It remains stagnating in the range of $ 110,000 to $ 120,000, while the Gold and American shares hover near the heights of all time.

According to the cohort of the Glassnod accumulation trend, the sales pressure is obvious in all portfolio groups. This metric measures the relative resistance of accumulation as a function of the size of the entities and the volume of parts acquired in the last 15 days. A value closer to 1 signals accumulates, while a value closer to 0 distribution signals. Exchanges and minors are excluded from this calculation.

Currently, each cohort, portfolios having less than 1 BTC to whales containing more than 10,000 BTC, is in distribution. The most important whales, with assets above 10,000 BTC, have some of the most aggressive sales levels in the past year.

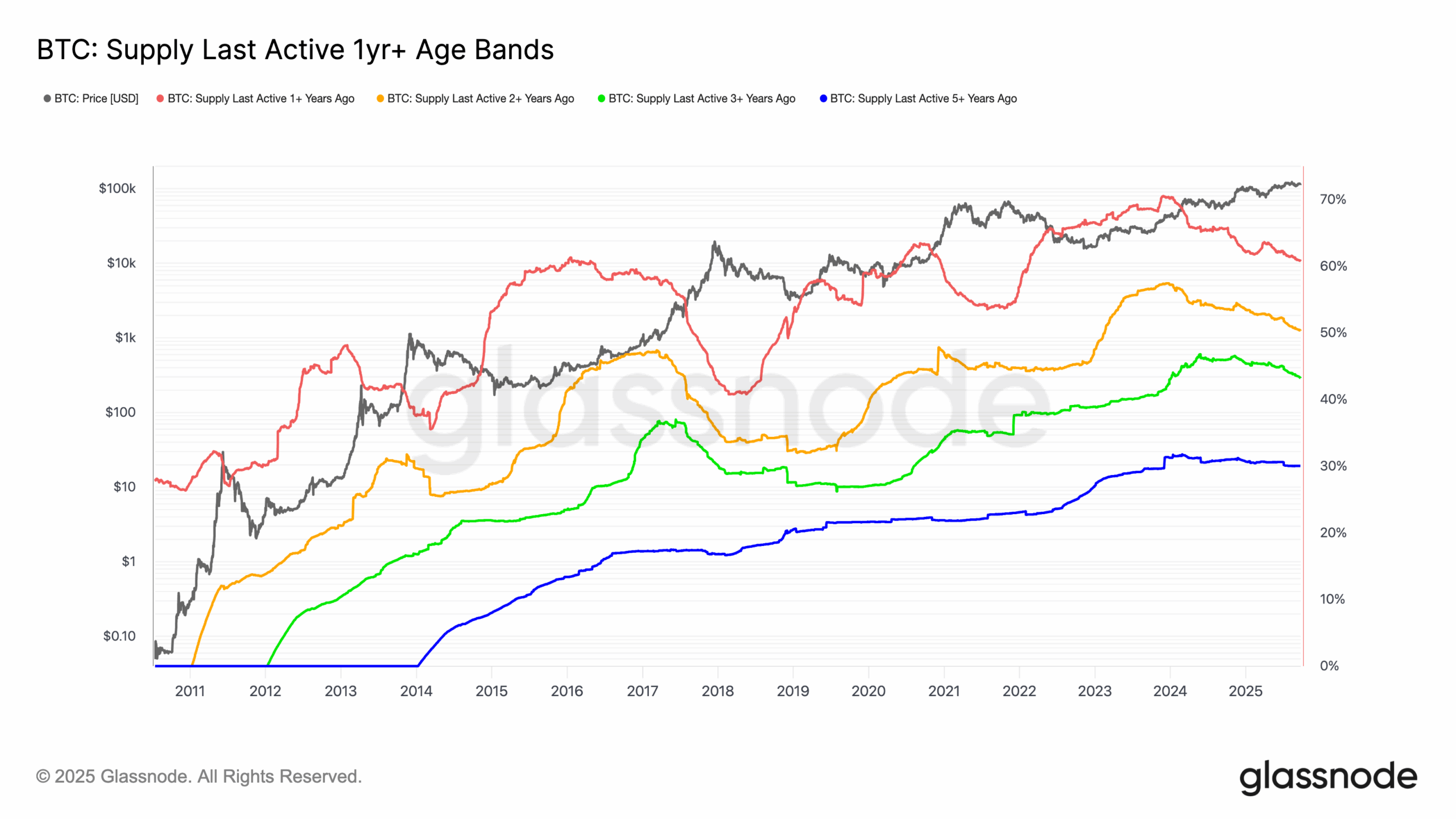

By examining the long -term holder’s offer, the percentage of the impassive circulation offer for at least 1 year fell heavily from 70% to 60%. The peak took place in November 2023, when Bitcoin exchanged nearly $ 40,000. At the same time, holders over 2 years old have also started to sell, their share going from 57% to 52%.

The cohort of three and over is now just 43% and has been down regularly since November 2024. These portfolios largely represent buyers from the previous high cycle in November 2021 to around $ 69,000, many of which accumulate more during the 2022 bear market when prices have reached $ 15,500 slowdown. With the resumption of Bitcoin, these investors make the gains.

On the other hand, five -year holders and holders remain stable, reflecting that the longest investors do not participate in the sale.

This trend shows that investors sitting on unrealized profits from this cycle continue to make profits, adding to the current sales pressure.

Read more: Blackrock’s Bitcoin Etf: the lowering feeling to Ibit remains strong for two consecutive months