Bitcoin (BTC) The low rebound of this week lacked gas on Thursday, the prices bringing below $ 110,000 and some market observers warning a deeper decline.

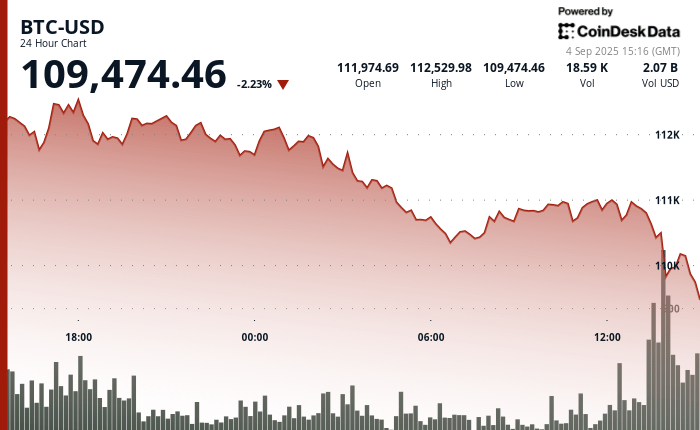

The largest cryptocurrency fell 2.2% compared to $ 24 hours at $ 109,500, erasing half of the earnings it made from the lowest of the $ 107,000 weekend because it exceeded $ 112,600 on Wednesday. Ether (Eth)Sola’s Sol (GROUND) And Ada de Cardano (ADA) Everything has dropped more than 3% in the last 24 hours.

The actions of Treasury of digital assets have also bled. The largest strategy of the corporate BTC owner (MSTR) has dropped by 3.2% and has been down 30% since July. Metaplanet based in Japan (3355) Lost 7% and is negotiated 60% lower than its June summit, while Geelinglymd (Naka) Slipped another 9% and has now been down 75% since mid-August. Ether focused vehicles (BMNR) And the Sharplink game (Sbet) fell from 8% to 9%.

How much could the BTC fall?

The concerns about the increasingly strong descent are stronger, some observers pointing in September being historically one of the weakest months of Bitcoin and the lowest months on the cryptography market.

At the same time, gold, the refuge and the coverage of old-fashioned inflation, broke out new records above $ 3,500 following a consolidation with several relays, apparently sucking more risky games.

A new Bitfinex report noted that BTC had entered its third consecutive week of trace compared to the summit of all time in August of $ 123,640. Historically, the corrections of the bull market were on average about 17% of friction peak, which suggests that the market is approaching the typical limit of its flaps, according to the report.

However, there is a deeper risk of withdrawal, analysts warned. The short -term holder produced Price, a gauge from the more recent investor cost base for the purchase of BTC, is currently nearly $ 108,900, less than 1% below the current BTC price. If this level fails as a support, it could open the way to a deeper retrace, with a dense supply group between $ 93,000 and $ 95,000 probably offering a sustainable floor, according to the report.

Joel Kruger, a market strategist of the LMAX group, remains more optimistic.

September was generally a month of consolidation before the highest performance in the fourth quarter, he said, adding that this year’s correction could be less deep if FNB entries, business cash benefits and regulatory tail winds materialize.

Read more: Bitcoin options downward tilt before Friday expiration: Crypto Daybook America

UPDATE (September 4, 4:00 p.m. UTC):: Add the BTC power cluster graphic.