The broader crypto feeling has remained fragile in the middle of risk flows, although Doge has shown resilience with coherent liquidity inputs.

New context

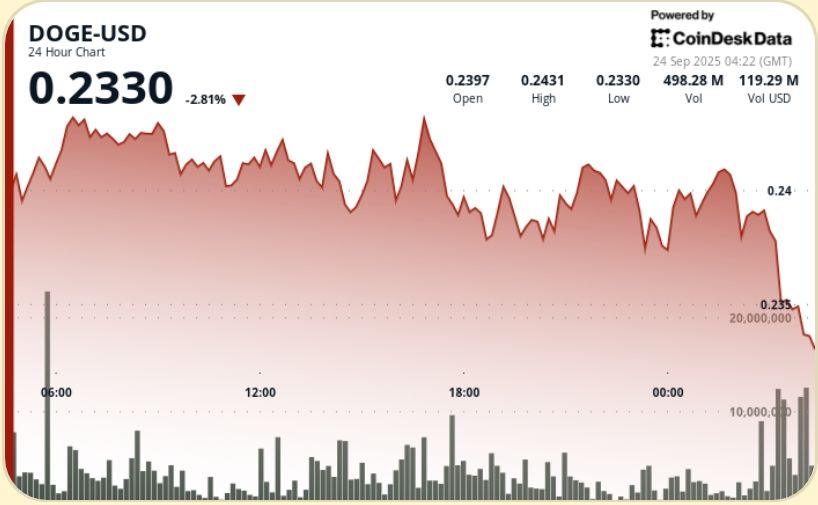

Consolidated in a tight band during the window 24 hours a day, September 23 at 03:00 a.m. to September 24 at 2:00 a.m., trading between $ 0.236 and $ 0.244. The first rallies at 6:00 am and 4:00 pm tested the bar of $ 0.244, but an upward momentum to repeated profit.

Summary of price action

• DOGE fluctuated in a fork of $ 0.008, equal to 3.28% of its trading spectrum.

• The early session peaks tested $ 0.244 but encountered sustained sales pressure.

• Hour of final session (01: 11–02: 10) saw DOGE move from $ 0.239 to $ 0.241 before consolidating $ 0.240.

• Net session gain of 1.37%, going from $ 0.237 to $ 0.240 closed underlines the defensive offer despite volatility.

Technical analysis

• Support: A solid base formed at $ 0.236 at $ 0.240 Zone with buyers working on hollows.

• Resistance: $ 0.241 to $ 0.244 remains a firm ceiling after several refusals.

• Volume: more than 500 meters transacted during the first rallies; The closing of the point above 7m highlighted the increased defense.

• Model: narrow consolidation suggests a potential winding for rupture, although the resistance at $ 0.244 must disappear for continuation.

What traders look at

• Place above $ 0.244 resistance to validate the upward continuation.

• Retirement from $ 0.236 to $ 0.240 Support band for accumulation signs in relation to exhaustion.

• Sustainability of volume – The fact that closing points are repeated in future sessions.

• The wider feeling of same as regulatory developments weighs on speculative assets.