By James Van Stratotn (at all times and unless otherwise indicated)

The last 24 hours are among the most eventful in cryptographic industry for years, and this has been reflected in the price of Bitcoin (BTC) on Thursday, which whipped from 2% to 3% several times in a few minutes. However, he managed to stay above the psychological level of $ 100,000 and is currently about $ 105,000.

President Trump’s rhetoric continues to help weaken the dollar, which generally stimulates risk assets such as cryptocurrencies. The index Dxy, a measure of the American currency against a basket of main trade partners, fell to the lowest since December 17, which should give risk assets a boost. US bond yields and crude WTI oil also descend, with oil for less than $ 75 a barrel, the lowest in two weeks.

On the other side of the world, the Bank of Japan (BOJ) has held its promise with another increase in the interest rate, bringing the rate of 0.50%policy, the highest in more than 16 years. This has followed a very hot inflation impression, with an inflation of large titles of 3.6% compared to the previous year, the fastest since January 2023. The question is whether we will obtain a second iteration of the trade Transport du Yen which took place in August from last year. Time will tell us. Stay vigilant!

What to look at

Crypto:

January 25: First deadline for dry decisions on the proposals for four ETF Solana Solana: Bitwise Solana Etf, Canary Solana ETF, 21shares Core Solana Etf and Vaneck Solana Trust, who are all sponsored by CBOE BZX Exchange.

January 29: Launch of the Mainnet Ice Open Network (ION).

February 4: Microstrategy Inc. (MSTR) Q4 FY 2024 Generation Report.

February 4: Pepecoin (Pepe) half reduced. In block 400,000, the award will fall to 31,250 pépectoin.

February 5, 3:00 p.m.: Upgrade of the Holocene Hard Fork network of Boba Network for its Mainnet L2 based on Ethereum.

Macro

January 24 at 4:00 a.m.: S&P Global Ording Janrical 2025 Europe HCOB Purchase Managers’ Index (FLASH) Reports.

PMI is. 49.7 against prev. 49.6.

PMI manufacturing is. 45.3 against prev. 45.1.

PMI services is. 51.5 against prev. 51.6.

January 24 at 4:30 am: S&P Global Ording Release January 2025 index index (flash) reports of the United Kingdom.

PMI is. 50 against prev. 50.4.

PMI manufacturing is. 47 against prev. 47.

PMI services is. 50.9 against prev. 51.1.

January 24, 9:45 am: S&P Global Order of January 2025 reports on the index of purchasing managers (FLASH) of the United States.

PMI composite PMI Prev. 55.4.

PMI manufacturing is. 49.6 VS provided. 49.4.

PMI services is. 56.5 against prev. 56.8.

January 24, 10:00 am: The University of Michigan publishes American consumer feeling data in January.

Index of consumer feeling (final) is. 73.2 against prev. 74.

Token events

Governance votes and calls

Frax Dao discusses an investment of $ 5 million in World Liberty Financial (WLFI), the crypto project supported by President Donald Trump’s family.

January 24: Deadline for the activation of Arbitrum Bold. Bold allows anyone to participate in validation and to defend themselves against malicious allegations in the state of an arbitrum chain.

January 24: Hedera (Hbar) is organizing a community call at 11 a.m.

Unlocking

January 31: Optimism (OP) to unlock 2.32% of the supply in circulation worth $ 52.9 million.

January 31: Jupiter (JUP) to unlock 41.5% of the supply in circulation worth $ 626 million.

Conferences:

Day 12 of 12: Swiss Web3fest Winter Edition 2025 (Zug, Zurich, St. Moritz, Davos)

Day 5 of 5: Annual meeting of the World Economic Forum (Davos-Klosters, Switzerland)

Day 1 of 2: Adopt Bitcoin (Cape Town, South Africa)

January 25-26: Catsanbul 2025 (Istanbul). The first community conference for Jupiter, a decentralized (DEX) exchange of an Solana.

January 30, 12:30 p.m. to 5:00 p.m.: International DEFI 2025 day (online)

January 30-31: Plan B forum (San Salvador, El Salvador)

January 30 to February 4: The Satoshi Round Table (Dubai)

February 3: Digital Assets Forum (London)

February 5-6: the 14th Blockchain World Congress (Dubai)

February 6: Ondo Summit 2025 (New York).

February 7: Solana Apex (Mexico)

February 13-14: The 4th edition of NFT Paris.

February 18-20: Hong Kong consensus

February 19: Su Connect: Hong Kong

February 23 to March 2: Ethdenver 2025 (Denver)

February 25: Hederacon 2025 (Denver)

Talk about tokens

By Shaurya Malwa

A new decentralized humorous autonomous organization, Fartstrategy (FSTR) DAO, invests user funds in Fartcoin.

The DAO takes advantage of soil borrowed to acquire the token, offering investors a chance to expose themselves to its price movements via FSTR.

If FSTR is negotiated below its support for Fartcoin, tokens holders can vote to dissolve the DAO, rebuilding their share of Fartcoin proportionally after setting debts into circulation.

Vine memecoin has reached a market capitalization of $ 200 million less than $ 48 hours after the issue.

He was launched on the Solana blockchain by Rus Yusupov, one of the co-founders of the original Vine application, and introduces as a nostalgic tribute to the eponymous platform known for its six-second loop videos. Vine was an important cultural phenomenon before closing in 2017.

There have been recent discussions on the potentially revival of the application, Yusupov and the Elon Musk technocrat manifested for his return.

Positioning of derivatives

TRX leads to growth in the open interest of perpetual term contracts for the main parts.

Major finance rates remain below a 10% annualized, a sign that the market is not too speculative despite the BTC trade near optimism records on Trump’s cryptographic policies.

BTC and ETH Call Skews have refreshed, with flows of blocks featuring long efforts in higher BTC calls and a distribution of bull calls in ETH, involving calls for $ 5,000 and 6,000 strikes and 6,000 $.

Market movements:

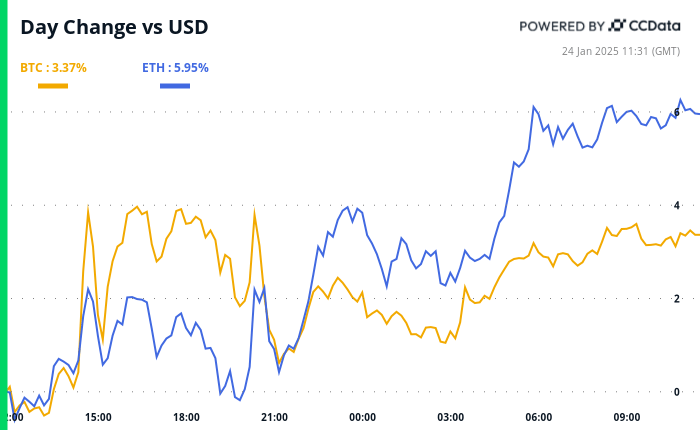

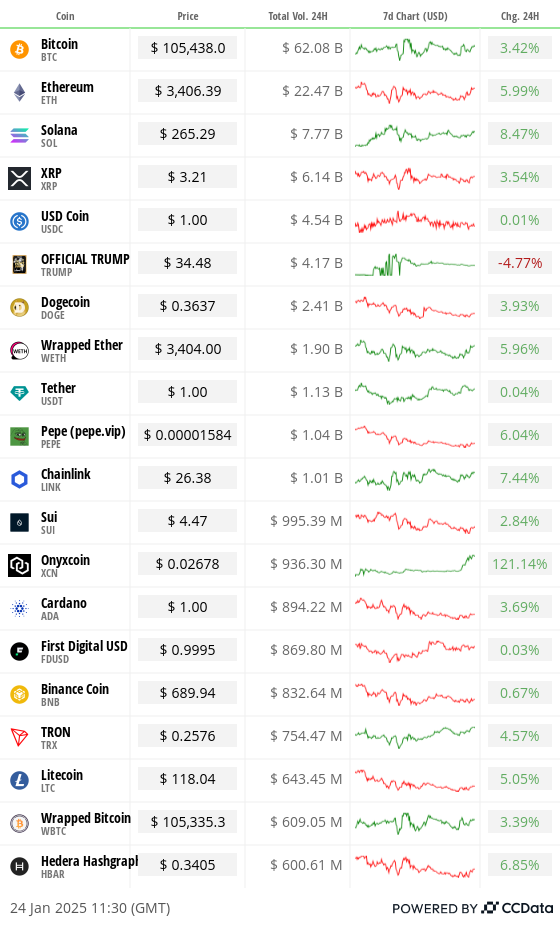

BTC is up 2% compared to 4 p.m. HE Thursday at $ 105,450.57 (24 hours: + 3.43%)

ETH is up 4.96% to $ 3,409.62 (24 hours: + 6.18%)

Coindesk 20 is up 2.4% to 3,988.16 (24 hours: + 4.79%)

The CESR composite strhead rate increases from 1 bp to 3.16%

The BTC financing rate is 0.0069% (7.58% annualized) on Binance

Dxy is down 0.48% to 107.53

Gold is up 0.68% to $ 2,775.28 / Oz

The money increased from 1.21% to $ 30.86 / Oz

Nikkei 225 closed unchanged at 39,931.98

Hang Seng closed + 1.86% to 20,066.19

FTSE is down 0.33% to 8,537.12

Euro Stoxx 50 increased by 0.73% to 5,255.47

Djia closed Thursday + 0.92% to 44,565.07

S&P 500 closed +0.53 to 6,118.71

Nasdaq closed + 0.22% to 20,053.68

The S&P / TSX composite index closed + 0.48% to 25,434.08

S&P 40 Latin America closed + 0.57% to 2,310.35

The US Treasury at 10 years old fell from 13 bps to 4.64%

The term contracts on E-Mini S&P 500 are down 0.13% to 6,143.75

The term contracts on the NASDAQ-100 E-Mini are down 0.56% to 22.005.50

E-Mini Dow Jones Industrial Industrial index is unchanged at 44,709.00

Bitcoin statistics:

BTC dominance: 58.51 (-0.11%)

Ethereum / Bitcoin ratio: 0.032 (0.68%)

Hashrate (Mobile average at seven days): 784 EH / S

Hashprice (spot): $ 61.0

Total costs: 6.8 BTC / 104,070 $

CME Futures open interest: 191 645

BTC at the price of gold: 38.1 oz

BTC VS Gold Bourse Capt: 10.83%

Technical analysis

The ether seems to have obtained a falling corner pattern, characterized by two convergent trend lines, representing a series of lower and lower lower tops.

The converging nature of the trend lines indicates that sellers slowly lose adhesion.

A break would represent a bullish trend reversal.

Cryptographic actions

Microstrategy (MSTR): closed Thursday at $ 373.12 (-1.11%), up 2.55% to $ 382.62 in pre-commercialization.

Coinbase Global (corner): closed at $ 296.01 (+ 0.05%), up 2.16% to $ 302.39 in pre-commercialization.

Galaxy Digital Holdings (GLXY): closed at $ 33.94 CA (+ 3.44%)

Mara Holdings (Mara): closed $ 19.95 (+ 1.32%), up 1.8% to $ 20.31 in pre-market.

Riot Platforms (Riot): fenced at $ 12.99 (-1.14%), up 2.62% to $ 13.33 in pre-commercialization.

Core Scientific (CORZ): closed at $ 16.34 (+ 2.32%), up 1.04% to $ 16.51 in pre-market.

Cleanspark (CLSK): closed at $ 11.41 (+ 2.42%), up 2.19% to $ 11.67 in pre-market.

Coinshares Valkyrie Bitcoin Miners Etf (WGMI): closed at $ 25.65 (+ 0.47%), up 1.75% to $ 26.10 in pre-market.

Semler Scientific (SMLR): closed $ 61.15 (-1.55%), down 10.89% to $ 54.49 in pre-commercialization.

Exodus movement (Exodus): closed at $ 44 (+ 7.32%), up 0.75% to $ 44.33 in pre-market.

ETF Flows

BTC ETFS spot:

Daily net flow: $ 188.7 million

Cumulative net flows: 39.42 billion dollars

Total BTC Holdings ~ 1.169 million.

ETH ETFF SPOT

Daily net flow: – $ 14.9 million

Cumulative net flows: $ 2.79 billion

Total of Holdings ~ 3.663 million.

Source: Wacky investors

Nightflow

Graphic of the day

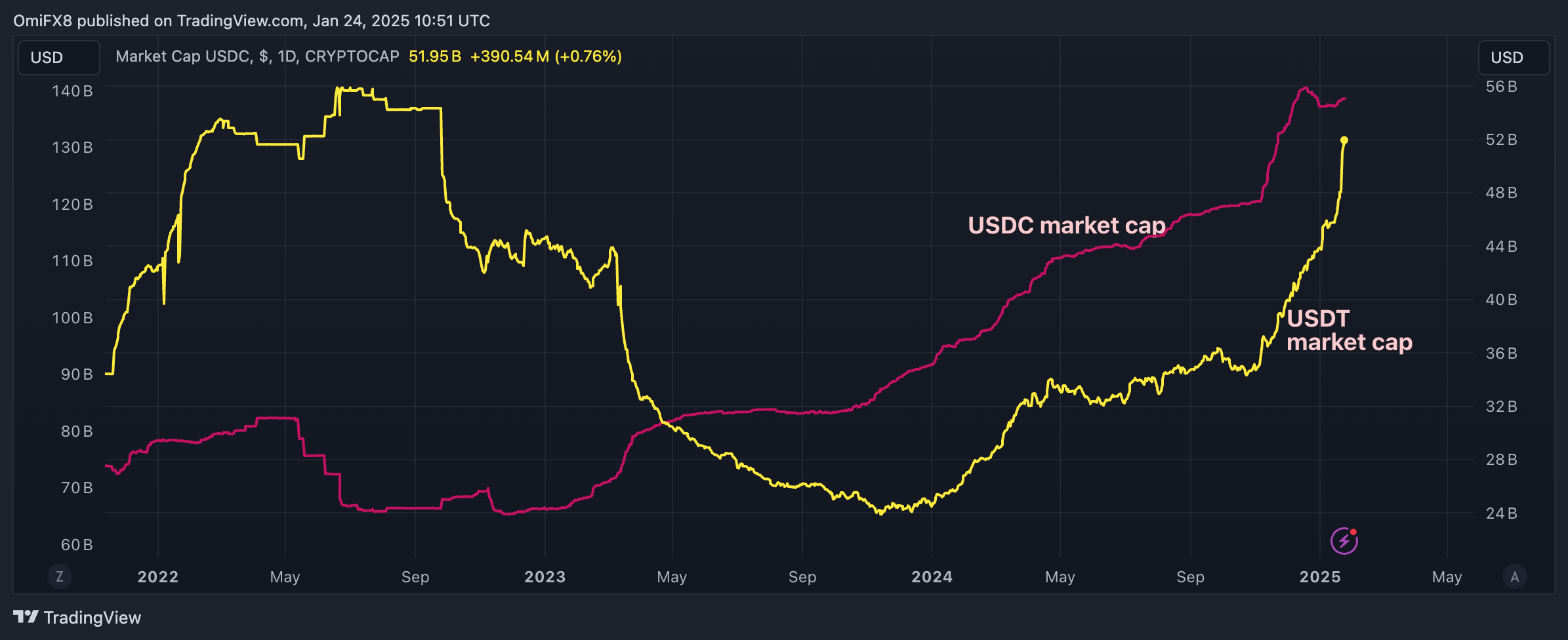

The market capitalization of the USDT in Tether, the largest stable -co -pointed in the world in the world, has flattened nearly $ 138 billion.

The USDC’s offer continues to increase and has reached nearly $ 52 billion this week, the highest since September 2022.

While you slept

Bitcoin stable nearly $ 104,000 after Bank of Japan has delivered an increase in Hawkish rates (Coindesk): Bitcoin maintained above $ 104,000 in Asian first hours on Friday despite the increase in rates of the Bank of Japan of Japan While the markets have watched President Trump’s executive decree on crypto and potential American policy changes.

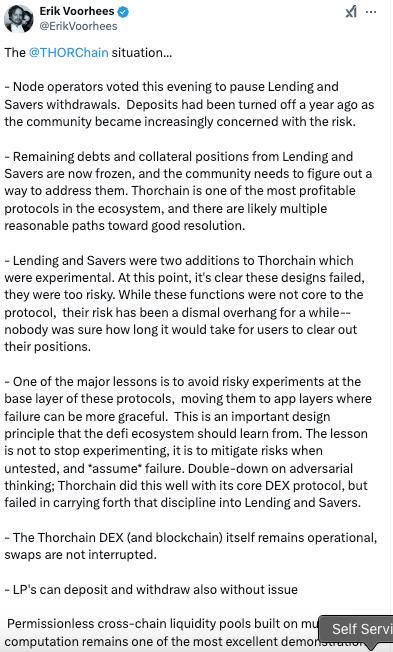

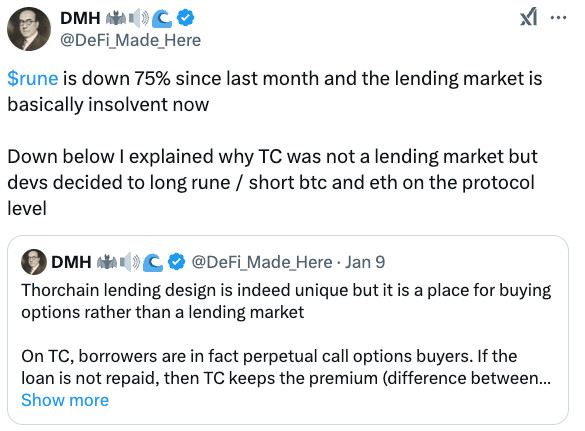

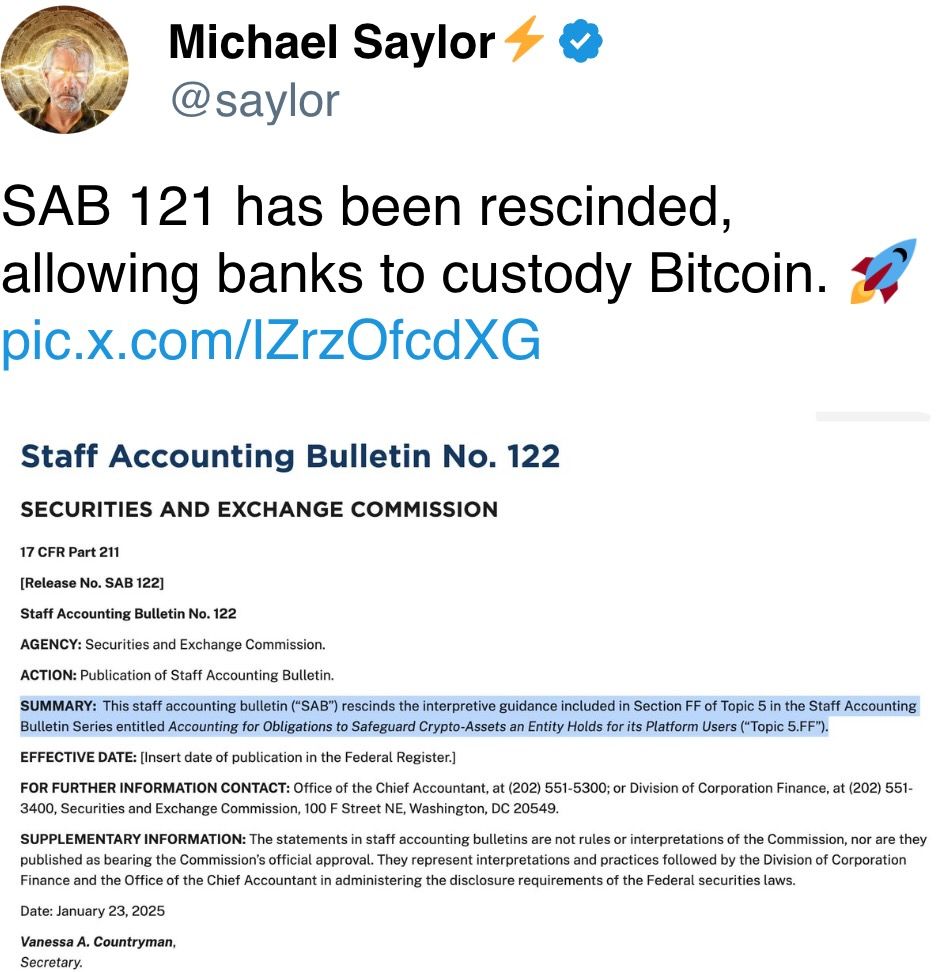

Trump issues a cryptographic decree to open a digital assets (Coindesk): President Trump published a pro-Crypto decree, leading the creation of a digital asset framework, prohibiting the development of the CBDC and considering a national reserve digital assets.

Vitalik Buterin Calls for Added Focus On Ether As Part of the Network’s Scaling Plans (Coindesk): in A Thursday post, Ethereum Co-Founder Vitalik Buterin Outlined Strategies To Boost the Value Of Ether Including Using It As Collateral, Implementing Fee-Burning Incentives and Increase in temporary transaction data called Blobs.

Hiking rates in Japan, strengthening the release of rock borrowing costs (Bloomberg): the Bank of Japan increased its key rate of 25 basis to 0.5% Friday, the highest of 17 years, reinforcing The Yen and raising bond yields at 10 years to 1.23%.

American shares at most expensive compared to the obligations since the Dotcom era (Financial Times): S&P 500 shares have reached record assessments, the equity risk premium becoming negative for the first time since 2002 by demand in arrow of dominant technological companies.

Trump 2.0 is going well for China so far. Can the honeymoon last? (CNN): In an interview on Thursday, President Trump described the prices as “formidable power”, but suggested agreements could avoid more strict measures. Beijing cautiously welcomed the stay, looking at the negotiations while preparing for future tensions.

In ether