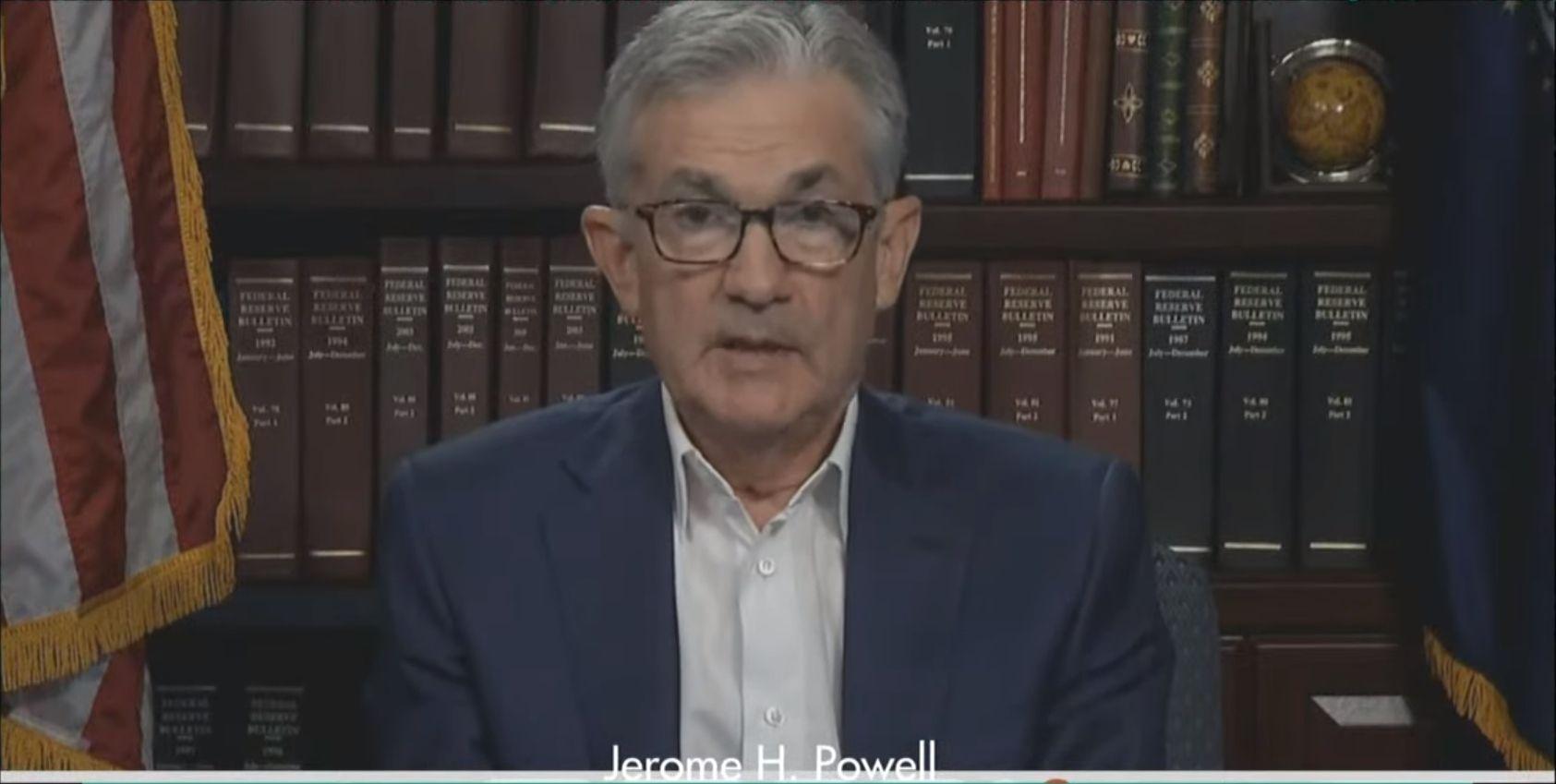

The ADA and the XRP of Cardano led losses among the majors on Tuesday while the merchants are waiting for the next meeting of the Federal Reserve (FOMC), where the rates should remain unchanged, but the comments of the president of the presidency of Jerome Powell could provide indications on the additional positioning of the market.

Bitcoin prices (BTC) exceeded $ 94,000 after briefly plunged below this level on Sunday, continuing its recent behavior linked to the range.

Ada Price fell by almost 4% while XRP slipped in the same way. The ether (ETH) dropped by almost 1%, the BNB of the BNB chain increased by 1.3% and the same Dogecoin (DOGE) fell by 2% in the last 24 hours.

The Coindesk 20 (CD20) with wide based, a liquid index which follows the largest tokens by market capitalization, fell just over 1.8%.

Elsewhere, some DEFI tokens such as AAVE, CUR CUR of Curve and the hyperliquid media was seen a bump on demand during last week as a sign of traffic interest for projects with utility and yield mechanisms, according to some.

“While Memecoins falls into disgrace, traders turn to projects with stronger fundamental principles and token savings,” said Kay Lu, CEO of Hashkey Eco Labs, in Coindesk in a telegram message.

“DEFI ecosystems benefit from this pivot, especially since Bitcoin shows a reduction in volatility and macro uncertainty linger. We hope to see the trend of the challenge continue while bitcoin maintains a reduction in volatility and that crypto acts as a hedge for economic uncertainty,” added.

The media threshing led to gains among the 100 best tokens with an increase of 72% last week, with Aave and CRV up to 40%.

Powell’s commentary in Focus

Crypto markets on the crypto markets and traditional finances are considering this week’s FOMC interest rate decision, with consensual expectations pointing to a break in rate increases.

However, the uncertainty about inflation, the broader prices and tensions of the American-Chinese exchanges left many prudent participants.

“We do not expect the FOMC to trigger a major movement on the markets,” said Augustine Fan, information manager at Signalplus, in a telegram message. “It is a reversal of money on management. Crypto will probably be inspired by a broader growth in profits and how the economy digests the impact of recent trade policies. ”

The recent stock market force suggests that investors only priced in a risk of light recession, around 8%, according to historical withdrawal models. This contrasts with more lower bond market signals and macroeconomic forecasts, added Fan.

Last week, President Trump did not confirm any immediate projects of talks with China, attracting the hopes of a breakthrough in American and Chinese commercial negotiations. However, the possibility of separate commercial concordants contributed to maintaining the feeling of risk intact, as indicated on Monday.