A slightly viewed gap in the term contracts on Bitcoin CME (BTC) was fully filled one day after a record leap in opening and fence prices, perhaps preparing the land for the next climb.

The BTC climbed $ 92,000 on Monday, powered by a renewed institutional fervor after the American president Donald Trump announced plans for a strategic crypto reserve on Sunday evening, including the largest token and the ether (ETH), XRP, Sola’s Sol and Cardano’s Ada.

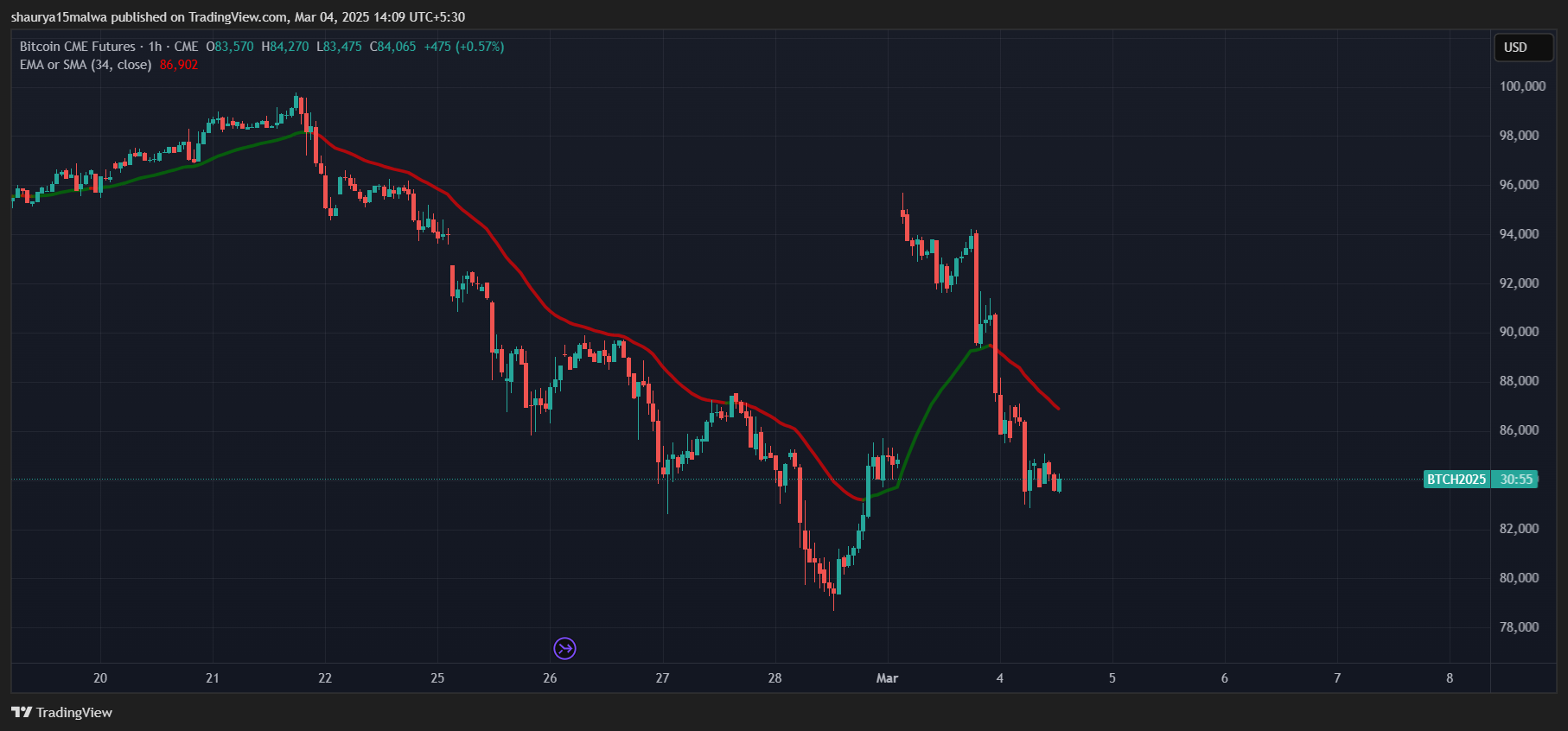

However, the rally left a significant gap in the table of future Bitcoin CME between the fence of Friday at $ 84,500 and the open Monday at $ 95,300. This was entirely by Asian afternoon on Tuesday with the BTC transferring to $ 83,500.

The CME gaps – The disparities in the prices caused by the closure of the stock market weekend while the punctual markets are negotiated 24 hours a day – tend to act historically as magnets for Bitcoin prices.

The data show that most of these gaps end up filling, often signaling a correction after net movements – and the filling of Tuesday gap is yet another example where BTC tends to return to balance after an explosive movement higher.

Meanwhile, Tuesday’s prices share evaporated more than $ 900 million ups of bullies on crypto-traced term contracts in the last 24 hours, shows the data, bringing three-day losses to more than $ 1.5 billion.

Nearly $ 400 million in Paris on higher Bitcoin prices have been liquidated in the past 24 hours, most of them in the United States and the early Asian hours, while BTC prices have turned over to the rally on Monday.

Liquidations occur when a scholarship firmly firm the lever effect position of a merchant due to a partial or total loss of the merchant’s initial margin. This happens when a trader cannot meet the margin requirements for a lever effect position, that is to say that he does not have enough funds to keep the trade open.

Unusual liquidations can be used in confluence with other market indicators in trading strategies. The assets can be considered to be overcrowded and ripe for a reversal or a profit – which makes it a set of data contrary to monitor.

So there are reasons to encourage now that the gap has been filled and that great liquidation has occurred? Maybe not.

A ventilation of the down range has made another difference in the term contracts on CME Bitcoin less than $ 80,000 under surveillance, which formed three months ago.

The gap appeared in CME Futures after Trump was elected president for the first time in early November, the prices having opened more than $ 81,000 – a notch greater than a summit of elections of $ 77,930.