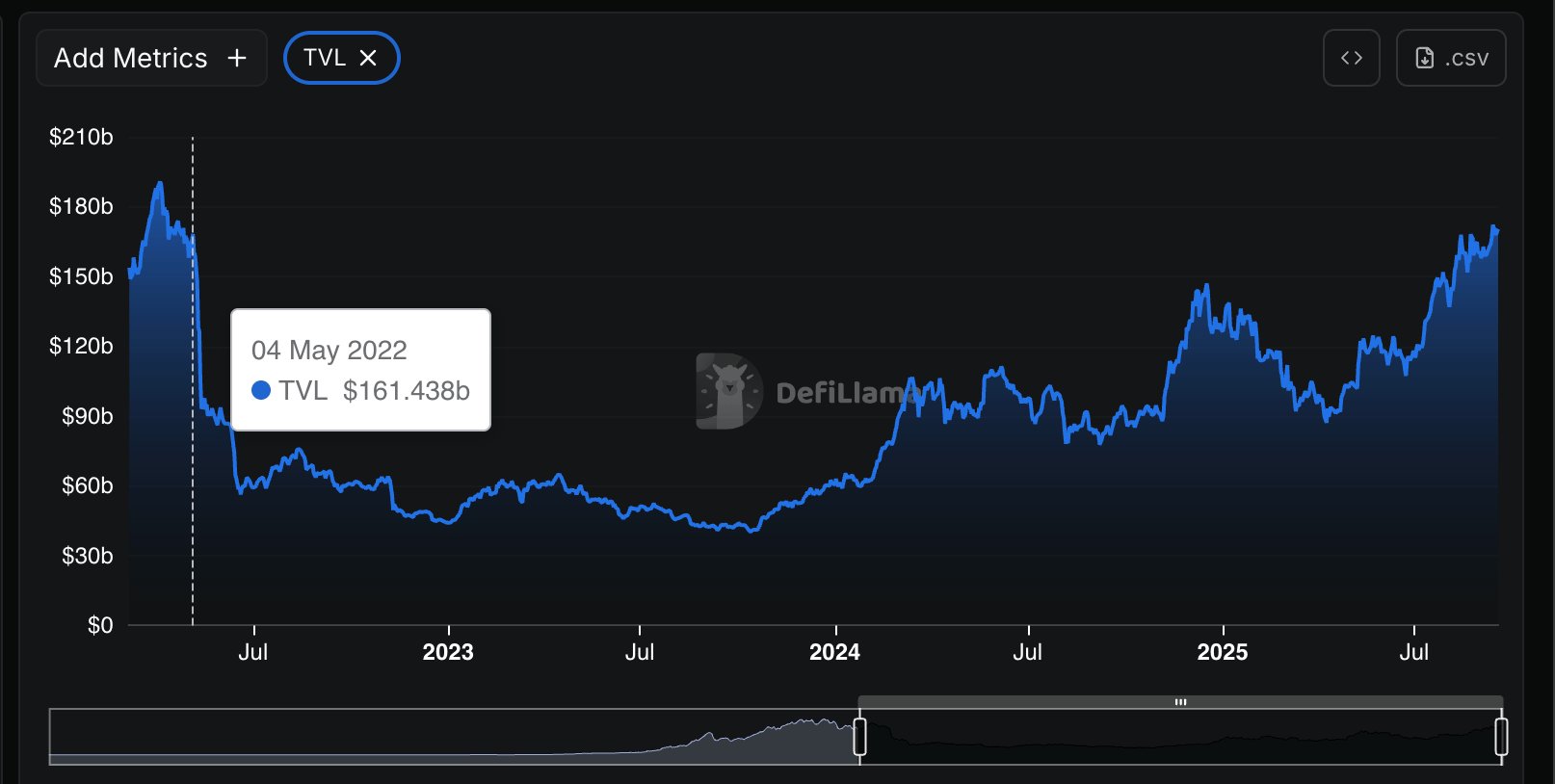

The total amount of capital locked on decentralized finance (Challenge) Protocols reached $ 170 billion on Thursday, a historic figure like now all losses in the terra / Luna 2022 ecosystem market and the bear market that have been deleted.

While Ethereum Still Commands The Lion’s Share of Capital at 59%, Newcomers include Coinbase-Backed Layer 2 Network Base, Hyperliquid’s Layer 1 Blockchain and Su Have Begun to Chip Away at Ethereum’s Dominance, Collectively Amassing More than 10 Billion Worth of Total Value Value Value (TVL)representing around 6%.

Investor trends have changed in this recent cycle; The institutional adoption of the ether has led to the outputs of traditional liquid ignition products like Lido in institutional implementation products such as the cloth, while there has also been growth of the Solana and BNB chain due to a seismic increase in the same activity.

Solana is now the second largest blockchain in terms of deffi with $ 14.4 billion in TVL with a BNB channel behind this with $ 8.2 billion.

A matured sector

The previous bullish market between January 2021 and April 2022 experienced rapid growth through the DEFI ecosystem, TVL from 16 billion to 202 billion dollars. This cycle was more measured with a slow but regular gain of $ 42 billion in October 2022 at 170 billion dollars in September 2025.

The increase suggests that cryptographic investors could learn from their 2022 errors and have created a more mature ecosytem to lend, borrow and generate a return.

The Terra Implosion has experienced a value of $ 100 billion in TVL was almost overnight while investors, including the Crypto bankruptcy coverage fund, three capital arrows, adopted a GUNG Ho approach on a stable algorithmic that finally failed – leading to the contagion and a poor debt spreading throughout the industry.

Terra was the cryptocurrency of a classic “dividend trap”, a product which offered too good yields to be true but which ultimately turned out to be unsustainable.

Now, the yields have fallen with the loan protocol, Aave offering a 5.2% yield on the stablescoins while resetting the ether protocol.

What is the following for Defi?

The DEFI sector is now back where it was before the terrack debacle, although with more sustainable yields, criticism will ask how the market can continue to develop to overthrow the 2021 record in terms of TVL.

The answer to this is nuanced. If it is true that institutional adoption and asset entries like Ether and Solana will continue to drive a bullish story, the industry is still fighting with creeping hacks, scams and connected prints at the same.

Crypto investors have lost $ 2.5 billion against hacks and scams in the first half of 2025 and for industry to really become a viable alternative to traditional finance, investors must be protected.

Unlike traditional finances where deposits are often assured and protected, the very essence of cryptocurrencies means that you are alone; If you lose your keys, be sentenced or hacked, there is no line of assistance to call.

The next iteration of DEFI, whether in this cycle or the next one, will have to focus on safety and hacking of hacking – because industry is always a major implosion far from another cryptographic winter.