Respecting Thursday prices in large cryptocurrencies is probably the result of a long pressure, or a relaxation of bull-up games with leverage, rather than a pure and simple bearish position.

The Coindesk 20 index (CD20) of the largest most liquid tokens lost 6.8% in the last 24 hours, with Bitcoin (BTC), the main cryptocurrency per market value, down almost 1% that could not maintain earnings greater than $ 120,000. Among the main altcoins, ether (ETH) fell by 3%, XRP (XRP) 13%and solana solan (solara).

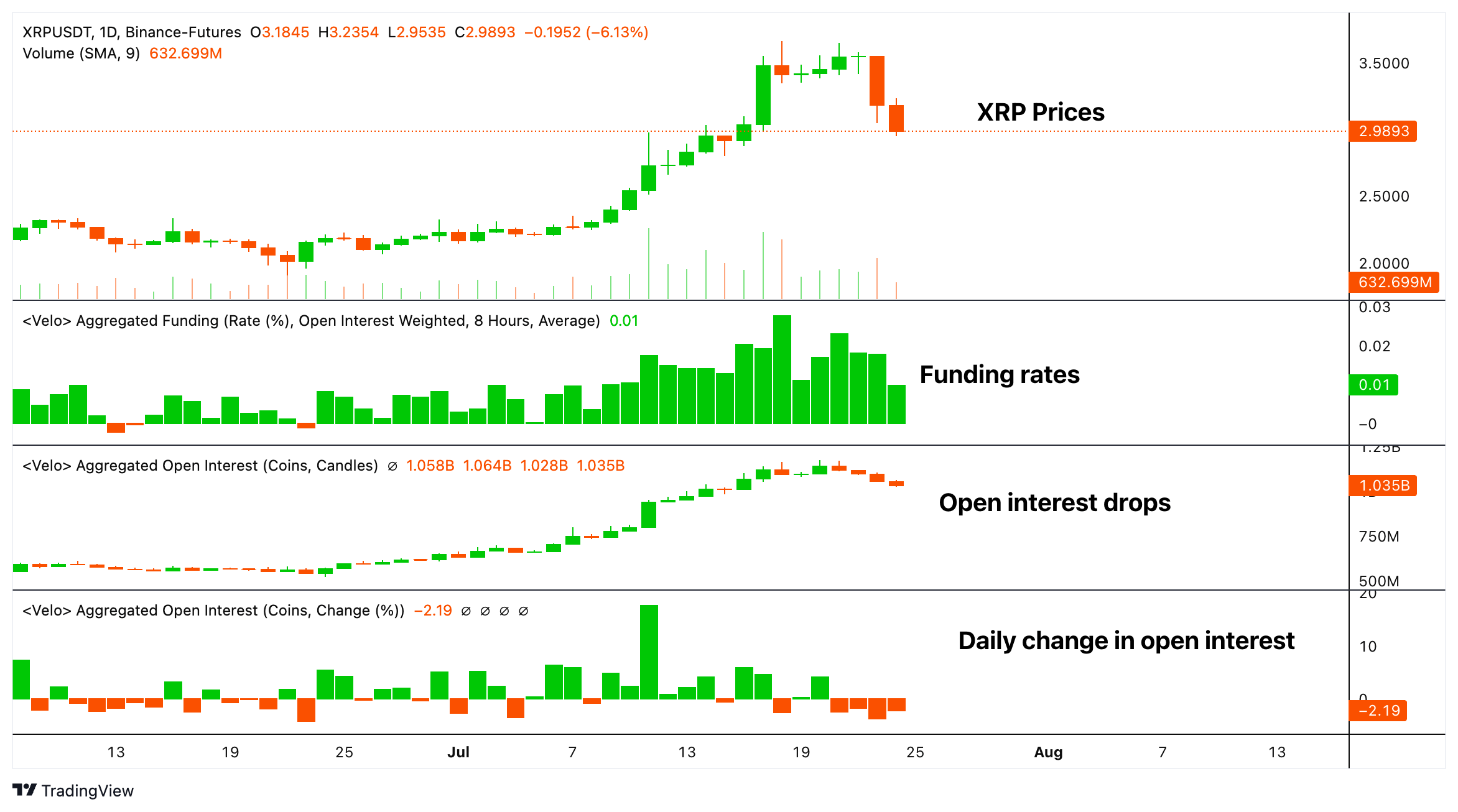

All declines are consistent with the lowering signals of the technical graphics. They are also characterized by the decrease in open interest in the market for perpetual offshore offshore and positive financing rates.

For example, the interest opened – the number of unstable contracts on the term market – for XRP fell by more than 6% in two days, according to the Velo data source. It is a sign of the market that participants reduce their exhibition and adopt less risky positions.

The interest opened in term contracts on soil, BTC and ETH decreased by 5%, 1.5%and 2%, respectively. Velo follows the activity in the perpetuates labeled in dollar and USDT listed on Binance, OKX, Bybit and other exchanges.

Meanwhile, the funding rates of the four tokens continue to be positive, indicating a net bias for bullish bets. Positive financing rates indicate that perpetuates are negotiated at a prime at a punctual price, requiring a periodic payment of long to shorts to keep their positions open.

Long pressure is widely considered as a necessary and positive event because it “cleans” the market by eliminating the excess lever effect and the too optimistic long positions.

The combination of the drop in prices, the drop in open interests and positive financing rates suggests that bullish bets are actively withdrawn from the market.

It excludes the probability that the drop in prices will be supported by investors taking new or lower positions, because in this case, the financing rate would have dropped in a negative territory because the short holders would need to pay long.

In addition, the new shorts would have increased open interest as prices have dropped, which is not the case either.

The drop in open interest suggests that merchants firmly their positions, a characteristic of long leverages are liquidated or that voluntarily leave the market, rather than new shorts entering the market. The assembly indicates that while the price drops, the feeling remains fairly robust.