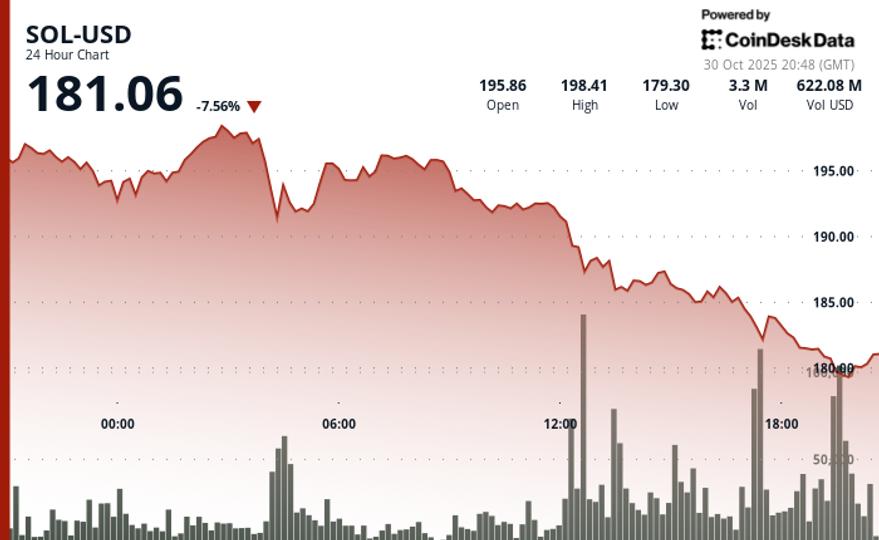

Solana fell 8% on Thursday, extending this week’s decline despite the long-awaited launch of the first Solana spot ETFs in the United States.

The fall below $180 erased all year-over-year gains for the token and also leaves it down 4% for 2025. Making these numbers worse for the bulls SOL, BTC and ETH – despite their own recent price weakness – continue to post year-over-year gains of over 40%.

The Bitwise Solana Staking ETF (BSOL), launched on Tuesday, generated $116 million in net inflows in the first two sessions, adding to $223 million in seed investment, according to data from Farside Investors. The Grayscale Solana Trust (GSOL), which switched from a closed-end fund to an ETF on Wednesday, attracted a modest inflow of $1.4 million.

Bitwise’s decent capital inflow wasn’t enough to support SOL, which saw a 12% decline from Monday’s highs.

What may have weighed on sentiment was a large on-chain transfer noted by blockchain detective Lookonchain. Blockchain data showed that Jump Crypto – one of the largest crypto trading companies – appeared to have transferred 1.1 million SOL (worth $205 million) to Galaxy Digital, receiving around 2,455 BTC ($265 million) around the same time, speculating that Jump could move from SOL to BTC.