Bitcoin

The minors are faced with mounting pressure while the hashrate and the difficulty of the network continue to climb, tightening the margins even if the price of bitcoin is stable, according to the monthly report of Theminemag.

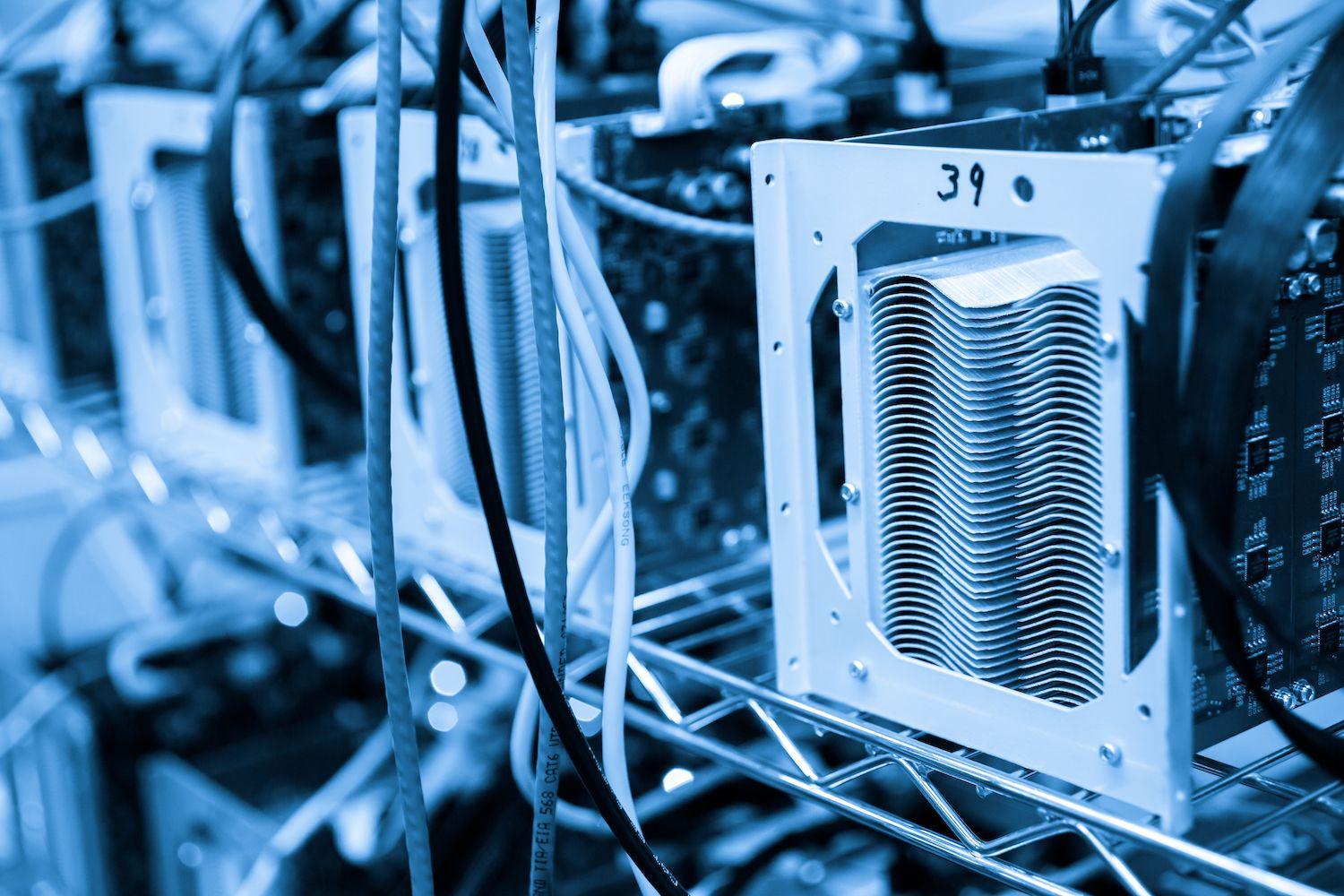

The mining difficulty of the network reached a record of 126.98 Billions, propelled by an average hashrate of 14 days of 913.54 Exehashes per second (EH / S). The transaction costs in June fell below 1% of block rewards, and hashprice fell to $ 52 per pH / s before bounced slightly.

Climbing competition and energy costs are expected to generate production expenses over $ 70,000 per BTC, compared to $ 64,000 in the first quarter of the year, according to the report.

To remain competitive, public minors such as Mara Holdings (Mara), Cleanspark (CLSK), Riot Platform (Riot) and Iren (Iren) accelerate constructions. Mara increased her hashrate by 30% in May, while Hive (Hive) added 32% after energizing a new installation in Paraguay. Cipher Mining (CIFF) targets an increase of 70% by widening its Texas operation.

High -level ASIC is now between $ 10 and $ 30 per Terahash, depending on the report, with operational recovery periods extending up to two years. This requires an electricity rate of $ 0.06 / kWh – already out of reach for some. Terawulf, for example, paid $ 0.081 / kWh in the first quarter, pushing its hashcost fleets by more than 25%.

Meanwhile, mining actions are available from the performance of Bitcoin prices. Iren, Core Scientific (Corz) and Bit Digital (BTBD) were all in the green in the last month, while Canaan (CAN) and Bitfarms (BitF) were both down to two figures during the same period.

The change suggests that investors pay more attention to commercial models rather than to the price of Bitcoin prices.