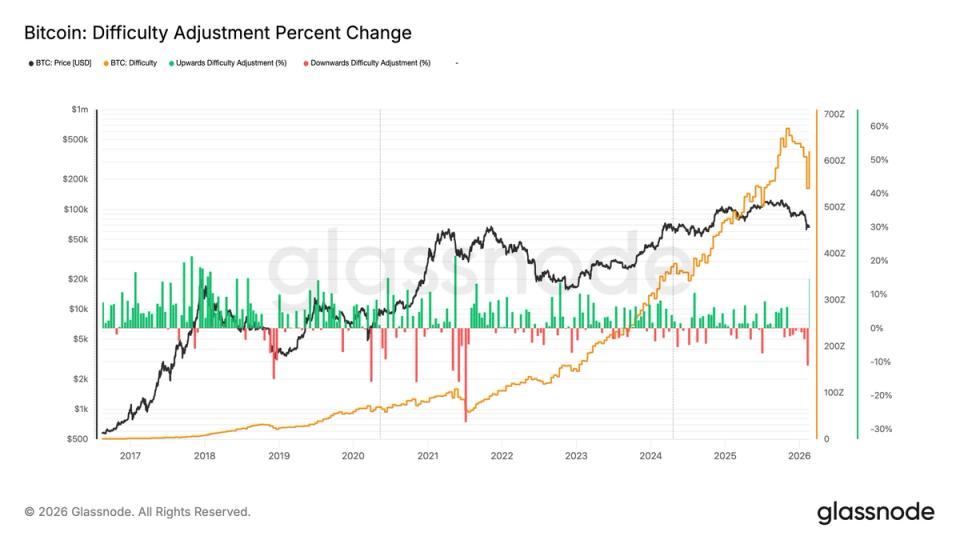

Bitcoin mining difficulty soared to 144.4 trillion (T), up 15%, the largest percentage increase since 2021, when China’s mining ban led to major disruption, which followed a 22% upward adjustment as the network stabilized.

Difficulty adjustments measure the difficulty of mining a new block on the network. It recalibrates every 2,016 blocks, approximately every two weeks, to ensure that blocks continue to be produced every 10 minutes or so, regardless of changes in the hashrate.

This adjustment follows a 12% drop in difficulty after a drop in bitcoin’s hashrate, which represents the total computing power securing the network. Mining activity suffered its biggest setback since late 2021 after a severe winter storm in the United States forced several major operators to scale back operations.

In October, when bitcoin hit an all-time high of around $126,500, the hashrate also peaked at 1.1 zettahash per second (ZH/s). As prices fell to $60,000 in February, the hashrate fell to 826 exahash per second (EH/s). Since then, the hashrate has returned to 1 ZH/s while the price has rebounded to around $67,000.

At the same time, hashprice, the estimated daily revenue miners earn per unit of hashrate, remains at its lowest level in several years ($23.9 PH/s), reducing profitability.

Despite this pressure on profitability, large operators with access to low-cost energy continue to exploit their production aggressively. The United Arab Emirates, for example, has approximately $344 million in unrealized profits from its mining operations.

Well-capitalized entities that can mine efficiently help keep the hashrate high and resilient, even amid moderate Bitcoin prices.