With bitcoin Stuck just above $ 110,000 and ether (Eth) consolidating after hitting new discs, Solana has become an interpreter off competition on the cryptography market recently.

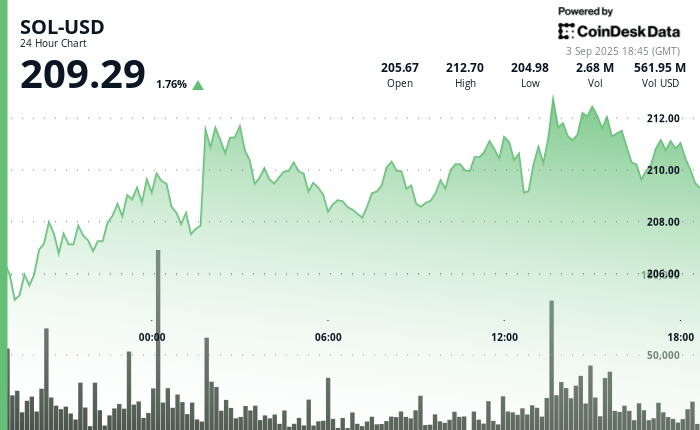

The token exchanged about $ 211 on Monday, up 33% compared to the beginning of August, making it one of the best interpreters in the Coindesk 20 index in the last month. Against Bitcoin, Sol won 34% in the last month, and it has strengthened 14% compared to the ETH since mid-August.

The rally reflects a wider rotation in altcoins, analysts said.

“The season for redistribution of profits between cryptocurrency holders continues,” said Sergei Gorev, risk manager at Youhodler, in a shared market note with Coindesk. He said that liquidity has left the BTC in second level tokens, with “a significant increase in the positive dynamic of soil capital flows”.

These flows could be long -term, because business investors are looking for major liquid projects to keep, added Gorev, appointing Sol alongside XRP Like “next interesting market ideas”.

Jeff Dorman, director of investments at Arca, tilted down to reproduce Ether’s reversal earlier this year. He underlined the resurgence of Ethereum after the adoption of the stablescoin, solid FNB entries and the relentless offer of digital assets, or dats, helped the ETH rally almost 200% since April.

“Sol seems ready to repeat exactly the same manual as ETH has just executed in the coming months,” wrote Dorman in a new report.

The first ETF of Solana, listed in the United States, was launched in July, but it was based on future. Several asset managers, including Vaneck and Fidelity, have filed for cash products later scheduled for this year, Dorman said.

Meanwhile, at least three dat on Solana collect funds that could channel up to $ 2.65 billion in soil over the next month, he added.

In one fifth of ETH’s market capitalization, the soil price could be even more reactive to flows if they materialize.

“Sol could be the most obvious for a long time at the moment,” said Dorman. “If ETH’s price has increased by almost 200% out of approximately $ 20 billion in new demand, what do you think of soil over 2.5 billion dollars or more new demand?”

Recent news could also add to the momentum. The conglomerate of digital active ingredients listed in Nasdaq Galaxy Digital A Tokensized its actions on Solana, while the approval of the upgrade of Alpenglow promises to improve the speed and purpose of the transaction.

Read more: Trump, XRP and Sol options report a potential end -of -year Altcoin season: Power Frade