Bitcoin (BTC) is known to be a volatile asset, but in recent times, this has not been the case; Bitcoin has been negotiated in a very tight range since the end of November, between $ 91,000 and $ 109,000.

In other words, Bitcoin volatility has compressed a lot. According to Glassnode data, the volatility carried out of 2 weeks, which provides how turbulent the asset was in the past two weeks, measures volatility in the past two weeks per year, fell to 32% annualized, the ‘One of the lowest levels for years. In addition, the implicit options for one month’s volatility, which is the expectation of the market in terms of volatility over four weeks, has slipped below 50% annualized, once again one of the lowest levels for years.

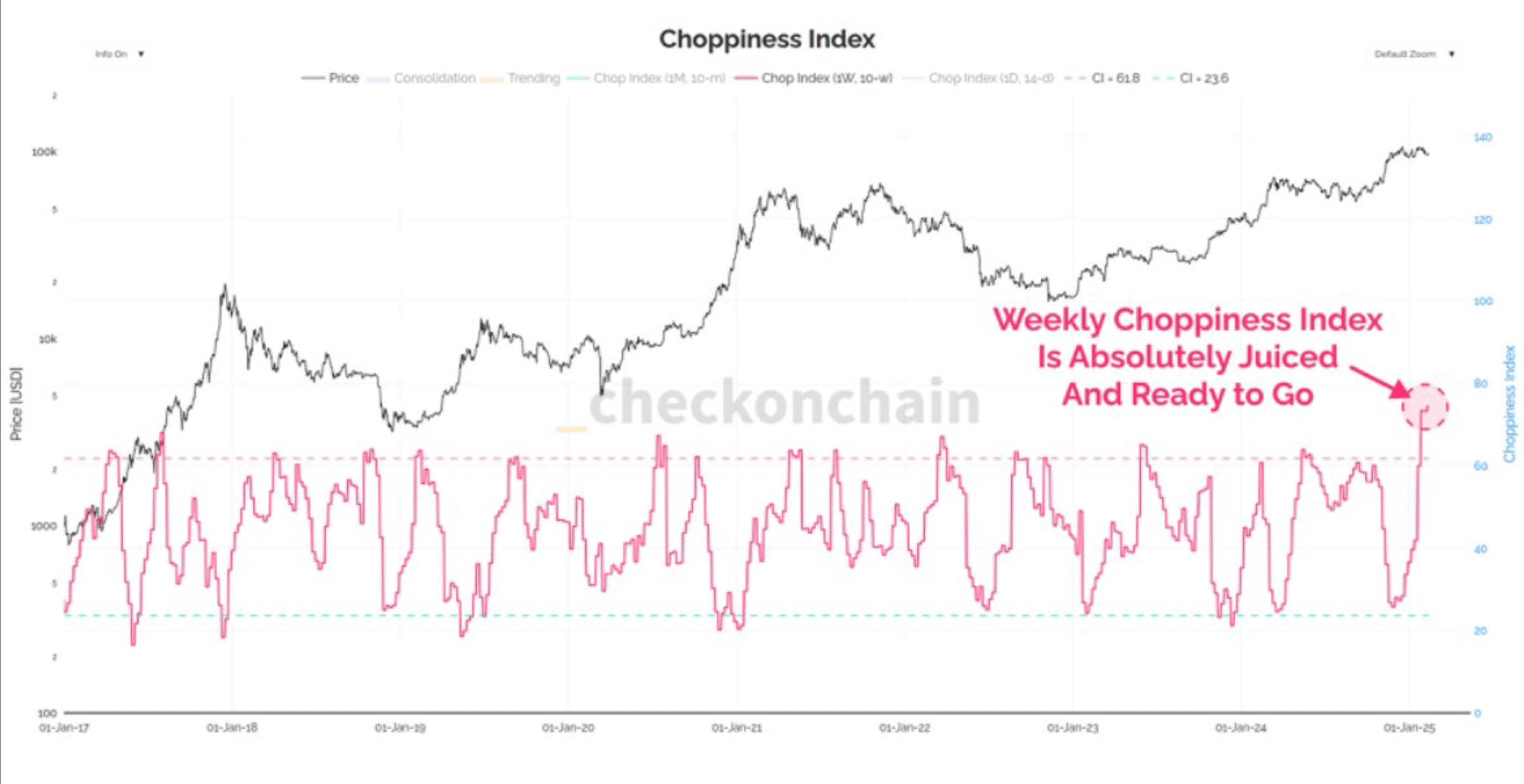

To put in context the quantity of bitcoin in this lateral consolidation, consider what the calls of the checkmate analyst are “the choppiness index”. The data show that Bitcoin, on a weekly time, based on his choppiness, has been at its highest level since 2015, which shows how tight this range of trading has been.

Volatility tends to refer, which means that an unusually stable market often opens the way to a large movement in both directions and vice versa. The longer the consolidation, the more violence violence in the explosion of volatility.

To cut the long history, the current range, the most intense since 2015, could soon pave the way for a wild price action. Bitcoin, at some point, will come out of this range; The question remains if it goes higher or more.