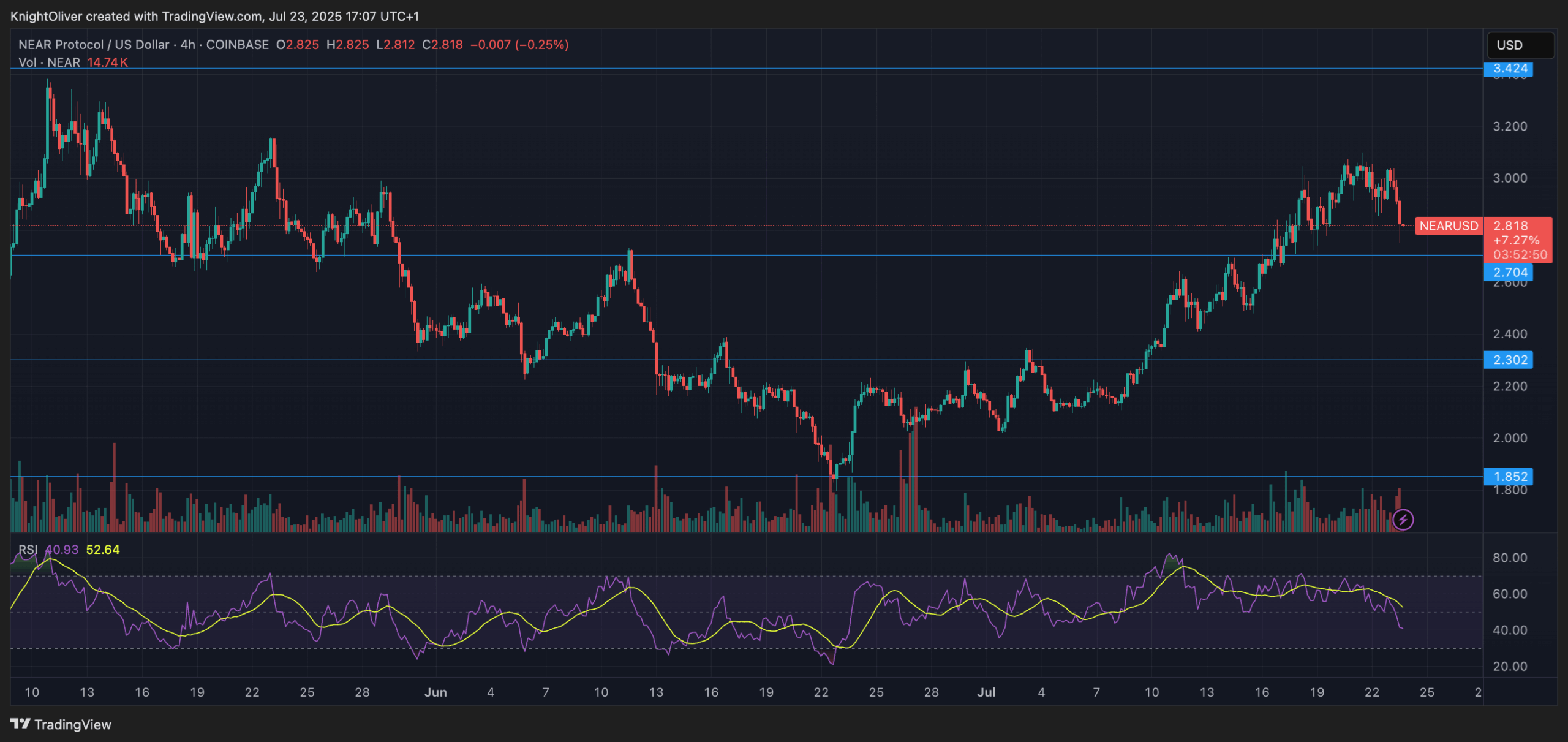

Near the protocol endured a turbulent 24 -hour section between July 22 3:00 p.m. and July 23, 2:00 p.m., from $ 2.97 to $ 2.81 in a movement of 5.41% which highlighted a wider weakness in the Altcoin complex.

The token exchanged in a volatile range of $ 0.28, culminating at $ 3.04 before lighting up to an intraday lower $ 2.76. The strongest sale emerged in July 23 1:00 p.m., because almost $ 2.84 to $ 2.76, with negotiation volumes reaching 14.19 million tokens, which, five times its average of 24 hours.

This dynamic has established significant resistance at $ 2.84, suggesting that traders will monitor this level for reversal signs.

During a critical hour from 1:10 p.m. to 2:09 p.m. UTC, almost briefly stabilized after plunging 2.46% from $ 2.84 to $ 2.77, before going back to $ 2.80.

The commercial intensity culminated between 13:41 and 13:51, when more than 850,000 units changed hands per minute, highlighting the fragility of support almost $ 2.76.

While the rebound alludes to a potential short -term consolidation, the softness of the wider Altcoin market raises questions about the question of knowing so closely can maintain an ascending momentum.

Adding to the mixture, near the partnership of the Foundation with Everclear to develop a transversal settlement infrastructure could act as a catalyst for a renewed interest. Meanwhile, traders continue to see the rise of narrative projects such as Magacoin finance, which has diverted speculative capital, as a development problem, development delays before the fourth quarter of 2025.

Technical analysis

- Price action: Nearly dropped by $ 2.41% to $ 2.97 to $ 2.81 (July 22-23), with a negotiation range of $ 3.04 (high) at $ 2.76 (low).

- Volume peak: 14.19 m tokens exchanged during the peak sale, well above the daily average of 2.89 m.

- Resistance level: $ 2.84 was established as a resistance of significant general costs after several rewards that failed.

- Level of support: $ 2.76 contained as a key floor during high volume volatility.

- Altcoin context: A larger weakness of the market weighs Narch’s recovery prospects.

Warning: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee accuracy and membership of our standards. For more information, see the complete Coindesk AI policy.