Solana soil

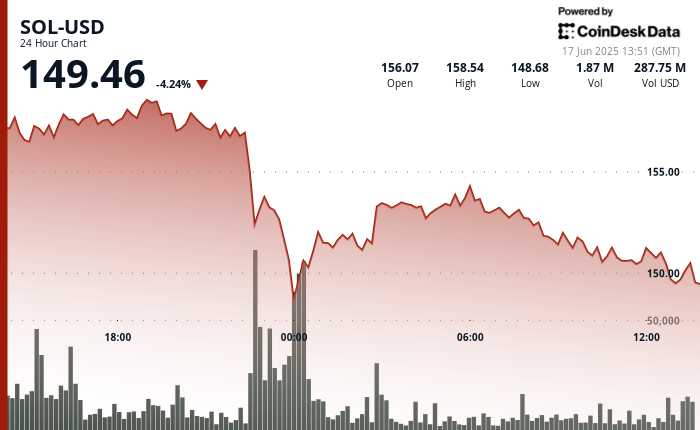

fell 4.24% in the last 24 hours to negotiate $ 149.46, withdrawing from a summit of $ 158.54 after a high night sale. The negotiation volume increased while Sol has broken under $ 155 on Monday evening, the final price at $ 148.68 before entering a restless consolidation around the $ 150 mark.

Despite the short -term pressure, certain institutional investors remain optimistic about the long -term positioning of Solana. On Monday, Cantor Fitzgerald launched the cover of three public companies – Defi Development Corp (DFDV), STRETEGIES SOL (HODL) and Upexi (UPXI) – which hold soil as an asset of the Treasury. The company awarded the three “overweight” notes and underlined Solana’s technical force.

Cantor analysts argued that Solana has exceeded Ethereum in the recent growth of developers and technical performance, citing chain metrics that show higher speed and lower latency. The report added that companies using soil as an asset of the Treasury consider it as a serious competitor to challenge the domination of the ETH, although the ether always has a market capitalization 2.5 times greater.

Although the recent correction has erased a large part of the weekend gains, Sol remains greater than the support area last week. Merchants are now looking at if the token can contain the fork from $ 148 to $ 150 or if additional downward pressure will emerge.

Strengths of technical analysis

- During the analysis window, Sol-USD dropped from $ 158.804 to $ 147,746, forming a 24-hour range of 11.058 points.

- The most steep sale occurred between 10:00 p.m. and 00:00 UTC over a volume greater than 2.7 million soil, by breaking down the support of $ 155.

- The price was later stabilized around $ 152 and exchanged in a tightening range between $ 151 and $ 154.

- The $ 152 zone at $ 153 went from support to resistance during correction, with $ 148.68 marking the weak.

- At 07: 57–07: 58 UTC, the price went from $ 153.118 to $ 152.680 on a peak greater than 150,000 soil in volume.

- Towards the end of the analysis period, Sol consolidated between $ 153,400 and $ 152,680 with a drop in volatility, signaling hesitation among bulls and bear.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.