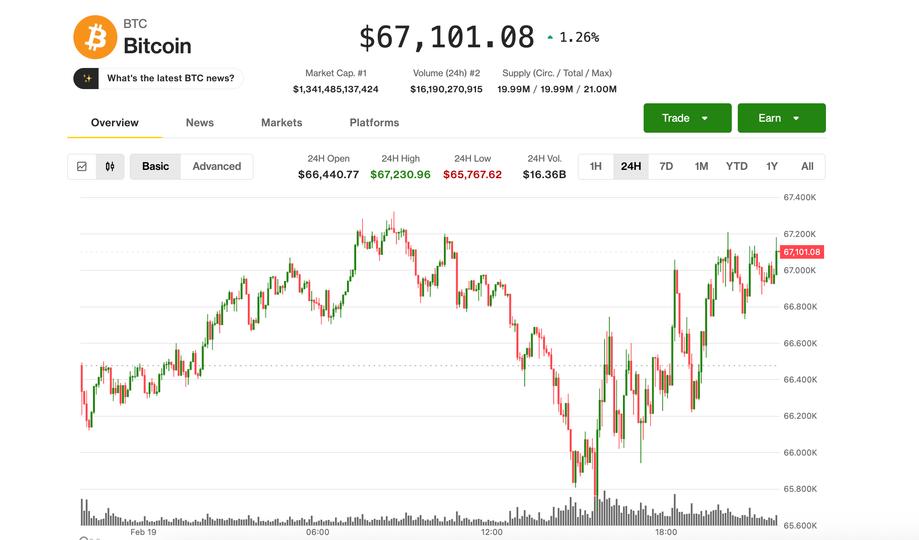

Bitcoin found its footing on Thursday, stabilizing above a key technical level after briefly slipping below $66,000 in early U.S. trading. The largest cryptocurrency recently changed hands at around $67,000, up around 1% in the past 24 hours.

CoinDesk 20 Index lags, with Ether (ETH), XRP, BNB, and solana (SOL) remained flat or slightly down over the same period, perhaps a signal of continued caution toward altcoins amid fragile crypto markets.

Crypto-related stocks edged higher across the board, with Bitcoin miners CleanSpark (CLSK) and MARA (MARA) standing out with gains of 6%. Meanwhile, the tech-heavy S&P 500 and Nasdaq 100 were down 0.3% and 0.6%, respectively.

On the political front, there have been tentative signs of progress on the Digital Asset Market Structure Bill. As CoinDesk’s Jesse Hamilton reported, talks held at the White House between crypto industry representatives and bankers have resulted in incremental moves, although no compromises have yet been reached.

At the same time, the cracks of the recent crypto downturn continue to surface. Chicago-based cryptocurrency lender Blockfills, as reported by CoinDesk, is considering a sale after suffering a $75 million loan loss during the recent price crash and temporarily suspending customer deposits and withdrawals last week. With cryptocurrency prices falling sharply in recent months, investors are bracing for potential blowouts like those of Celsius and FTX in 2022. So far, however, the fallout appears contained — on the one hand, tempering the worst fears, but on the other, avoiding the kind of complete collapse that paved the way to the bottom of this brutal bear market and the start of the 2023-25 bull run.

Yet risks outside of the crypto sphere continue to loom, making investors hesitant to take risks.

Concerns about rising stress in credit markets have intensified after private equity firm Blue Owl (OWL) permanently limited redemptions from its $1.7 billion retail-focused private credit fund. OWL fell 6% on Thursday, while shares of other large private credit managers including Apollo Global (APO), Ares Capital (ARES) and Blackstone (BX) slipped more than 5%.

Geopolitical tensions remain another danger, with the prospect of US military action against Iran still in play amid ongoing regional strengthening. Crude oil rose another 2.8%, above $66 a barrel, hitting its highest price since August.

Traders play defense

This caution is reflected in crypto derivatives markets, pointed out Jake Ostrovskis, head of OTC at trading firm Wintermute. Many traders buy downside protection while limiting their upside participation, he noted, meaning they are effectively paying for insurance against further downside while capping potential gains in the event of an upside breakout.

The average cost basis for Bitcoin ETFs in the United States now stands at nearly $84,000, leaving a large portion of ETF investors underwater – suffering a 20% paper loss on average – and potentially vulnerable to “capitulation selling” if prices fall further.

Nonetheless, total ETF holdings remain around 5% of their peak in Bitcoin terms, suggesting that institutions are reducing their exposure rather than rushing for the exit.