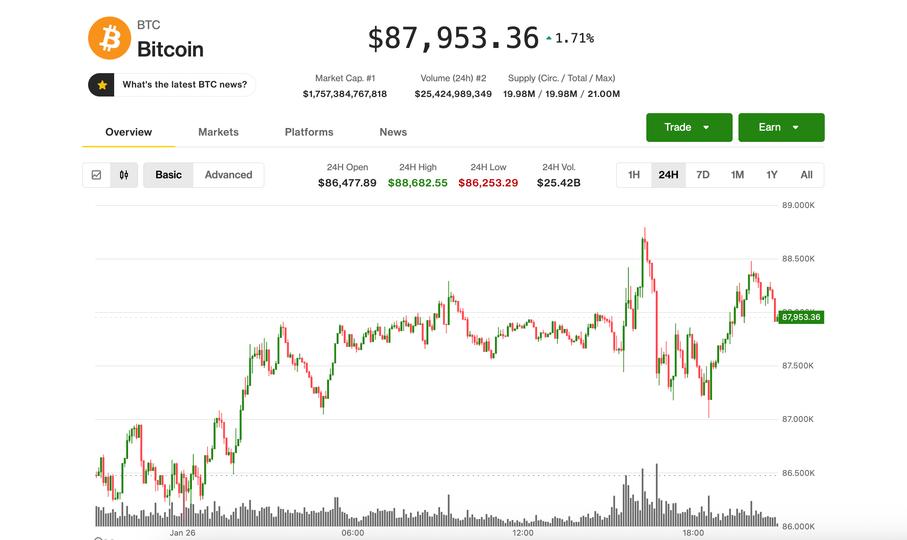

Bitcoin remained stuck in limbo at around $88,000 on Monday as gold and silver extended their meteoric rallies before paring gains.

BTC is up a bit from what is becoming a new pattern of weekend panic selling, but down from around $90,000 Friday night. The growing likelihood of a government shutdown on Jan. 31 — and the reduction in liquidity that could bring — were among the main reasons for Sunday’s selloff.

However, it is the exact same news that has left precious metals bulls unfazed. Gold climbed to $5,000 and then $5,100 for the first time on Sunday and Monday, while silver hit $118. However, signs of exhaustion could set in. Gold fell as low as $5,043 — now up 1.3% for the day — while silver retreated to $108, still up 7%.

“Gold and silver carelessly add an entire market cap to bitcoin in a single day,” wrote Will Clemente, a widely followed crypto analyst, summarizing the mood of bitcoin investors.

The US Dollar Index (DXY) fell to its lowest level since September as the US Federal Reserve and the Bank of Japan reportedly teamed up to intervene in foreign exchange markets in a bid to boost the yen against the greenback. At 154.07 per yen, the dollar is down more than 1% on Monday.

Bitcoin will remain limited

According to Swissblock analysts, the lack of bullish follow-up of bitcoin despite the weakness of the dollar has made traders cautious in the short term. “Recent price action has reinforced the bearish outlook,” they said in a Monday note.

A decisive break below the $84,500 support level could open the door for a deeper correction towards $74,000, they warned. Nonetheless, they signaled that if this support holds as risk indicators calm down, it could provide an attractive entry point for bulls.

Bitfinex analysts echoed the cautious tone, noting that BTC is expected to remain in a range between $85,000 and $94,500. They also highlighted changes in the options market, with traders responding tactically to short-term risks without factoring in long-term volatility.

That means traders are “assessing a transitory risk rather than a lasting disruption to market structure,” analysts wrote in a Monday note.

The continued selling of spot Bitcoin ETFs adds to the pressure. Cumulative outflows exceeded $1.3 billion over the past week, reflecting a lack of risk appetite among investors.

Risk of Government Shutdown for Crypto Legislation

Jim Ferraioli, Schwab’s director of crypto research and strategy, sees no reason to expect sustainable development beyond current levels without an improvement in metrics such as on-chain activity, ETF flows or derivatives positioning and miner participation.

A bigger catalyst, he says, is passage of the Clarity Act, but that could be delayed by the possibility of a government shutdown. Until the legislation is passed, he expects trading to tighten between the $80,000s and mid-$90,000s with major institutional players staying away.