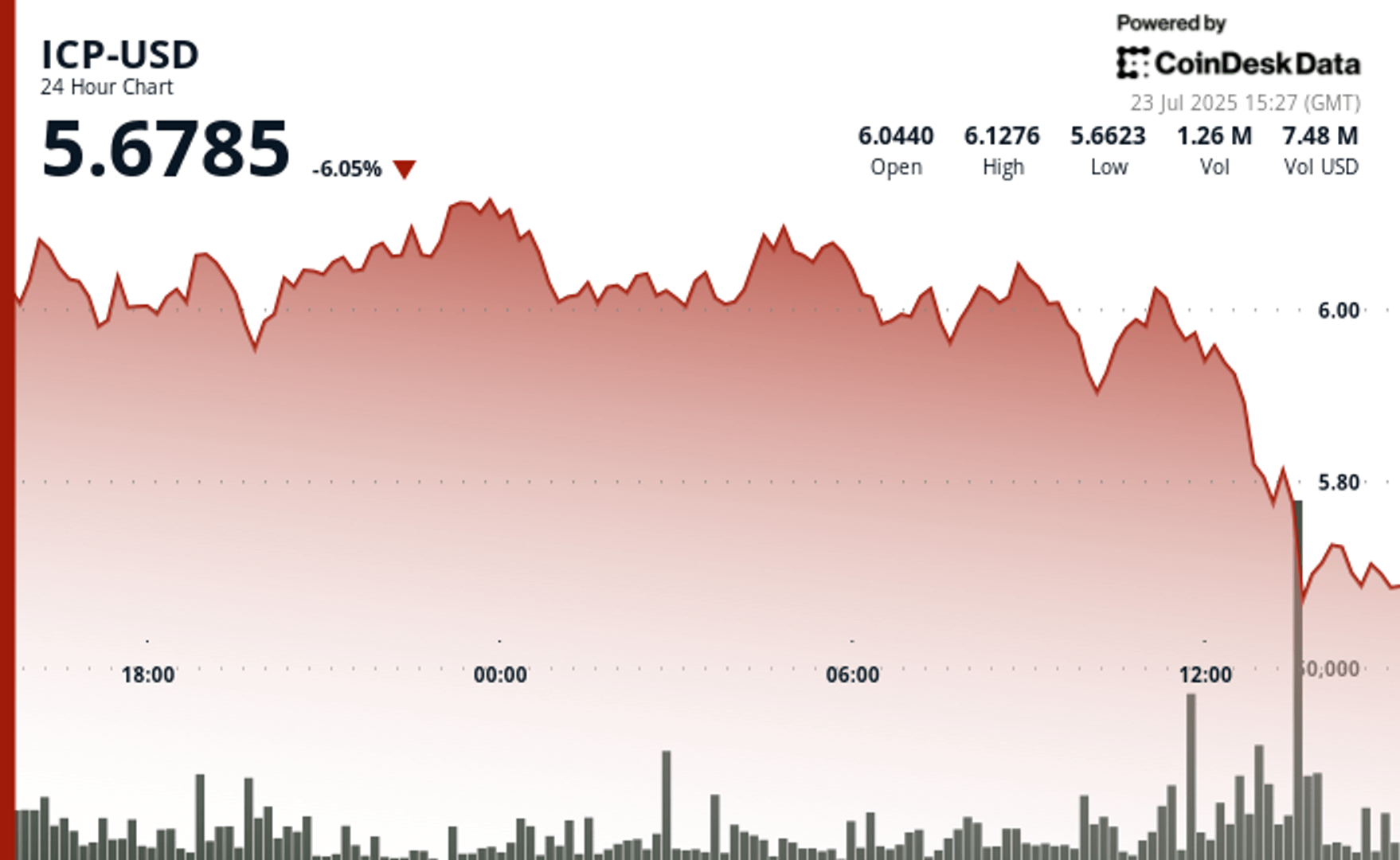

The Internet computer (ICP) recorded a decline of 5.35% in the last 24 hours, from $ 6.01 to $ 5.69 as weakness takes place among the larger Altcoin market. The ICP struggled to maintain bullish momentum, meeting with the company’s resistance in the $ 6.00 at $ 6.10 zone which had capped several escape attempts.

The highest decline occurred during the UTC time at 1:00 p.m. Thursday, when the ICP slipped to $ 5.62, compared to $ 5.97 in a few minutes, driven by a disproportionate increase in the volume of negotiation. Total daily turnover has reached 2.58 million tokens – almost four times the average of 24 hours – highlighting the institutional distribution pressure, according to the Technical Analysis Data model of Coindesk Research.

The wider market has shown a similar dynamic, with altcoins such as soil, AVAX and ADA back in the midst of profits and regulatory developments. Analysts described the retirement of healthy rotation after gatherings linked to President Donald Trump and renewed attention to the legislation on Stablescoin. Despite individual bullish catalysts, many tokens have failed to maintain traction upwards, traders reallocating capital and defending key support areas.

Technical analysis

- DIP fell 5.35% from $ 6.01 to $ 5.69 between July 22 and 23.

- An intra -day summit of $ 6.14 and a bottom of $ 5.62 has established a volatile range of $ 0.52 (broadcast of 8.4%).

- The price fell at $ 5.62, compared to $ 5.97 at 1:00 p.m. UTC on July 23 in the middle of 2.58 million tokens.

- The volume during the capitulation exceeded 100,000 per minute, almost 4 × daily average of 650,000.

- The resistance was confirmed from $ 6.00 to $ 6.10 with several failed escape attempts.

- Critical support was formed at $ 5.62 after a high sale for 13: 40–13: 51 UTC window.

- The market had trouble recovering $ 5.83, with a persistent sale on minor rebounds.

Non-liability clause: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee the accuracy and membership of Our standards. For more information, see Complete Coindesk AI policy.