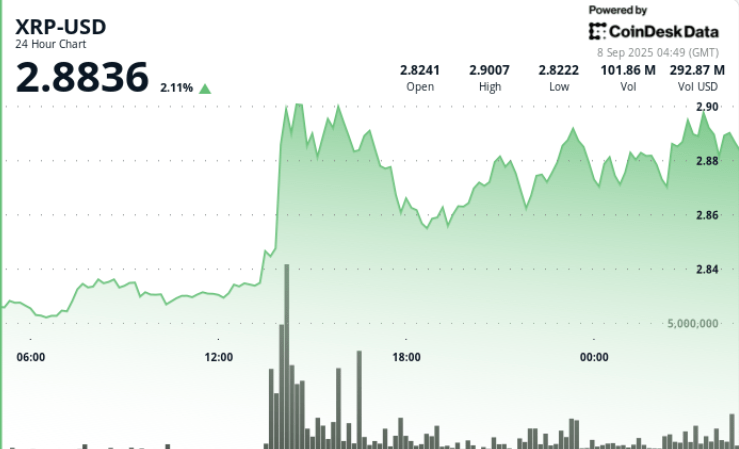

XRP jumped strongly during the session on Monday, going from $ 2.83 to $ 2.88 while a push in small groups briefly tested $ 2.92 over an average volume of six times. Bulls held a company above $ 2.86 support, but a repeated rejection at $ 2.90 to $ 2.92 capped upwards. With reduced bets of the Fed 100% before the September 17 meeting, the institutional entries remain strong – letting the token consolidate just under critical resistance.

New context

• The expectations of the decrease in Fed rates increased, the term markets with a chance of 99% of a drop of 25 base points at the FOMC meeting on September 17.

• The climbing of American-Chinese trade tensions has delighted volatility and pushed the risk in the crypto.

• The DOM market analyst reported + 10m XRP net of pressure purchase in 15 minutes during the rupture window.

• Split of the technical community: a lower divergence reported on weekly graphics compared to upward projections in escape to targets of $ 4.50.

Summary of price action

• XRP increased by 3% in the window from September 7 to 8, merchant a range of $ 0.10 between $ 2.83 and $ 2.92.

• Sequence in small groups at 2:00 p.m. (September 7) the price raised from $ 2.85 to $ 2.92 on Volume 231.25m – 6x the average 24 hours.

• Bulls defended the support of $ 2.86 on several repetitions.

• The resistance strengthened at $ 2.90 to $ 2.92, where upward attempts failed.

• The last hour withdrawal saw XRP slipped 1% from $ 2.88 to $ 2.87, with a net volume of 2.1 m at 02:20 ceiling of the rally.

Technical analysis

• negotiation plux: $ 0.10 (4% volatility) Between $ 2.83 and $ 2.92.

• Support: $ 2.86 remains the key floor; Repeated defense shows accumulation.

• Resistance: $ 2.90 – $ 2.92 have gatherings capped on several tests.

• Indicators: RSI MID-50S = neutral biases with stool.

• MacD histogram converging towards a bullish crossing, confirming the trend of accumulation.

• Model: descending consolidation of triangles in less than $ 3.00; Escape greater than $ 3.30 could extend the objectives to $ 4.00 to $ 4.50.

What traders look at

The question of whether XRP can display supported fences greater than $ 2.90 remains the immediate development. A rupture confirmed above this resistance could open a room at $ 3.00 to $ 3.30, while repeated failures can strengthen the ceiling and invite renewed sales pressure.

• The meeting of September 17 of the Federal Reserve is largely loomed, the markets almost tariff the certainty of a cup of 25 points. Any surprise in the rates route directives will directly affect the liquidity of the dollar, which traders consider a key engine for short -term cryptography flows.

• Whale entries remain closely followed, with reports of 340 million XRP accumulated in recent weeks. Large -scale purchases could support the consolidation soil, while slowing down of accumulation would weaken an increased conviction.

• The DSA October decisions on ETF XRP spot applications are the longer -term catalyst. Approval could trigger structural entries from institutional vehicles, while delays or refusals can alleviate the feeling and cap of the momentum around the $ 3.00 level.