The Cardano ADA token has climbed $ 2% to $ 0.87 in the last 24 hours, echoing wider recovery from cryptographic markets. The Coindesk 20 index (CD20), which follows the largest digital assets, won 2.8% over the same period.

This decision occurred while merchants weighed two major developments: growing confidence in an interest rate in September reduced by the Federal Reserve and Securities and Exchange American Commission (SECOND) Decision to extend his examination of the fund negotiated by Cardano de Grayscalay (ETF) Until the end of October 2025.

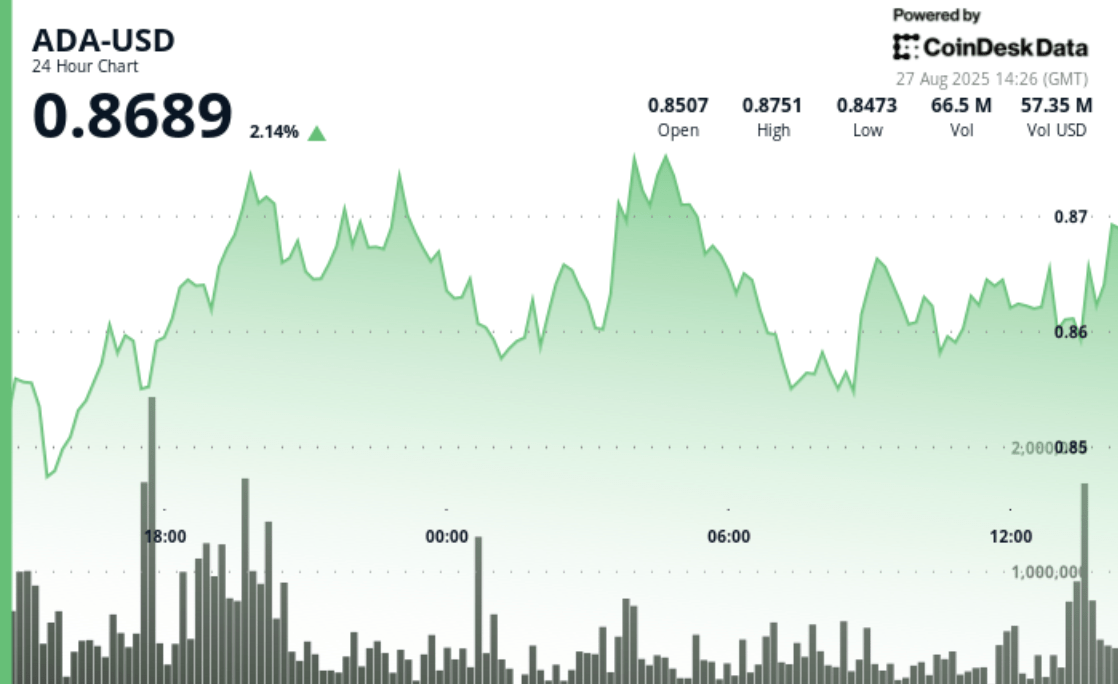

ADA exchanged in a tight but volatile strip of $ 0.04, swinging between a minimum of $ 0.83 and a summit of $ 0.88, according to Coindesk Analytics data. This spread of approximately 5% reflected increased activity. At one point, the token increased sharply, from $ 0.84 to $ 0.88 on negotiation volumes which more than doubled the average of 24 hours of 39.3 million.

After the escape, Ada settled in consolidation. The merchants allowed resistance to $ 0.88, with a new support forming approximately $ 0.85. The action at the end of the session saw the price stabilize at $ 0.86, according to level analysts, can indicate institutional accumulation before another potential rally.

The wider backdrop of the market has been agitated. Cryptographic active ingredients fell sharply on Monday while traders locked up the benefits of a weekend wave triggered by the remarks with the Fed Jerome Powell chair in Jackson Hole. These comments have fueled the expectations of rate drops, which generally support risk assets such as cryptocurrencies by making traditional yields less attractive. Tuesday, investors seemed to treat decline as an opportunity to buy, helping altcoins to bounce back.

Lower interest rates often act as a rear wind for the cryptography sector, where investors are looking for higher yields compared to public debt. Historically, such conditions have prepared the field for the “Altcoin season”, the periods when small tokens surpass bitcoin During the consolidation phases.

Meanwhile, the DEC late in the Graycale FNB Cardano was widely planned, because the regulator has slowed down almost all the decisions of Crypto ETF. While the news has briefly injected uncertainty, Ada’s resilience suggested that traders focused more on the momentum of the market and the rotation of Bitcoin capital in Altcoins.