By Francisco Rodrigues (at any time and unless otherwise indicated)

Cryptocurrency investors seem to adopt a “wait” approach to the plethora of contradictory titles appearing. Consequently, the Volatility Index of the BTC (DVVAD) on the discussion of popular options has been decreasing since January 20, going from a summit from 72 to around 50.8.

The fall signals the maturation of Bitcoin as an actor, according to Tracy Jin, COO of the Mexc cryptocurrency trading platform. “Rather than reacting strongly to short -term market shocks, the BTC shows signs of stabilization, increasingly resembling the dynamics of the markets of raw materials and traditional security assets,” said Jin.

While the payments of FTX creditors began to deploy, the balance of balance token continues to intensify. The co-creator of the token, Hayden Davis, boasted of buying access to the interior circle of the Argentinian president Javier Milei before the launch of the same, according to the messages examined by Coindesk.

Meanwhile, the strategy, the largest holder of the Bitcoin company, is expected to collect additional $ 2 billion by selling convertible zero coupon tickets. The funds collected will be used mainly to accumulate more BTC.

As CEO and CIO of Brevan Howard Digital – this is only one person – underlined in the Hong Kong consensus, the cryptocurrency ecosystem has evolved since the collapse of the FTX, but the risk management 24/7 is always a necessity.

On the macro level, traders focus on the minutes of the meeting of interest rates of the federal reserve. The indications for the potential impact of increased tariffs are a particular point of development, given President Donald Trump’s comments on prices “in the 25% district for cars, semiconductors and pharmaceuticals” .

The recent American-Russia talks in Riyadh led to the appointment of teams to negotiate the end of the war in Ukraine and the commitments to “normalize the functioning” of their diplomatic missions. However, the exclusion of representatives of Ukraine and Europe remains a point of discord. Stay vigilant!

What to look at

- Crypto:

- Macro

- February 19, 2:00 p.m.: The Fed publishes the minutes of the January 28 meeting of the FOMC.

- February 20, 8:30 am: Statistics Canada reports that data from the price inflation inflation data.

- Ppi Mom is. 0.8% against prev. 0.2%

- PPI YOY PREV. 4.1%

- February 20, 8:30 am: The American Labor Department publishes the weekly unemployment insurance report for the closed week on February 15.

- Initial complaints on unemployment is. 215K against Prev. 213K

- February 20, 5:00 pm: Fed governor, Adriana D. Kugler, delivering a speech entitled “Inflation waves navigation while rolling on the Phillips curve” in Washington. Livestream link.

- February 20, 6.30 p.m.: Japanese Ministry of Internal Affairs and Communications Reports The data of consumer price inflation data in January.

- YOY central inflation rate is. 3.1% against Plan. 3%

- YOY PREV inflation rate. 3.6%

- MOM PREV inflation rate. 0.6%

- Gains

- February 20: Block (xyz), post-market, $ 0.88

- February 24: Riot platforms (Riot), post-marketing, -0.18 $

- February 25: Bitdeer Technologies Group (BTDR), pre -commercialization, -0.53 $

- February 25: Cipher Mining (CIFF), pre -market, -0.09 $

- February 26: Mara Holdings (Mara), post -marchand, -0.13 $

Token events

- Governance

- Unlocking

- February 21: Fast Token (FTN) to unlock 4.66% of the supply in circulation worth $ 78.6 million.

- February 28: Optimism (OP) to unlock 1.92% of the supply in circulation worth $ 34.23 million.

- Token launches

- February 20: PI Network (PI) will be listed on Mexc, OKX, Bitget, Gate.io, Coinw, Digifinex and others.

Conferences:

Coindesk consensus to take place in Hong Kong on February 18 to 20 and in Toronto from May 14 to 16. Use the code’s day book and save 15% on passes.

Talk about tokens

By Oliver Knight

- Sonic, the recently renamed token called Fantom, increased by 37% last week. The overvoltage was attributed to an increase in activity on the chain and a boost in the general feeling after the brand change.

- The Memecoin sector is in shock from the controversy on Argentinian president Javier Milei and the balanced token. The market capitalization of the sector is down 4.4% in 24 to 72.9 billion dollars while traders begin to draw liquidity and question the legitimacy of a market that many consider an endless cycle of “pump and discharge”.

- More than $ 35 billion in value has left decentralized funding protocols (DEFI) since mid-December. Part of the crisis is linked to the drop in prices for assets, but there has also been a disproportionate quantity of outings from protocols for the implementation of Solana -based liquid this week, according to Defillama data.

Positioning of derivatives

- CME Futures Premium of BTC compressed 6% annualized, according to data followed by paradigm. It is a sign of bullish expectations that are dipping in the middle of a continuously continuous price movement.

- LTC, TRX and Hy leads the growth of the perpetual interest of term contracts.

- The BTC and ETH options provided for the settlement after February continue to show up bullish feeling, although the call premium has reduced to some extent.

- The block flows were mixed with puts purchased on February.

Market movements:

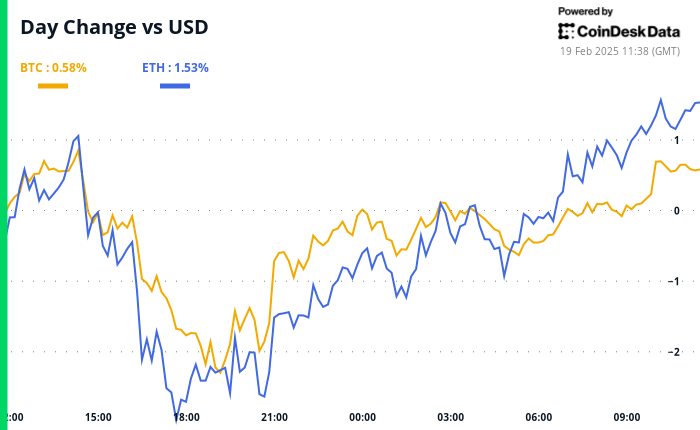

- BTC increased by 1.34% compared to 4 p.m. HE Tuesday to $ 96,356.41 (24 hours: + 0.79%)

- ETH is up 3.25% to $ 2,735.66 (24 hours: + 1.54%)

- Coindesk 20 is down 2.80% to 3,195.66 (24 hours: + 1.12%)

- The CESR ether composite pace is down 13 BPS to 3.05%

- The BTC financing rate is 0.0205% (7.4657% annualized) on Binance

- Dxy is up 0.14% to 107.20

- Gold is up 0.31% to $ 2,944.53 / Oz

- The money increased by 0.59% to $ 33.05 / Oz

- Nikkei 225 closed -0.27% at 39,164.61

- Hang Seng Closed -0.14% to 22,944.24

- FTSE is down 0.28% to 8,742.27

- Euro Stoxx 50 is down 0.48 to 5,507.77

- Djia closed on Tuesday unchanged at 44,556.34

- S&P 500 closed + 0.24% to 6,129.58

- Nasdaq closed + 0.07% to 20,041.26

- The S & P / TSX composite index closed + 0.65% to 25,648.84

- S&P 40 Latin America closed + 0.28% to 2,497.37

- The 10 -year American cash rate was up 1 bps to 4.56%

- The term contracts on E-Mini S&P 500 are down 0.1% to 6,140.5

- The term contracts on the NASDAQ-100 E-Mini are down 0.1% to 22,219

- E-min dow jones industrial index index index is down 0.16% to 44,571

Bitcoin statistics:

- BTC dominance: 61.08 (-0.32%)

- Ethereum / Bitcoin ratio: 0.02836 (1.54%)

- Hashrate (Mobile average at seven days): 784 EH / S

- Hashprice (spot): $ 53.61

- Total costs: 4.7 BTC / 452 182 $

- CME Futures open interest: 172 530 BTC

- BTC at the price of gold: 32.6 oz

- BTC vs Gold Bourse Capt: 9.26%

Technical analysis

- The Sol-BTC report has abandoned a consolidation range of several weeks.

- The technical distribution suggests the possibility of a continuous underperformance by the Solana blockchain token.

Cryptographic actions

- Microstrategy (MSTR): closed Tuesday at $ 333.97 (-1.11%), up 0.87% to $ 336.88 in pre-commercialization.

- Coinbase Global (corner): closed at $ 264.63 (-3.53%), up 1.27% to $ 268.

- Galaxy Digital Holdings (GLXY): closed at $ 26.31 CA (-4.58%).

- Mara Holdings (Mara): closed $ 16.05 (-5.03%), up 1.56% to $ 16.30.

- Riot Platforms (Riot): fenced at $ 11.56 (-5.79%), up 1.12% to $ 11.69.

- Core Scientific (CORZ): closed at $ 12.39 (-0.96%), down 1.05% to $ 12.26.

- Cleanspark (CLSK): closed at $ 10.08 (-4.00%), up 1.39% to $ 10.22.

- Coinshares Valkyrie Bitcoin Miners Etf (WGMI): closed at $ 22.84 (-2.39%), up 0.31% to $ 22.91.

- Semler Scientific (SMLR): closed at $ 50.72 (+ 2.11%), up 2.09% to $ 51.78.

- Exodus movement (Exodus): closed at $ 46.55 (-6.90%), up 5% to $ 49.00.

ETF Flows

BTC ETFS spot:

- Daily net flow: – $ 60.7 million

- Cumulative net flows: 40.06 billion dollars

- Total BTC Holdings ~ 1.163 million.

ETH ETFF SPOT

- Daily net flow: $ 4.6 million

- Cumulative net flows: $ 3.16 billion

- Total ETH Holdings ~ 3.784 million.

Source: Wacky investors

Nightflow

Graphic of the day

- Dollar Agora Agora supported by the US dollar (AUSD), which made its debut in Solana in late January, exceeded $ 100 million in market capitalization.

- The next stop could be $ 1 billion, according to Artemis.

While you slept

- Wintermute who seeks to develop the United States, Open Office in New York (Bloomberg): at Consensus Hong Kong, the CEO of Wintermute Trading, Evgeny Gaevoy, announced its intention to offer over-the-counter products in the United States and expressed its optimism as to upcoming regulation changes.

- The crypto has exceeded the FTX, but still needs risk management 24/7, believes that the CI CI (Coindesk) by Brevan Howard (Coindesk): three experts in traditional finance speaking in the Hong Kong consensus recognized Clock risk management.

- Private jets, political species among $ 1 billion in the confiscated assets of Sam Bankman: the court (Coindesk): while the FTX initial failed reimbursements began, a Federal Federal Court made its last confiscation order against the CEO condemned From the stock market now disappeared, entering the seizure approximately $ 1 billion in assets.

- Donald Trump’s late evening posts send currency traders on Asian markets (Financial Times): the President’s late evening and weekend announcements disrupted regular negotiation models, which prompted some traders American and European FX to bed in Asian markets.

- Inflation in the United Kingdom reaches a 10-month top, complicating the rate of the Bank of England (the Wall Street Journal): the annual inflation rate of the United Kingdom has reached 3% in January, in increase of 0.5 percentage points compared to December, which makes the central bank more difficult to reduce rates.

- Boj Policymating calls for more rate increases, warns the risk of inflation (Reuters): Hajime Takata said that persistent inflationary pressures and the increase in wages suggest that the need to increase interest rates. Analysts see the short -term interest rate to 0.75% in July.