The native token of Oracle Network Chainlink (link) has strongly rebounded with the wider cryptography market after the remarks with the president of the Federal Reserve Jerome Powell in Jackson Hole, Wyoming.

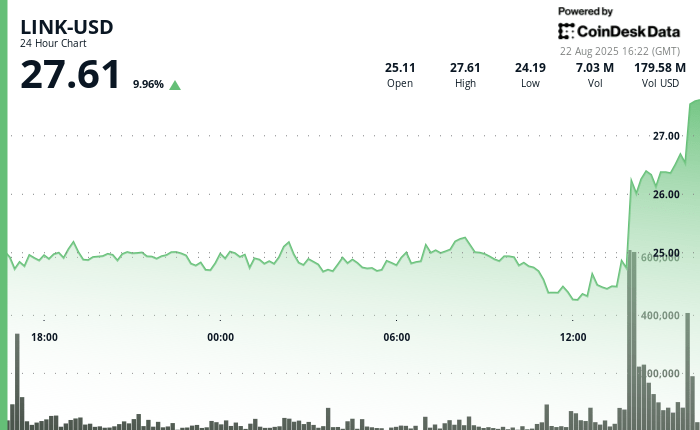

Link joined 12% in the past 24 hours, reaching $ 27.8, his highest price since December. Bitcoin (BTC) appreciated 3.5% in the same period, while the Coindesk 20 index with wide market jumped 6.5%.

In the news specific to the protocol, ChainLink obtained two main security certifications this week: ISO 27001 and a type 1 SOC 2 certificate, marking a first for an Oracle Blockchain platform. The audits, produced by Deloitte, have covered ChainLink Price Foods, Reserve Proof and Transversal Interoperability Protocol (CCIP).

The supplier of Oracle claims that the decision strengthens confidence in its data services and can strengthen adoption between banks, asset issuers and decentralized financing protocols.

Support the rally, the Chainlink reserve, which periodically buys liaison tokens on the free market using the protocol income, bought 41,000 tokens on Thursday, worth around $ 1 million at that time. This brought total titles to 150,778 tokens, or about $ 4.1 million at current prices.

Technical analysis

- Support levels: A substantial defense was established at $ 24.15 with high volume confirmation, according to the technical analysis data of Coindesk Research.

- Entering resistance: Systematic progress through $ 25.00, $ 25.50 and $ 26.00 with the validation of the volume of institutional participants.

- Analysis of the volume of negotiation: Exceptional increase of 12.84 million volumes during the rupture phase, representing five times the average of 24 hours of 2.44 million units.

- Consolidation models: extended consolidation of the tight range around $ 24.70 to $ 25.10 preceding an explosive institutional escape.

- Momentum indicators: Ascending trajectory sustained with advanced advanced characteristics and institutional accumulation signals of business treasury operations.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.