Bitcoin slipped 0.11% in the last 24 hours to $ 116,702, according to Coindesk data, but remains 25% for a year before, just after the gain of 29% Gold among the major asset classes, according to data shared by the financial strategist Charlie Bilello on X.

2025 Performance so far

As of August 8, the 25% Bitcoin yield of 25% in the start of the year ranked behind only 29.3% of Gold. Other major asset classes have displayed more modest gains, with emerging market actions (VWO) In addition to 15.6%, the Nasdaq 100 (Qqq) Up 12.7% and large American caps (SPY) increase of 9.4%. Meanwhile, US Mid Caps (Mdy) and small caps (IWM) 0.2% won only 0.8%, respectively. This marks the first time that Gold and Bitcoin occupied the two main positions in the annual classification of Bilello asset classes since the start of records.

Cumulative feedback 2011-2025

In the longer term, Bitcoin has delivered an extraordinary total yield of 38,897,420% since 2011 – a figure that overshadows all other asset classes in the data set. Cumulative yield of 126% Gold over the same period in the middle of the pack, capital references such as the Nasdaq 100 (1101%) And we, large caps (559%)as well as average traffic jams (316%)small caps (244%) and emerging market stocks (57%). Based on bilello figures, the total Bitcoin yield has exceeded gold of more than 308,000 times in the past 14 years.

Annualized feedback 2011-2025

When measured on an annualized basis, the domination of bitcoin is just as clear. The flagship cryptocurrency has carried out an average annual gain of 141.7% since 2011, against 5.7% for gold, 18.6% for the Nasdaq 100, 13.8% for large American ceilings and 4.4% to 16.4% for other significant funds of equity and real estate. Gold’s long -term stability has made it precious coverage in certain market cycles, but its rate of appreciation was much slower than the exponential rise in Bitcoin.

Gold vs Bitcoin, according to Peter Brandt

Renowned merchant Peter Brandt weighed on August 8, contrasting Gold merits as a reserve of value with Bitcoin potential to exceed all Fiat alternatives. “Some people think that gold is a large reserve of value-and this is the case. But the ultimate value store will prove to be bitcoin,” he said on X, sharing a long-term table of the purchasing power of the US dollar. His comments echo the growing story that the scarcity and decentralization of Bitcoin make him unique to surpass traditional hedges over time.

Strengths of technical analysis

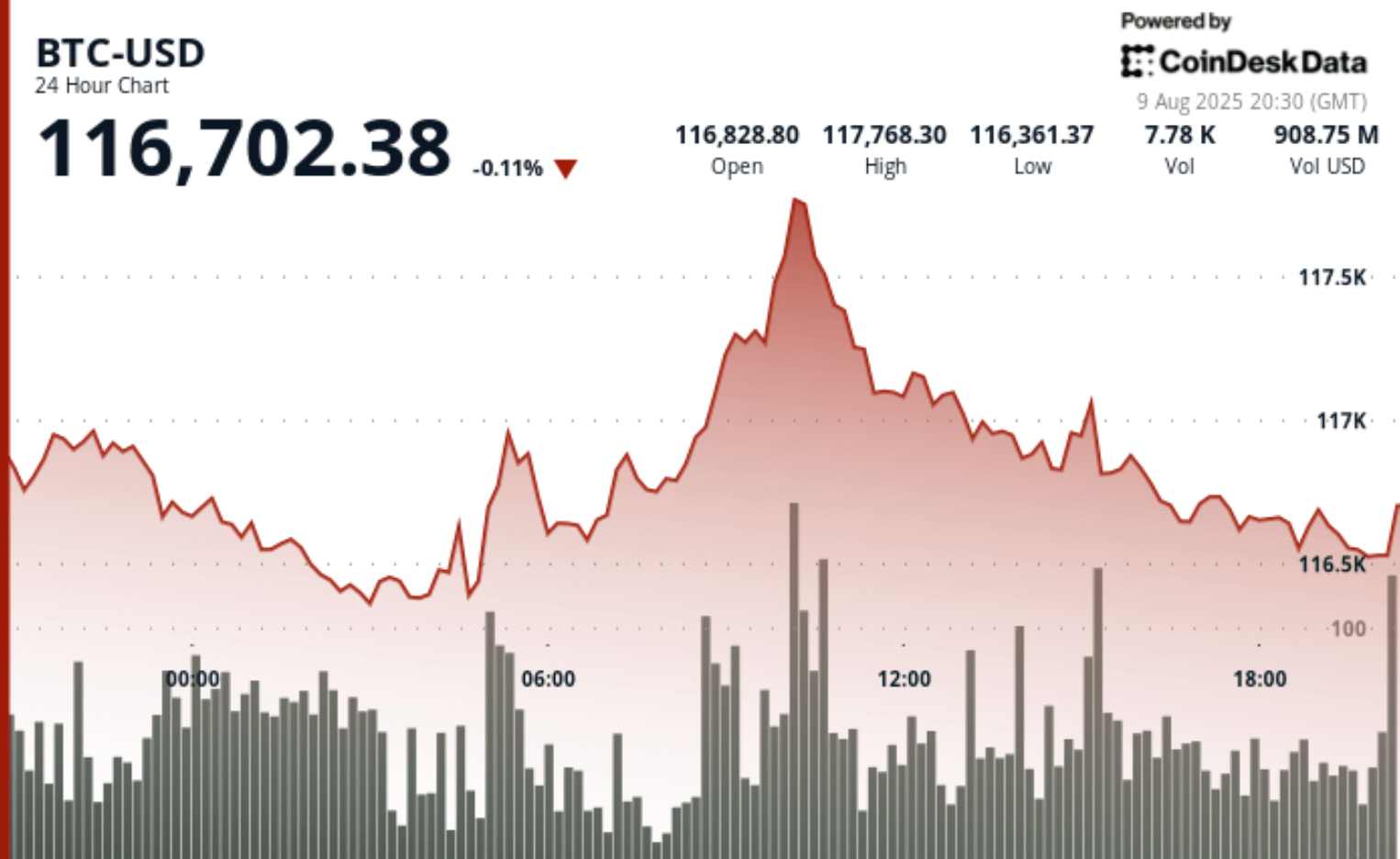

- According to the Technical Analysis Data model of Coindesk Research, between August 8 at 9:00 p.m. UTC and August 9 at 8:00 p.m. UTC, Bitcoin exchanged in a range of $ 1,534.42 (1.31%) From $ 116,352.52 to $ 117,886.44.

- The price opened its doors nearly $ 116,900 and moved laterally before rising during Asian hours, going from $ 116,440 to $ 117,886 between 05:00 UTC and 10:00 am UTC on August 9, with a 24 -hour negotiation volume exceeding 9,000 BTC during these intervals.

- Solid purchases emerged nearly $ 116,420 at 05:00 UTC, while the sales pressure intensified around the top of $ 117,886.

- Bitcoin closed the session at $ 116,517, down 0.32% of the open, with a support defined at $ 116,400 at $ 116,500 and a resistance at $ 117,400 at $ 117,900

- In the last hour of the analysis period (August 9, 19: 06-20: 05 UTC)Bitcoin remained under pressure in a strip of $ 195.11, from $ 116,629.40 to $ 116,519.29 (-0.09%).

- The largest last hour volume peak occurred at 19:27 UTC, when 296.43 BTC changed hands while the price tested support of $ 116,547.

- Recovery attempts have been capped several times nearly $ 116,600 at $ 116,713, in accordance with the previous intra -day resistance.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.