The Crypto Terawulf (WULF) extraction company plans to raise debts of $ 3 billion to extend its data center operations in an agreement supported by Google, while the AI infrastructure race is intensified.

The company, reports Bloomberg, citing the CEO of Terawulf, Patrick Fleury, works with Morgan Stanley to organize funding, which could be launched next month through high -performance bonds or leverage loans.

Credit rating agencies assess the agreement, and Google’s support can help guarantee a higher credit rating than what is typical of the company.

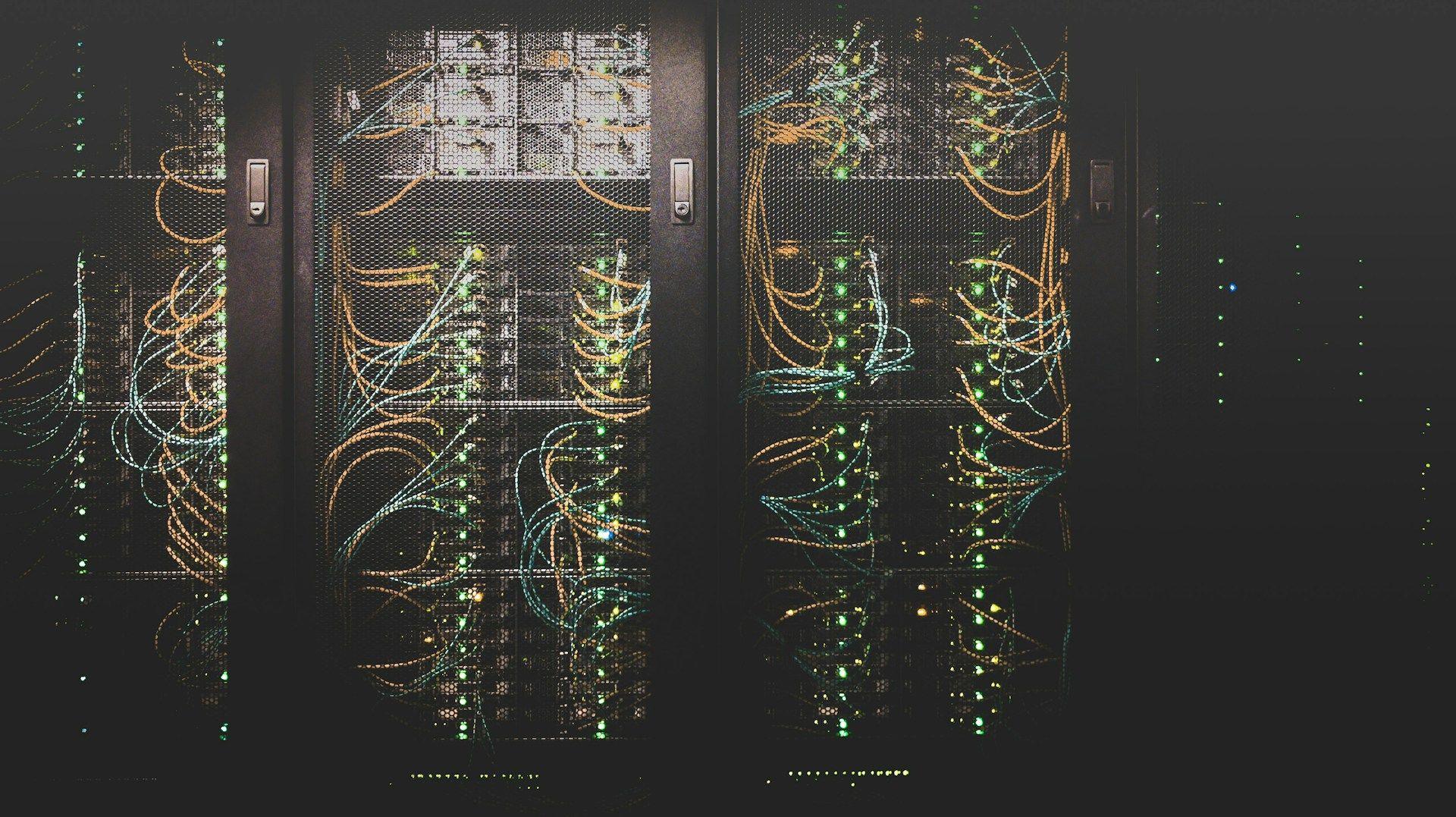

The hunger of the AI industry for the space of the data center, fleas and electricity has attracted improbable cryptographic minors, which already control a high intensity infrastructure which can be reused for the workloads of AI.

Google, which recently increased its fixed for Terawulf to $ 3.2 billion, now has a 14% stake in the company. This support helped Ai Cloud Platform Fluidstack to extend its use of a data center managed by Terawulf in New York in August.

Other cryptocurrency companies follow suit. Cipher Mining has concluded a similar agreement with Google and Fluidstack this week. Google will also bring together $ 1.4 billion in obligations related to this agreement and will take equity in capital in Cipher.

Terawulf’s shares dropped by around 1.3% during the negotiation session on Friday and were unchanged in trade after opening hours.