Hello, Asia. Here is what is news on the markets:

Welcome to the morning briefing in Asia, a daily summary of the best stories during the hours and an overview of market movements and analyzes. For a detailed overview of the American markets, see the Americas of the Coindesk Crypto Daybook.

Bitcoin cash companies are faced with a simple but brutal test: can they surpass the BTC itself, or should investors ignore them and buy the assets outright?

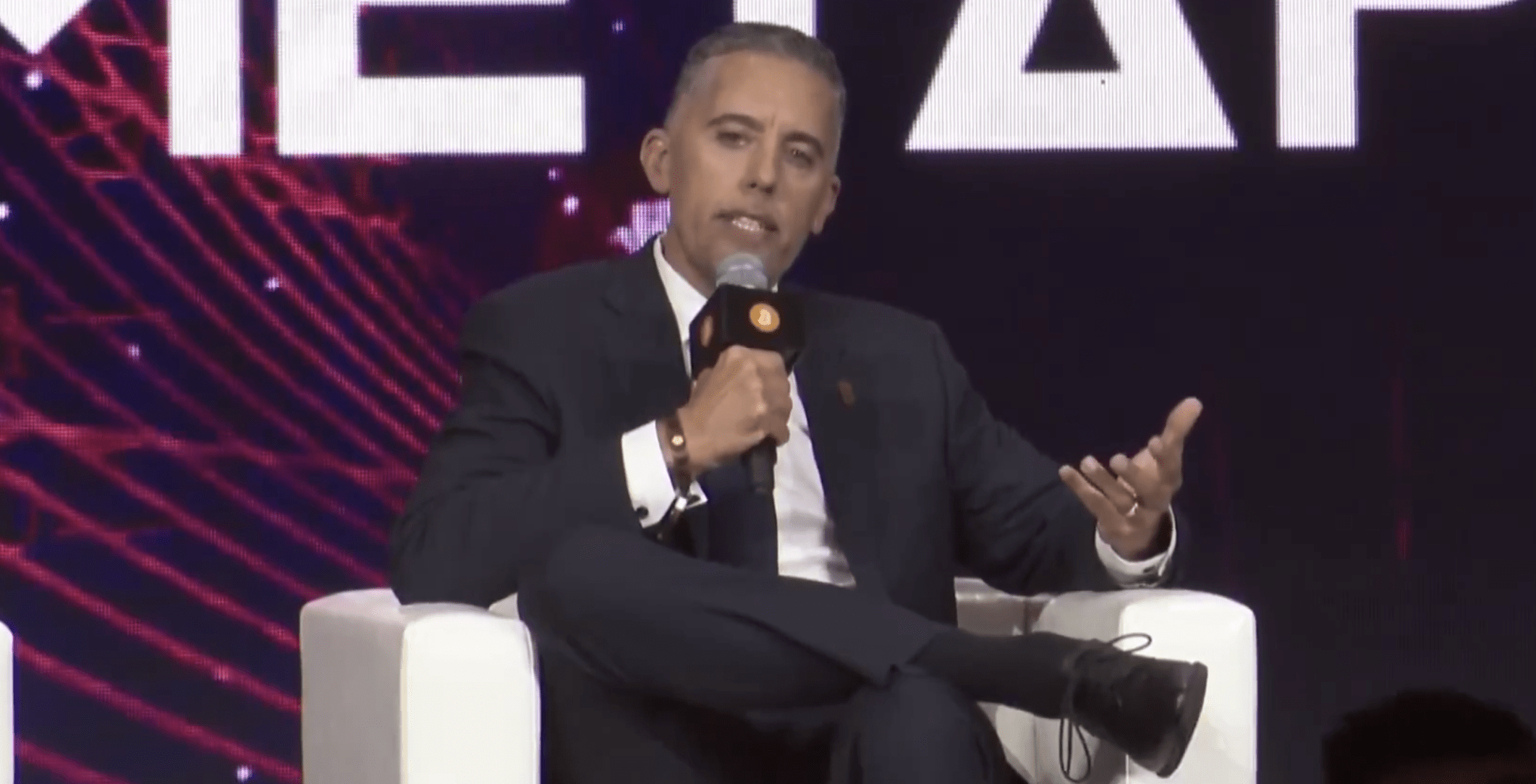

“If you don’t do this, there is no reason to do the strategies, just buy an ETF Bitcoin,” said Matt Cole, CEO of Strive Asset Management, during a BTC Asia panel in Hong Kong.

Cole could be best known to be an ardent defender of GameStop Put BTC on its assessment.

On stage, Cole described the game book as a search for alpha, finding ways to surpass the BTC without simply stacking the specific risk to bitcoin. Cole explained that this is up to funding, where he underlined a passage from perpetual favorite equity convertibles to lock the lever effect.

He added that the most difficult milestone is the scale: reaching $ 1 billion in capital, the point where financing becomes cheap enough to support the IPOs and the largest teams.

“The most difficult thing to do for Bitcoin cash companies is to reach a billion dollars,” he said, citing Michael Saylor from microstrategy.

This scale, stressed Cole, only works with Bitcoin. Ethereum and other tokens, he said, act too much as actions with changing monetary policies.

“Ethereum makes a horrible asset for a cash company,” said Cole. “Bitcoin perpetually increases against fiduciary currencies because they are degraded.”

In his opinion, the fixed BTC supply makes it the only asset capable of supporting a lever effect cash strategy designed to worsen over time.

Andrew Webley from The Smarter Web Company, a British web designer on the stock market with BTC on the balance sheet, brought a more measured tone regarding market navigation, Bitcoin yield compared to the dilution and size of the company.

Small businesses, he said, have an advantage in raising capital, but transparency and clear communication of the risks remain just as important as mathematics.

“The most important thing you can do as a public company, in my opinion, is to publish our rules first,” said Webley, adding that a clear disclosure helps investors understand the compromises of a BTC cash model.

“If someone can understand the risks, then in our opinion, these things are the best value opportunities around the world,” he added.

The split has underlined the choice facing investors: investing in companies that pursue aggressive strategies to outdo BTC or promote companies that promise regular growth with clear transparency.

Be that as it may, the panelists have agreed that the role of Bitcoin as an act of the Treasury only develops while Fiat continues to be degraded.

Market movement:

BTC: Bitcoin is negotiated above $ 110,500, trading slightly lower following a minor decline, although signs of accumulation, such as resilient demand near the key support, suggest that market players remain optimistic during its next break, according to the Coindek market insights.

ETH: ETH is traded at $ 4,300, down 0.6%. The ETH continues to benefit from solid institutional interests and FNB entries, which support its longer -term structural advantage.

Gold: The gold continues to negotiate near the record summits supported by expectations of slowdown and an increasing demand for security, although it has experienced a slight withdrawal in favor of profit.

Nikkei 225: The largest index in Japan continues to rally, supported by a combination of strong foreign purchases, motivated by the passage from the country of long-term revival, business reforms and growing yields, and dominant monetary clues of the United States, stimulating the feeling of equity.

S&P 500: The S&P 500 increased by 0.83% for a record of 6,502.08, while merchants increased data of low data on private jobs while waiting for Friday’s employment report for tariff prospects and recession risks.

Elsewhere in crypto:

- World Liberty Financial Black Lists by Justin Sun with $ 107 million WLFI dollars (Coindesk)

- The dry goes everything in the agenda Pro-Crypto with a series of digital asset diets (decrypt)

- The NFL opener draws $ 600,000 on Polymarket, because the platform targeted $ 107 billion on the sports betting industry (Coindesk)