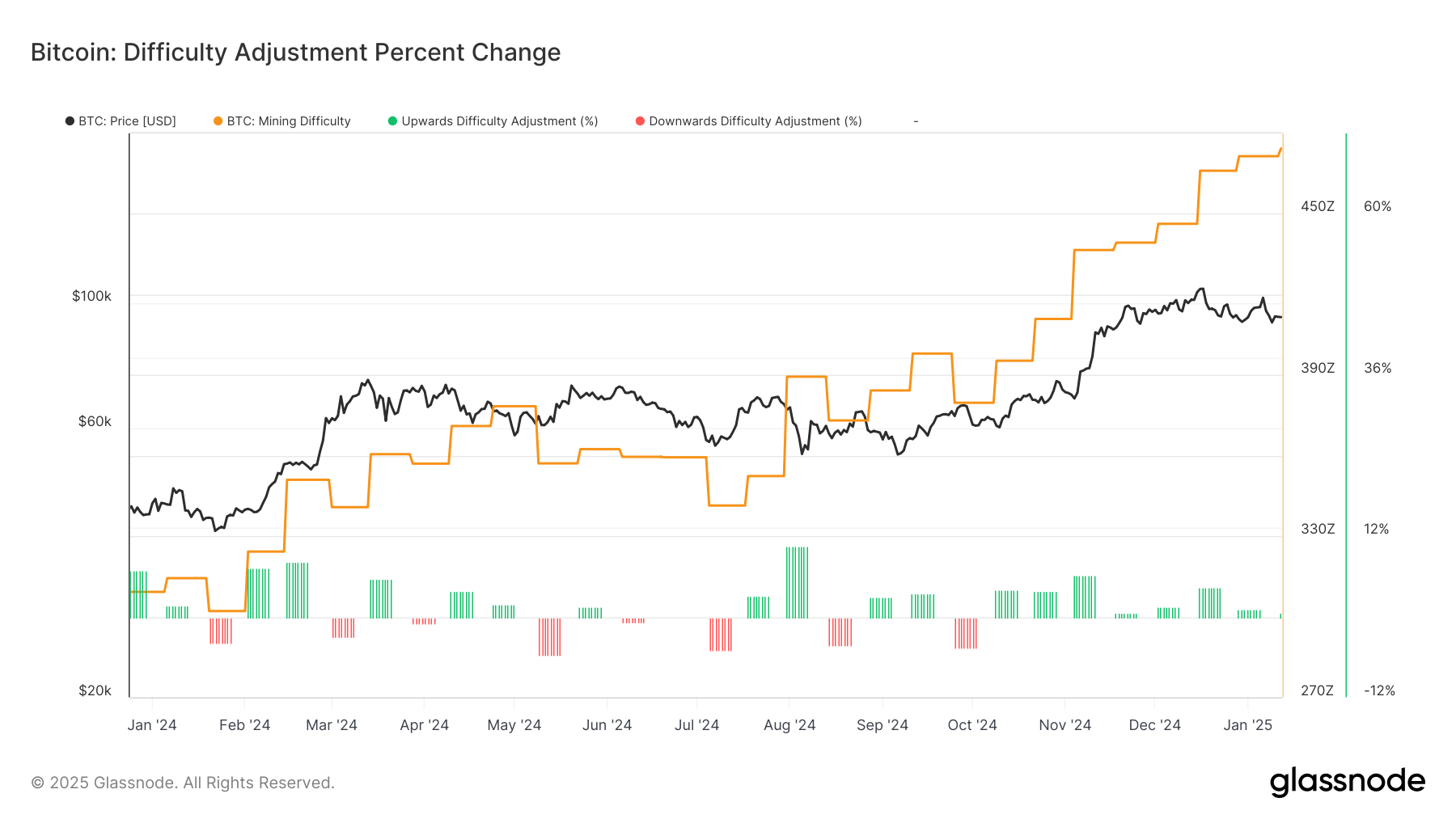

New records continue to be set in the Bitcoin (BTC) ecosystem, which saw mining difficulty adjustment reach a new all-time high of 110.45T (trillion). 110.45 trillion means the difficulty is approximately 110.45 trillion times harder than it was at the time of Bitcoin’s genesis block.

Difficulty adjustment adjusts every 2,016 blocks and recalibrates to ensure blocks are mined on average every 10 minutes.

This is now the eighth consecutive positive adjustment in difficulty, putting additional pressure on miners as the industry becomes more cutthroat and more difficult to mine a block to receive bitcoin rewards.

This is one of the reasons why some publicly traded miners turned to the high performance computing (HPC) and artificial intelligence (AI) sectors, as they could not survive by mining Bitcoin alone. Additionally, we have seen MARA Holdings (MARA) issue convertible bonds to purchase Bitcoin. In addition to MARA, he maximizes his income by lending his bitcoins to earn a single-digit return.

This is not the first time we have seen so many consecutive positive adjustments. We’ve seen these types of records before, during the summer of 2021, shortly after China’s mining ban, which saw the hashrate drop by around 50%.

Shortly after this event, from July to November 2021, the difficulty experienced nine consecutive positive adjustments, with the last adjustment coinciding with the peak of the bull market when bitcoin reached around $69,000. Bitcoin then entered a bear market for the entire year of 2022. The last positive adjustment marked the high in 2021.

However, the opposite happened in 2018, when Bitcoin made 17 positive adjustments compared to December 2017, which coincided with the peak of the bull market, when Bitcoin was around $20,000. A small negative adjustment followed in July 2018, when the price was around $6,000.

The network then made six more consecutive positive adjustments before seeing several negative adjustments around the fourth quarter of 2018, when Bitcoin hit its lowest level for the cycle at around $3,000.

No clear pattern appears when Bitcoin makes so many positive consecutive adjustments, but it has indicated close cycle highs and lows in the past. However, it is important to recognize that the ongoing strength of the hashrate, over a 7-day moving average, is 775 EH/s, with CoinDesk research implying that 1 zettahash per second can be reached before the next halving.