Friday, cryptographic markets had a relatively calm day despite the renewal of the threat of prices.

Bitcoin

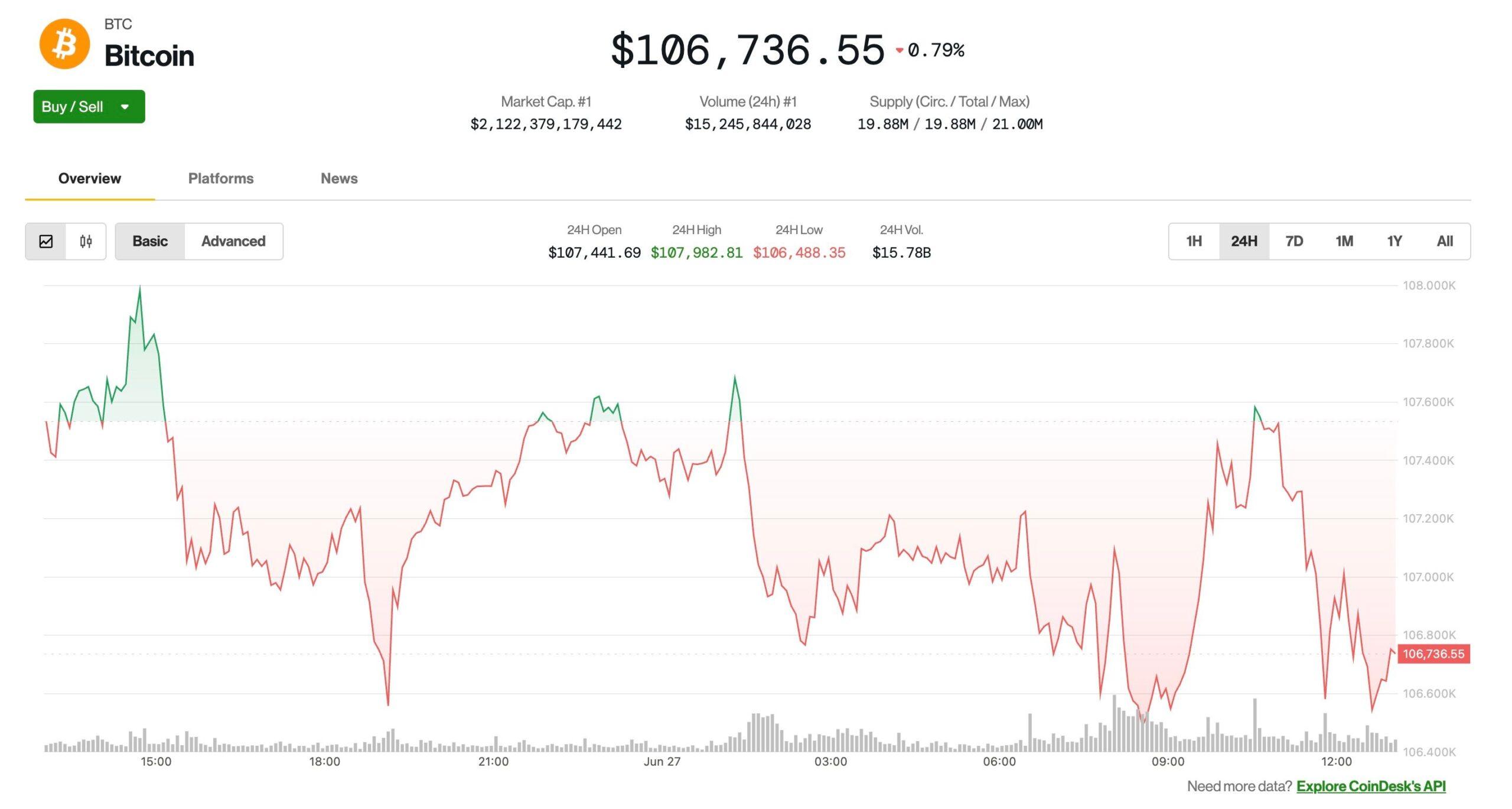

is down 0.7% in the last 24 hours, now a merchant $ 106,700, according to Coindesk market data.

The performance of the Orange Coin was largely in line with the Coindesk 20 – an index of the first 20 cryptocurrencies by market capitalization, with the exception of the stabbed, the same and the exchange parts – which dropped by 0.7% during the same period. Sui

was the index token that experienced the biggest price change anyway, and it only increased by 3.3%.

Crypto stocks have experienced greater movements, with Coinbase (COIN) and surround (CRCL) Lose 6% and 16% respectively. The Stablecoin issuer’s shares is down 40% because it exceeded almost $ 300 on Monday.

Bitcoin minors remained relatively stable by day, including the scientific heart (Corz)This increased by more than 30% Thursday of a report according to which Ai Hyperscaler Coreweave was planning to acquire the company, although Hut 8 8 (HUT) fell 6.5%.

The slight price action contrasts with the prospect of the price strategy of the White House which launches at high speed. US President Donald Trump announced that his administration would end all trade discussions with Canada in light of digital services tax that the country aims to impose on American technological companies.

“We will get to know the price in Canada that they will pay to do business with the United States of America over the next seven days,” said Trump.

The break on reciprocal prices should also end on July 9, but neither the traditional markets nor the crypto seem particularly concerned, noted Coinbase analysts in a research report.

“”[Markets] have largely ignored the potential economic risks resulting from this situation … in part because this has not necessarily been reflected in economic data, “analysts wrote.

The complacency concerning the prices will probably continue, they said, because they are unlikely to be as inflationary as expected.