The founder of Curve Finance, Michael Egorov, unveiled a proposal on the Curve Dao governance forum which would give holders of decentralized scholarships a more direct means of winning income.

The protocol, called the yield base, aims to distribute lasting yields to CRV holders who put tokens to participate in governance votes, receiving VECRV tokens in exchange. The plan goes beyond the occasional air terminals which have defined the economy of token of the platform to date.

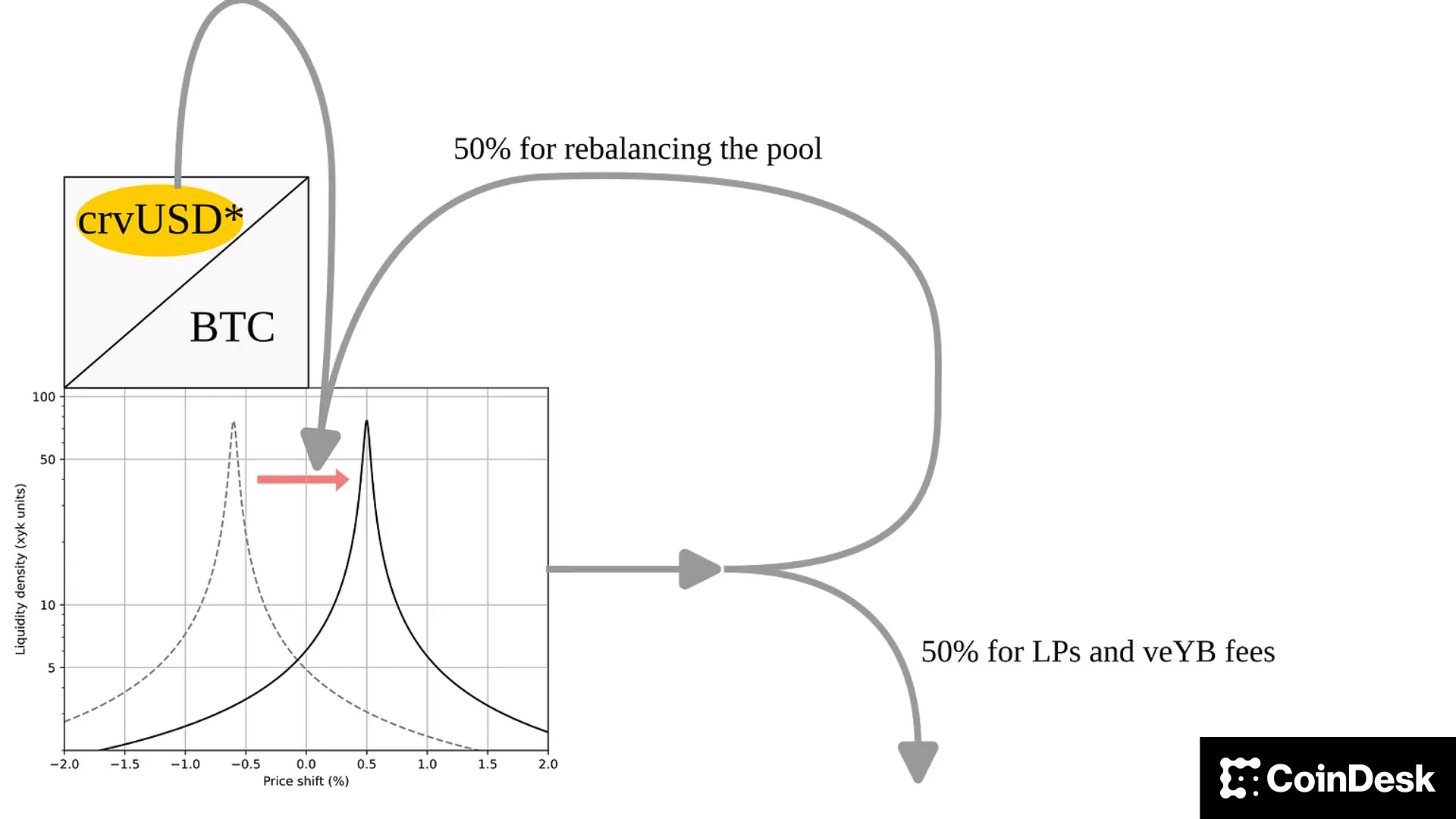

Under the proposal, 60 million dollars of Curve Stable Crvusd will be struck before the start of the yield base. The token sales funds will support three swimming pools focused on Bitcoin; WBTC, CBBTC and TBTC, each capped at $ 10 million.

The yield base will render between 35% and 65% of its value to VECRV holders, while reserving 25% of yield basic tokens for the curve ecosystem. The vote on the proposal takes place from September 17 to September 24.

The protocol is designed to attract institutional and professional merchants by offering transparent and durable bitcoin yields while avoiding problems of current impermanent loss in automated merchants.

The impermanent loss occurs when the value of the assets locked in a liquidity pool changes compared to the maintenance directly of the assets, leaving liquidity suppliers with fewer gains (or more losses) Once they withdraw.

The new protocol is aimed at a context of financial turbulence for Egorov himself. The founder of the curve underwent several high -level liquidations in 2024 linked to the purchases of CRV with leverage.

In June, more than $ 140 million in CRV posts were liquidated after Egorov borrowed strongly against the token to support its price. This episode left the curve with $ 10 million in questionable receivables.

More recently, in December, Egorov was liquidated for 918,830 CRV (about $ 882,000) After the token, dropped 12% in a single day. He said later on X that the position was linked to the Uwu hack funds and represented the reimbursement of a promise from the Uwu founder.

The CRV has increased by around 1% in the last 24 hours.