Thursday, the fundamentals of Solana in mind acquired a major vote of confidence as a Corp Development of Development based in Florida (DFDV) announced that he had expanded his soil

Treasure by acquiring 17,760 additional tokens. The purchase, valued at around $ 2.72 million, was executed at an average price of $ 153.10 per token. This decision is aligned with the long -term strategy of the company to aggravate Sol Holdings and stimulate the awards.

After this acquisition, the total assets of Devi Dev Corp reached 640,585 soil and soil equivalents, representing a value in US dollars of approximately $ 98.1 million. On the basis of the last reported total of the company 14,740,779 actions in circulation, the current soil-per-share (SPS) amounts to 0.042, about $ 6.65 per share using the price data of the day.

All newly acquired soil will be punctuated with a variety of validators, including the own infrastructure of Defi Dev Corp on the Solana network. This approach allows the company to gain an indigenous return by rewards and validator costs, while directly contributing to decentralization and operational resilience of Solana.

Devi Dev Corp positioned itself as the first public company to make Solana the centerpiece of its cash strategy. In addition to the accumulation and the jalitude of soil, it is also actively engaged in a decentralized finance (Challenge) Opportunities and participation in ecosystems. The company’s cash strategy offers shareholders a direct economic exposure to the token while supporting the development of Solana’s application layer.

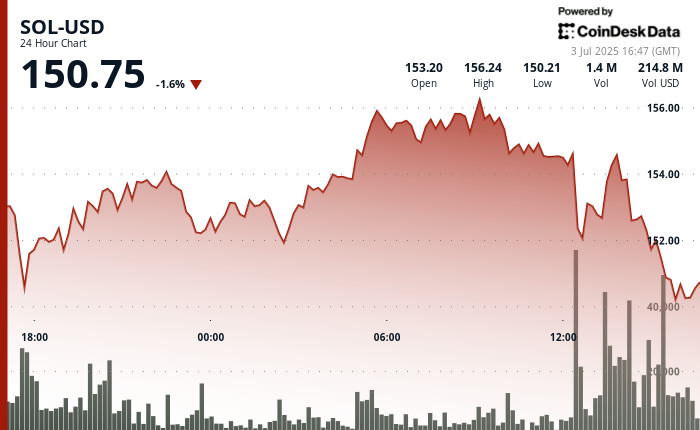

At the time of writing the editorial staff, Sol was negotiated at around $ 150.75, down 1.6% during the last 24 -hour period, according to the Technical Analysis model of Coindesk Research. Meanwhile, the wider cryptography market, as evaluated by the Coindesk 20 index (CD20)is up 0.13% during the same period.

Strengths of technical analysis

- Sol varied from $ 156.28 to $ 150.04 between July 2 5 p.m. and July 3, 4:00 p.m., reflecting 4.15% volatility.

- Strong resistance was formed at $ 156 during the first hours of negotiation, a volume greater than the average triggering a reversal.

- The price dropped below the key support at $ 152 during the period from 12:00 to 3:00 p.m., regulating at $ 150.44.

- In the last hour (15: 16-16: 15 UTC)Soil decreased by 0.63% from $ 151.85 to $ 150.89.

- A strong sale occurred at 15:35 UTC, with a price down to $ 150.44 in high volume (213.6K).

- The support appeared at $ 150.35 with an increasing activity of purchase and a modest recovery in the last minutes.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.