By James Van Stratotn (at all times and unless otherwise indicated)

After the consumer price inflation figures (IPC) on Wednesday, all eyes are now turning to the product price report at 8:30 am

Analysts expect the PPI from year to year reaching 3.2%, below 3.3%of December, with a monthly reading of 0.3%, against 0.2% . The basic PPI, which removes volatile food and energy prices, should display an underlying inflationary pressure, accelerating 0.3% compared to 0% in December. From January from last year, it was found at 3.3%.

Data warmer than expected could point out that monetary policy remains too cowardly, potentially delaying or even eliminating Fed’s rate reductions this year, against the wishes of President Trump. A more restrictive Fed is likely to be lower for risk assets. On the other hand, softer inflation data could weaken the dollar and reduce treasury yields while helping to increase risk assets.

After the IPC data markets were volatile.

Treasury yields jumped at 4.6% before retiring slightly. The dollar index (Dxy) reflected this movement, stabbing at 108.5 before retreating below 108.

Despite the initial sale, the major asset classes have rebounded, with Bitcoin (BTC), American actions and gold ending the session in green.

Also on the agenda, Coinbase (Coin) reports the revenues of the fourth quarter after the closing of the market. After the solid results of Robinhood, expectations are high and a positive report could give a boost to the cryptocurrency market. Stay vigilant!

What to look at

- Crypto:

- Macro

- February 13, 8:30 a.m.: The price index report (PPI) of the United States Office (BLS) publishes the January report.

- PPI Core Mom is. 0.3% against prev. 0%

- Core Ppi Yoy is. 3.3% against Plan. 3.5%

- Ppi Mom is. 0.3% against prev. 0.2%

- PPI YOY PREV. 3.3%

- February 13 at 8:30 am: The American Labor Department publishes the weekly unemployment insurance report for the closed week on February 8.

- Initial complaints on unemployment is. 215K against Prev. 219K

- February 14, 8:30 am: US Census Bureau publishes retail data in January.

- Retail sale Maman is. -0.1% against prev. 0.4%

- Retail sales Yoy prev. 3.9%

- February 13, 8:30 a.m.: The price index report (PPI) of the United States Office (BLS) publishes the January report.

- Gains

- February 13: Coinbase Global (Coin), post-market, $ 2.11

- February 14: RemixPoint (3825)

- February 18: Coinshares International (CS), pre-market

- February 18: Semler Scientific (SMLR), post-marketing

- February 20: Block (xyz), post-market, $ 0.88

Token events

- Governance votes and calls

- Curve Dao votes on the increase in the amplification coefficient of 3pool to 8,000 over 30 days and increases the administration fees to 100%. To optimize liquidity, as part of an experiment, 3pool will have higher costs while strategic reserves will offer lower costs.

- Aave Dao discusses the use of GHO as a gas token on various networks. The frame offers to use the canonical network bridge to test the GHO directly as a gas token.

- Unlocking

- February 14: The sandbox (sand) to unlock 8.4% of the supply in circulation worth 80.5 million dollars.

- February 16: Arbitrum (ARB) to unlock 2.13% of the supply in circulation worth $ 45.1 million.

- February 16: Avalanche (AVAX) to unlock 0.4% of the supply in circulation worth $ 42.8 million.

- February 21: Fast Token (FTN) to unlock 4.66% of the supply in circulation worth $ 79 million.

- February 28: Optimism (OP) to unlock 2.32% of the supply in circulation worth $ 34.8 million.

- Token launches

- February 13: Ethereumbow (Ethw) and the polygon (Matic) are no longer supported.

- February 13: Story (IP) to list on Bybit, Bitrue, Bitget, Mexc, Kucoin and OKX, among others.

- February 14: According to a message shared by the Penguins Grassouillards account.

Conferences:

Coindesk consensus to take place in Hong Kong on February 18 to 20 and in Toronto from May 14 to 16. Use the code’s day book and save 15% on passes.

Positioning of derivatives

- Funding rates in perpetual term contracts linked to soil, TRS, TRON and DOT remain negative, indicating a bias for shorts, Coinglass and VELO data shows.

- BTC and ETH annualized financing rates hover by almost 5%.

- Most major parts, excluding BNB, have experienced cumulative volume deltas adjusted to negative open interest, a sign of net sales pressure, which raises a question point on the sustainability of the post -resumption -Américan on Wednesday.

- BTC and ETH options are positive in all areas, reflecting a bias of a bull.

- The flows, however, have been stifled, with a certain request for higher strike ETH calls out of money, according to the DRIBIA and paradigm data sources.

Market movements:

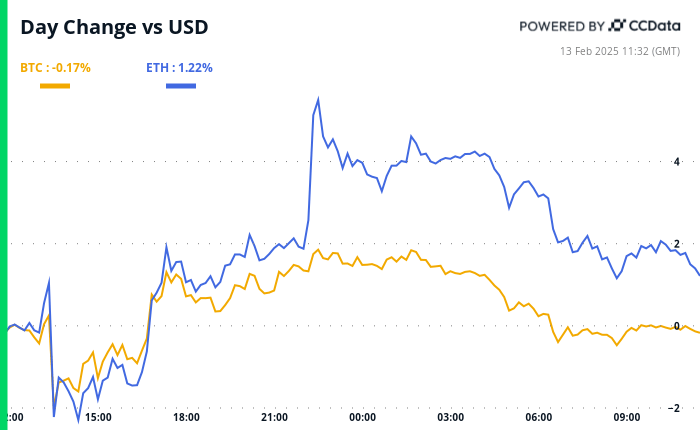

- BTC is down 1.53% compared to 4 p.m. HE Wednesday at $ 96,206.67 (24 hours: -0.02%)

- ETH is down 0.23% to $ 2,677.69 (24 hours: + 1.79%)

- Coindesk 20 is down 0.71% to 3,251.06 (24 hours: + 0.66%)

- The CESR ether composite pace is down 5 BPS to 3.05%

- The BTC financing rate is 0.0005% (0.5606% annualized) on Binance

- Dxy is down 0.34% to 107.58

- Gold is up 1.26% to $ 2945.7

- The money is up 0.49% to $ 32.85 / Oz

- Nikkei 225 closed 1.28% to 39,461.47

- Hang Seng Closed -0.20% at 21,814.37

- FTSE is down 0.74% to 8,742.63

- Euro Stoxx 50 increased by 1.23% to 5,471.99

- Djia closed Wednesday -0.50% to 44,368.56

- S&P 500 closed -0.24% to 6,051.97

- The Nasdaq closed 0.03% to 19,649.95

- The S & P / TSX composite index closed -0.27% at 25,563.1

- S&P 40 Latin America closed -0.93% to 2,421.78

- The 10 -year American treasure rate fell from 2 BPS to 4.61%

- E-Mini S&P 500 Futures are unchanged at 6,073

- The term contracts on the NASDAQ-100 E-Mini increased by 0.17% to 21,842.75

- E-minini Dow Jones Industrial Industrial Index In Term is unchanged at 44,480

Bitcoin statistics:

- BTC dominance: 60.91 (-0.14%)

- Ethereum / Bitcoin ratio: 0.02784 (-0.50)

- Hashrate (Mobile average at seven days): 802 EH / S

- Hashprice (spot): $ 53.2

- Total costs: 4.63 BTC / 446 657 $

- CME Futures open interest: 166 680 BTC

- BTC at the price of gold: 33.1 oz

- BTC vs Gold Bourse Capt: 9.40 Oz

Technical analysis

- Since the accident of January 3, Bitcoin has remained below the simple 50 -day mobile average (SMA).

- It now seems that the price has also dropped under the cloud of Ichimoku, suggesting a change in potential slide.

- This twin rupture could embrace the bears. Immediate support is observed at around $ 90,000.

Cryptographic actions

- Microstrategy (MSTR): closed Wednesday at $ 326.82 (+ 2.3%), down 0.56% to $ 325 in pre-commercialization.

- Coinbase Global (corner): closed at $ 274.90 (+ 3%), up 3.24% to $ 283.8 in pre-commercialization.

- Galaxy Digital Holdings (GLXY): closed at $ 26.87 CA (+ 1.24%)

- Mara Holdings (Mara): closed $ 16.24 (+ 1.37%), down 0.55% to $ 16.16 in pre-market.

- Platforms Riot (Riot): closed $ 11.16 (+ 0.18%), down 0.54% to $ 11.10 in pre-commercialization.

- Core Scientific (CORZ): closed at $ 12.09 (-1.39%), unchanged in pre-commercialization.

- Cleanspark (CLSK): closed at $ 10.52 (+ 2.33%), down 0.67% to $ 10.45 in pre-commercialization.

- Coinshares Valkyrie Bitcoin Miners Etf (WGMI): closed at $ 22.73 (+ 1.75%), unchanged in pre-commercialization.

- Semler Scientific (SMLR): closed at $ 47.69 (+ 1.51%), unchanged in pre-market.

- Exodus movement (Exodus): closed $ 48.85 (-0.63%), up 2.48% to $ 50.06 in pre-commercialization.

ETF Flows

BTC ETFS spot:

- Daily net flow: – $ 251 million

- Cumulative net flows: $ 40.21 billion

- Total BTC Holdings ~ 1.174 million.

ETH ETFF SPOT

- Daily net flow: – $ 40.9 million

- Cumulative net flows: $ 3.13 billion

- Total ETH Holdings ~ 3.788 million.

Source: Wacky investors

Nightflow

Graphic of the day

- Daily negotiation volumes in decentralized purses based on PancakesWap have reached the highest level since early December.

- The renewed activity partly explains the leap from Cake Token to a maximum of two months of $ 3.4.