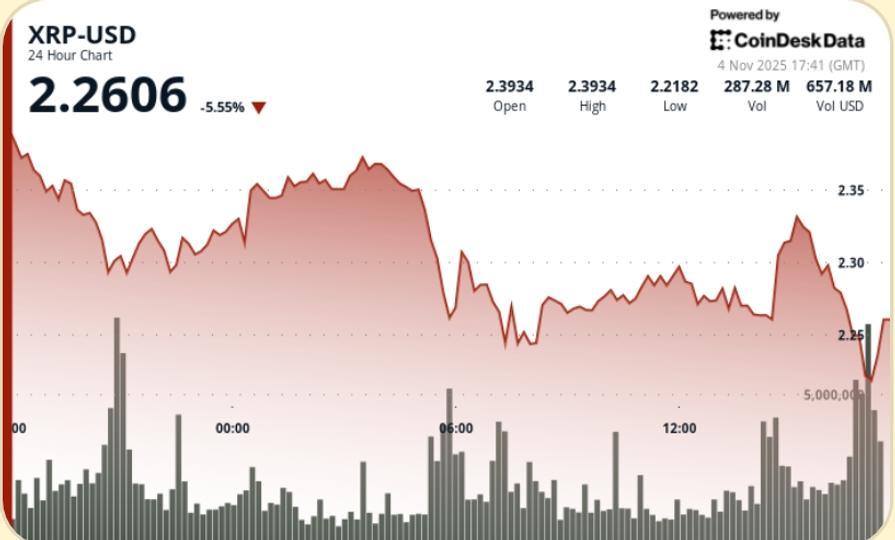

XRP extended its decline on Tuesday, falling 6% to $2.25, as whale selling and a sharp trendline break accelerated bearish momentum. The move, coupled with a 15% drop in open interest, keeps pressure on bulls ahead of a looming death cross setup and a retest of key support at $2.20.

What you need to know

• XRP fell from $2.39 to $2.25 (-6%), confirming a break below the multi-month ascending trendline.

• Whale wallets unloaded around 900,000 XRP over five days

• Open interest fell about 15% as leveraged long positions unraveled.

• Volume reached approximately 193.7 million during the outage period.

• Lower-high structure now established at $2.39 → $2.37 → $2.33

News context

The sell-off follows the whales’ persistent breakdown since late October, with large holders losing positions following repeated failures above the 200-day moving average. Macroeconomic risk also resurfaced in risk assets as open interest rates compressed across major currencies, suggesting it was deleveraging – not a retail panic flow – that drove Tuesday’s move. Analysts point to an impending death cross pattern as momentum indicators decline decisively, while some positioning desks have flagged bids near $2.20 as the next pocket of liquidity for potential stabilization.

Price Action Summary

• Inability to reclaim the $2.37 to $2.39 supply zone

• Progressive distribution of lower treble signals

• Trendline Violation Triggered Accelerated Algorithm Selloff

• Volume increased approximately 87% over the 24-hour average during an outage.

• Session low printed at $2.24 before a modest resumption of bidding to $2.25.

Technical analysis

• Trend: break of the ascending structure, bearish dynamics

• MA: 50-day MA falling towards 200 days → risk of death

• Support: $2.25 base in the short term; Psychological layer from $2.20 to $2.00; deeper pocket around $1.85

• Resistance: The $2.37-$2.39 area remains the dominant supply wall

• Volume: Expansion confirms distribution; exhaustion at the end of the session portends a short-term break

What traders are looking at

• If $2.20 absorbs selling pressure or reaches $2.00.

• Confirmation (or fade) of the Death Cross configuration

• Stabilization of open interest rates after a 15% flush

• Whale wallet behavior after dumping around 900,000 tokens

• Recovery of the range from $2.37 to $2.39 as the threshold for invalidating increases.