Cryptographic markets pushed higher on Monday while traders moved from geopolitical anxieties to institutional developments linked to crypto before the next meeting of the Federal Open Market Committee.

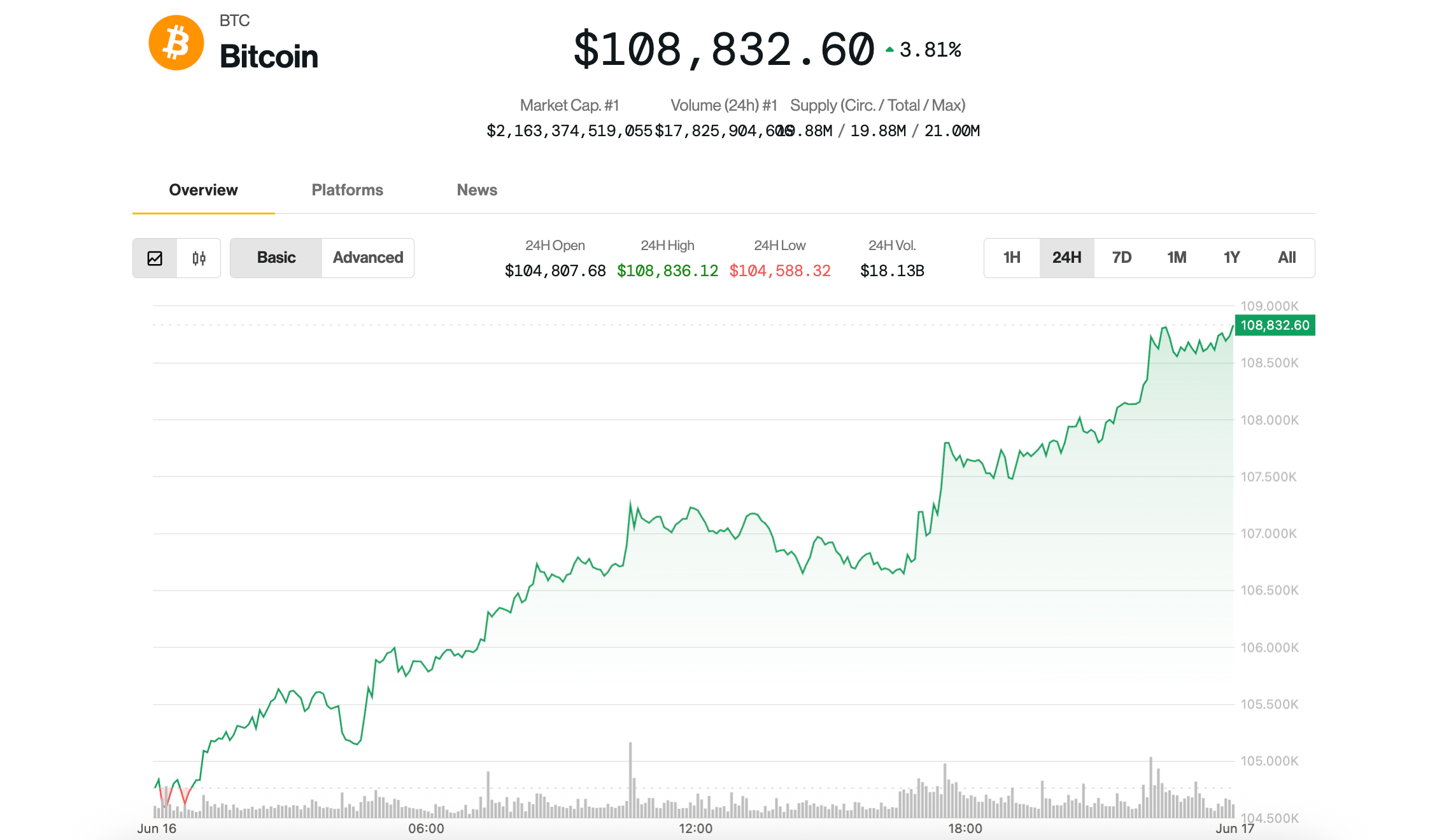

Bitcoin

increased by 3.1% in the last 24 hours and is now negotiated $ 108,600, or only a few thousand dollars below its record of all time. It was certainly not alone in his ascent. The Coindesk 20 – An index of the first 20 cryptocurrencies by market capitalization, excluding staboins, the same and exchange parts – is up 4.3%during the same period, supported by high performance of the chain and the chain, which both marked gains from 6 to 7%, and most other token increasing at least 3%.

A check on the traditional markets shows that Risk APPTITE returned after last week’s nervousness on Israel and Iran launch of missiles. The S&P 500 and Nasdaq indices rebounded 0.9%and 1.4%, while Safe Haven Gold decreased by 1.5%.

Crypto Stocks has also joined the push. Coinbase (room) and Circle (CRCL) closed the day 7.7% and 13% in green. Among Bitcoin, Bitdeer (BTDR) and Hut 8 (HUT) minors gained 6.9% and 5.6% respectively. Remarkably, one of the only actions in the red was the strategy (MSTR), which lost almost 0.2%, while the Bitcoin Metaplanet rival companies increased by 25% on the Japanese stock market.

The positive news related to crypto added more fuel to today’s rally: JPMorgan has filed a brand request for a product that seeks to offer digital asset services such as trading, exchange, payment services and the issue. Meanwhile, Asset Manager Objective is about to launch its XRP stock market fund in Canada, while the momentum for ETF focused on Altcoin increases.

When is the Altcoin season?

While the outperformance of today’s Altcoin may have inspired the hope of certain traders for an imminent Alt season, Nansen research analyst Nicolai Søndergaard has paid cold water to such expectations.

It is always Bitcoin that leads the market, he said, with the force often reversing the greatest performance of cryptography.

“BTC mainly served as a trigger for altcoins”, Søndergaard. “Some alts succeed as well. BTC breaks an ATH? The market likes it.” Certain benefits of the rise of BTC to a fresh record may have been able to go to other cryptos, while certain sectors such as DEFI have experienced short -term outperformance gusts.

“However, these have not been prolonged races for the Alts, and looking at the big scheme of things, most of the alts have been bleeding for some time,” he said. The objective is always very important on BTC. “”

Low’s strong Bitcoin rebound could well increase for the cryptography market.

Bitfinex analysts noted that the index index index Fear and Greed fell on the territory of “fear” last week, while the volume of Bitcoin Taker showed an aggressive sale.

“This behavior, combined with a peak in liquidations, looks like past capitulation style configurations that often mark local stockings,” said analysts. “If BTC can contain the area from $ 102,000 to $ 103,000, this may suggest that the sales pressure is absorbed and that the market could be ready for the recovery.”

Eyes on the Fed and Powell

From a macro lens, attention is downright on the press conference of the Federal Reserve and the President of the Fed.

Investors are massively expecting the FED to maintain stable reference rates this week and the next meeting in July, according to the CME Fedwatch tool, market players will focus on Powell’s remarks on the indices on how political decision -makers are sailing on inflation and pressures on the labor market.

“Powell’s tone, not the rate decision, will stimulate volatility,” said Swissblock, the digital asset analysis company, in a note on Monday. “Expect an exchange of lashes through basic products, yields and risk assets.”