Crypto merchants buy Bitcoin (BTC) on Kraken, one of the 10 largest cryptocurrency grants, while the price slides at a three-month lower, told Coindesk, Alexia Theodorou, told Coindesk .

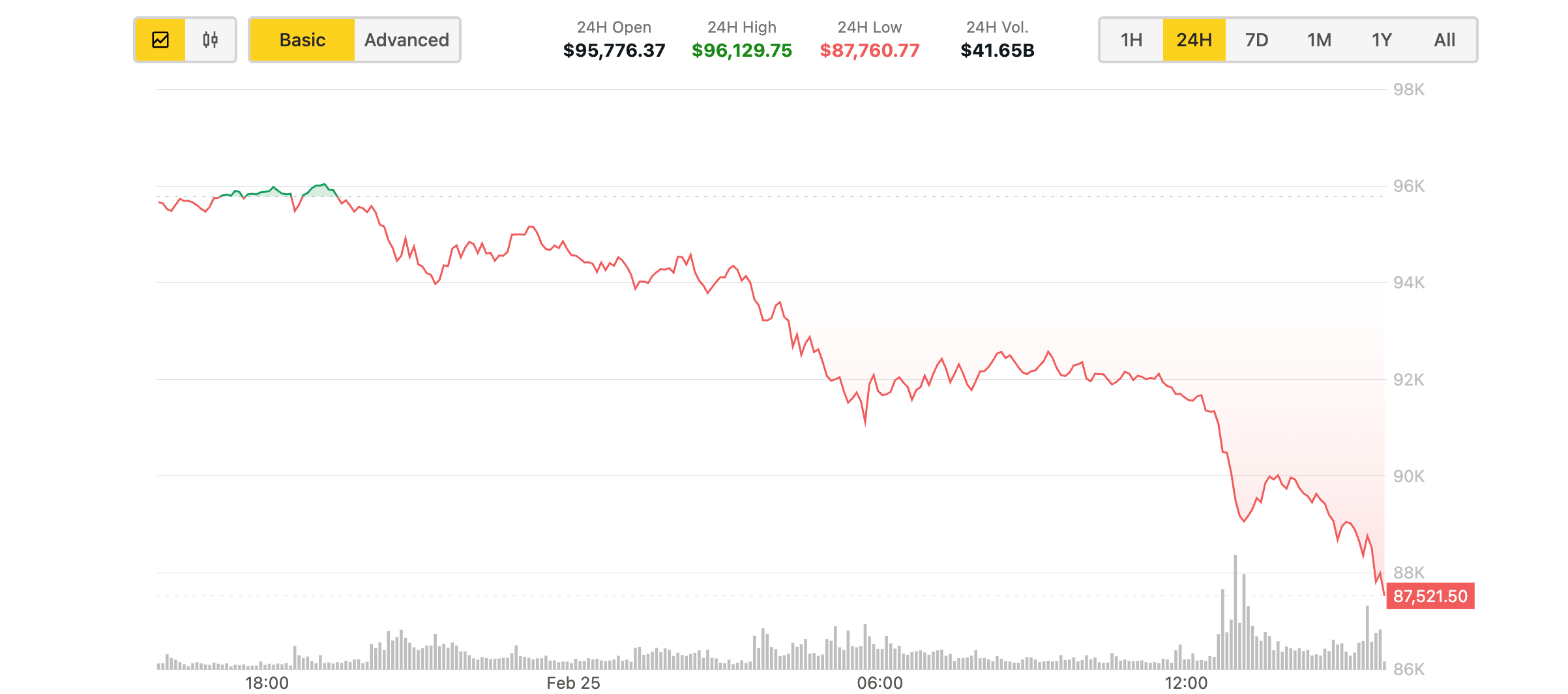

The BTC dropped by less than $ 88,000 shortly before the publication while the Nasdaq term contracts underlined a continuous risk aversion to Wall Street and the Yen, a paradise during troubles, strong held against the US dollar And basic products sensitive to growth such as the Australian dollar.

The drop in BTC follows an increase of $ 1 billion in the position of term contracts on Binance on Monday evening, probably due to traders who take shorts in anticipation of a deeper price drop.

However, good deals hunters intervened via Kraken, lifting the perpetual long-short report at a record summit of 0.8. The ratio measures the proportion of purchasing stations open compared to active sales positions at any time.

“Despite the price of Bitcoin below $ 90,000, Kraken saw an increase in traders opening long positions in its perpetual BTC markets,” said Theodorou in an interview. “The long / short ratio has climbed to a record level of ~ 0.8, while the open interest has reached a four weeks higher.

Although evidence of the drop in Kraken is an encouraging sign for Bulls, the long -term ratio remains less than 1, which means that there is even more shorts than long on exchange.

“During this [record long-short ratio] Talk about the underlying positive feeling on the market, liquidations are still at relatively normal levels, which means that there can still be an excess lever effect in the system. This could potentially leave the market vulnerable to other decline movements, perhaps in the form of a long pressure, in the short term, “said Theodorou.