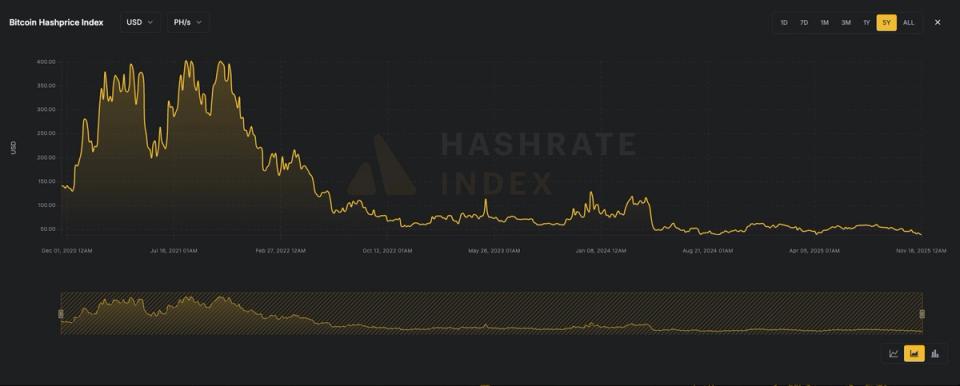

The Bitcoin hash price fell to its lowest level in five years, according to Luxor, now sitting at $38.2 PH/s. Hashprice, a term introduced by Luxor, measures the expected daily value of one terahash per second of computing power. The metric reflects the amount of revenue a miner can expect from a specific amount of hashrate. It can be denominated in any currency or asset, although it is usually displayed in USD or BTC.

Hashprice depends on four key variables: network difficulty, bitcoin price, block subsidy, and transaction fees. Hash price increases with bitcoin price and fee volume, and decreases as mining difficulty increases.

Bitcoin’s hashrate remains near record levels at over 1.1 ZH/s on a seven-day moving average. Meanwhile, bitcoin’s price is at $91,000, down about 30% from its all-time high of over $126,000 in October, and network difficulty remains near all-time highs at 152 trillion