The Senatoric Banking Committee presented a discussion bill to combat the structure of the cryptographic market, by attacking a part of what will be generally an important legislative push to respect the law on the clarity of the Chamber.

You read State of Crypto, a Coindesk newsletter looking at the intersection of the cryptocurrency and the government. Click here to register for future editions.

Auxiliary assets

The story

The Senatoric Banking Committee has presented a bill on the structure of the discussion project market to explain how it thinks that the American securities and exchange commission should supervise digital assets, presenting the concept of an “auxiliary asset” and asking the general public to weigh on the project by the beginning of August.

Why it matters

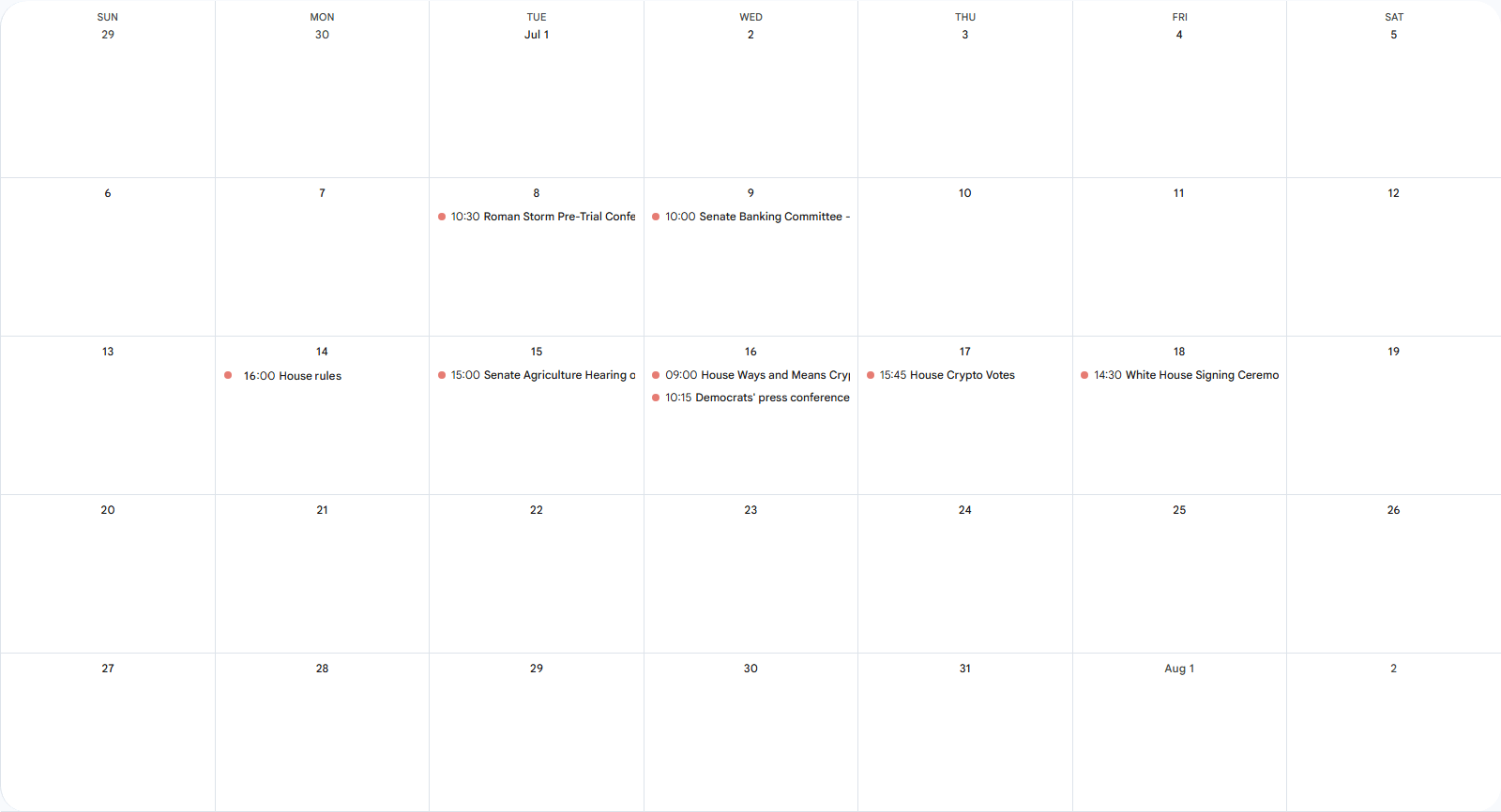

While the Chamber voted to advance its clarity law last week, the Senate must still sign the legislation on the structure of the market before President Donald Trump could sign it. This week, the senatoric banking committee revealed where its efforts were focused: the dry and its role, but with a somewhat different approach from the room.

Decompose it

The Senatoric Banking Committee has published a discussion bill for its financial innovation law responsible for 2025, giving the general public for two weeks to answer one or more of the dozens of questions he asked about the project.

The project creates the term “accessory asset” and defines it in terms of how the securities and exchange commission could supervise them.

Rashan Colbert, the director of American policies of the Crypto Council for Innovation, an industry interest group, told Coindesk that the discussion project is clearly focused on the jurisdiction of the banking committee.

“In the bill, you see a reference to a digital goods, but you do not see an attempt to explicitly articulate what it is … along this line, you do not see the attempt to articulate what the trade in digital products really looks like,” he said. “Seeing a part of the total image here, and this is very clear of their work is a project, and they asked for answers, to help them help them flesh out the image.”

The process that the Senate progresses can be different from the way in which the Chamber has adopted its law on clarity, said Colbert, but it expects that the committees of agriculture and the bank end up coordinating the legislation on the structure of the market.

Whatever the progress of the bill, it will also take the Democratic contribution, given the threshold of 60 vote to move a bill via the Senate – at present, the discussion project has been published in a press release which cited the majority members.

Stories that you may have missed

- Roman temporary trial: Is coding a crime? The Battle of the Tornado Cash Court intensifies: The criminal trial of Roman Storm continues, the accusation resting Thursday. Cheyenne Ligon explains what’s going on in the courtroom.

- The defense raises the possibility of a trial on a testimony of testimony of “victim” allegedly misleading: the Roman temporary trial: One of the witnesses to the case of the Ministry of Justice against Storm may have had no connection with the Tornado Cash, which led to the defense saying that he could consider calling a trial.

- The Doj envisages criminal charges against capital employees Dragonfly for investments in Tornado species aged years: Prosecutors of the Ministry of Justice suggested that they could carry accusations against Dragonfly Capital leaders for their investments in the torade in cash years ago, saying that they do not give Dragonfly’s general immunity, Tom Schmidt Immunity if he testified for the defense of Storm.

- The dry approves, pauses immediately with Bitwise to convert the Bitw crypto index fund to ETF: Bitwise has received delegated staff approval to launch a multi-active stock market negotiated fund, but as the similar product of Graycale before him, the SEC interrupted this magazine of the Commissioner in the meantime.

- The Crypto Polymarket prediction market weighs the launch of its own stablecoin: Source: Polymarket plans to launch your own stablecoin or conclude an income sharing agreement with Circle.

- Polymarket returning to us with an acquisition of $ 112 million after the prosecutors probe: Polymarket also acquired American license derivatives QCX, which gave it back to American customers legally after last week news that federal investigators no longer sought if it raped a CFTC consent order which blocked it by serving American customers.

- The FBI drops the criminal probe to the founder of Kraken Jesse Powell: The founder and president of Kraken Jesse Powell was under federal investigation into the hacking of suspicions, but the FBI abandoned this investigation, said a lawyer for him in a court.

- The great jury accuses the pastor, marries in an alleged cryptocurrency scam of several million dollars: The Denver district prosecutor brought charges against a couple who would have requested nearly $ 3.4 million from visitors to their church and other churches for a cryptocurrency.

- The $ 9 million victory in Yuga Labs Bored Ape Yacht Club against Ryder Ripps must better prove the brands violation: A court of appeal ruled that, although Yuga Labs is eligible for the protection of brands for his NFTS Club Ape Yacht, he must better prove that Ryder Ripps and the NFT of his partners break this brand under the law.

- Photos: Trump signs genius in law: Here are some pictures that my colleague Jesse Hamilton and I took at the White House last week.

This week

This week

- A business meeting has been planned for the Senatorial Agriculture Committee to examine the appointment of Brian Quintenz to the president of the Commodity Futures Trading Commission, but was postponed to July 28.

Elsewhere:

- (Bloomberg) Cryptographic companies have spent a little less than $ 7 million in lobbying in the second quarter of 2025. Coinbase spent just under a million dollars in digital asset problems, as well as lobbying “on issues affecting budgetary demand and credits of the securities committee,” said Bloomberg.

- (Politico) US President Donald Trump visited the offices of the Federal Reserve, inflating the cost of his current renovation in an exchange with the president of the Fed, Jerome Powell.

- (Galaxy Digital) Galaxy has published an overview of all Donald Trump’s policy changes around Crypto during the first six months of his presidential mandate.

If you have reflections or questions about what I should discuss next week or any other comment you want to share, do not hesitate to send me an e-mail at nik@PK Press Club.com or to find me on Bluesky @ nikhileshde.bsky.social.

You can also join the group conversation on Telegram.

See you next week!