Bitcoin

A exceeded $ 124,000, fixing its fourth higher level of 2025.

Glassnod’s chain data suggest that this could mark the first stages in a continuous bull market.

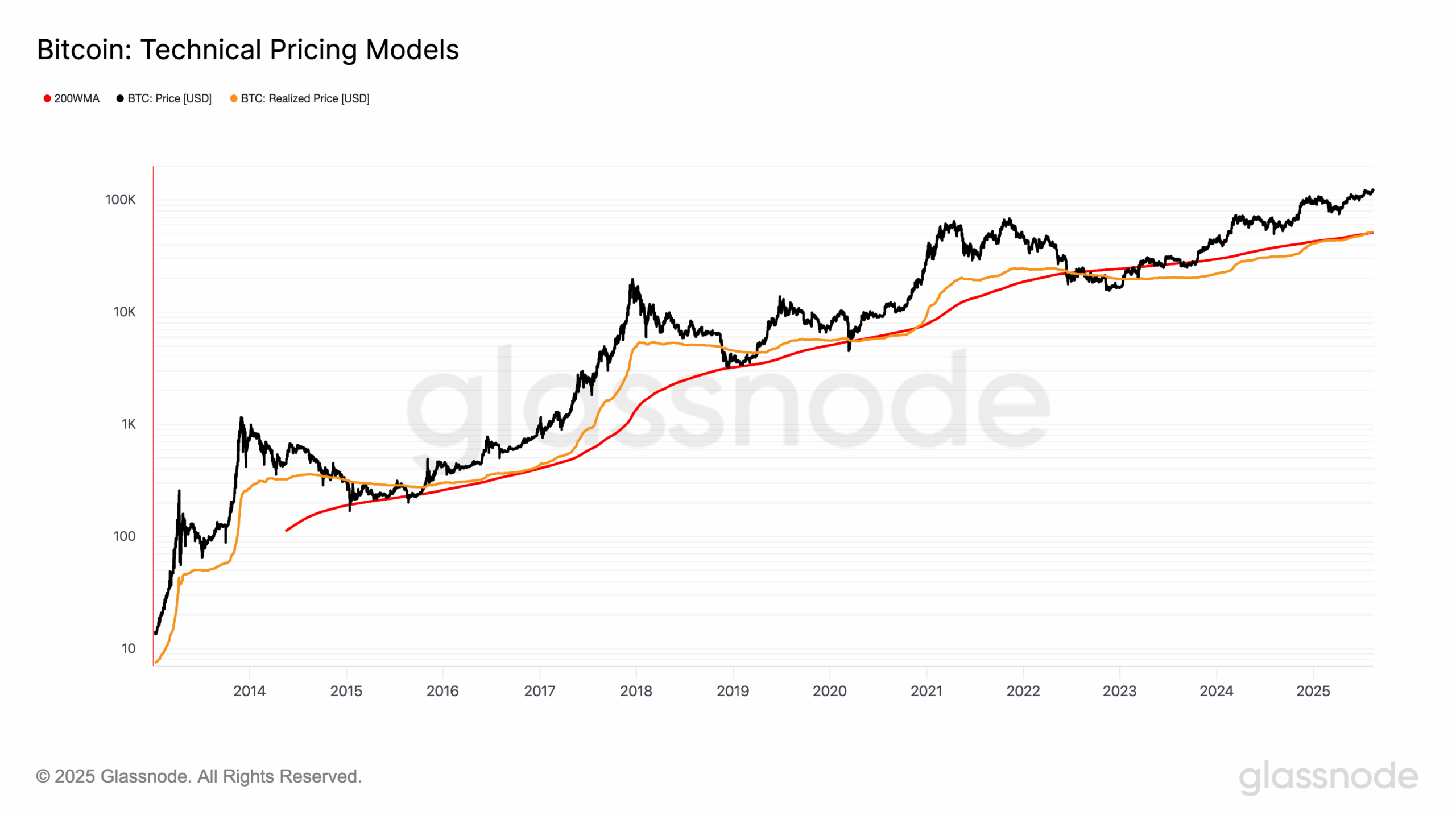

A key metric underlying this point of view is the price achieved, which measures the total value of all bitcoins at the price they have been moved for the last time, divided by the number of coins in circulation. This metric at $ 51,888 has now exceeded the 200 week Bitcoin mobile average (200wma)A long -term trend line often considered as a line of demarcation between the bear markets and bulls.

The story shows that when the price made exceeds 200Wma and continues above, as it did in the 2017 and 2021 cycles, the upward trend is maintained longer. The 200WMA is currently $ 51,344, acting as a long -term level of support which has historically defined the soil during the lower markets.

This level was only raped during periods of extreme market stress. The most recent example came at the end of the 2022 bear market, when Bitcoin fell sharply in the middle of the collapse of the FTX. The price made fell below 200WMA in June 2022 and stayed there for almost three years before recovering it in 2025.

The break above 200wma is important because it indicates a renewal of investor confidence and a change in market structure.

If the historical patterns hold, this technical development could be the precursor of a sustained rally. With macroeconomic conditions and the alignment of institutional interests, the recent action of bitcoin prices could be the first chapter of its next major growth phase.

Read more: who withdraws bitcoin from record heights greater than $ 120,000?