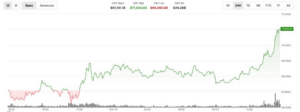

COIN and MSTR lead gains as bitcoin (BTC) climbs above $70,000

Crypto-related stocks opened Wednesday’s US session with big gains in the form of Bitcoin BTC$72,127.07 surged above $72,000 for the first time in almost a month. Crypto exchange Coinbase (COIN) surged above $200 to its highest price since late January, up 12% in the first minutes of trading. Strategy (MSTR), the largest corporate bitcoin holder, […]

COIN and MSTR lead gains as bitcoin (BTC) climbs above $70,000 Read More »