What to know:

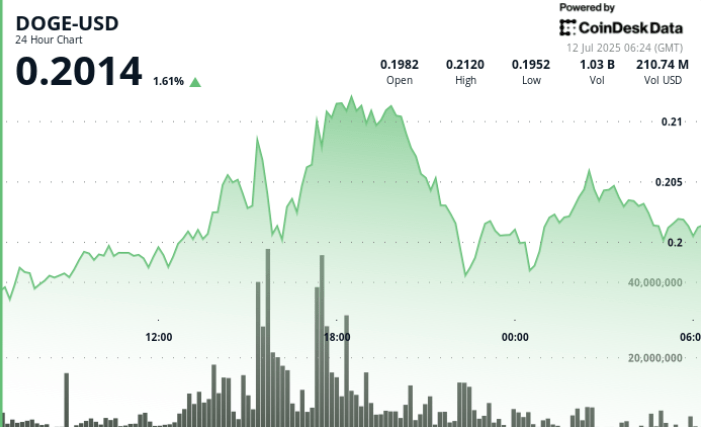

- DOGE increased from $ 0.198 to $ 0.198 to $ 0.213 between July 11, 6:00 p.m. and July 12 05:00 before ending at $ 0.202 – A full retracement of its intraday earnings.

- Negotiation volumes went beyond 1.1 billion tickets during the session of 13: 00 to 15: 00, establishing resistance between $ 0.208 and $ 0.213.

- Support between $ 0.200 and $ 0.201 until volatility at the end of the session, with a last hour stabilizing price approximately $ 0.202.

- Analysts reported rejection at $ 0.211 (20:00) as proof of systematic profit by greater holders.

Context of the news: BTC file, Drive risk flow the rally of the memes

Bitcoin affected a summit of $ 118,000 during the session, as cryptographic markets benefited from an increase in institutional entries – estimated at only $ 50 billion this week.

The relaxation of geopolitical tensions, the improvement of trade relations and the dominant signals of central banks have stimulated risk assets in all areas. Dogecoin, usually a high beta game during crypto gatherings, jumped alongside Altcoins in response.

Summary of price action

- Range: $ 0.198 → $ 0.213 → $ 0.202 | Total swing: 8.6%

- Escape area: $ 0,200 to $ 0.208 authorized over a strong volume

- Resistance: 0.208 to $ 0.213, with reversal of $ 0.211

- Support: $ 0,200 to $ 0.201 tested and maintained several times

- Final time (04: 55–05: 54): The price went from $ 0,200 → $ 0.202 (+ 0.5%)

- Volume pex: 1.1b between 13: 00 and 15: 00; 19m for 05: 00 to 05: 10 late overvoltage

Technical analysis

- The momentum at mid-session broke out above the areas of resistance of the keys but failed to maintain more than $ 0.213

- A reversal supported by the volume close to the High session suggests strategic outings by institutions

- Final hour recovery shows that $ 0,200 remains psychologically significant

- Cooling of the momentum; Short -term consolidation provided in a band of $ 0.200 to $ 0.204

What traders look at

- Can DOGE recover and maintain above $ 0.208 to $ 0.210 to retest the heights?

- A failure less than 0.198 to $ 0.200 would indicate the exhaustion of trends

- Consolidation greater than 0.202 would support a bullish continuation configuration in next week

- The broader feeling of the BTC and macro-risk will continue to dictate the flows of Altcoin

Take away

DOGE followed wider crypto markets higher with its own intra -day break – but its rejection at $ 0.213 and a net withdrawal highlight the fragile nature of meme rallies during high volatility sessions.

Institutional flows remain, but merchants should monitor confirmation of the volume before continuing the increase. $ 0,200 is now the line in the sand.

Warning: Parties of this article were generated with the help of AI tools and examined by our editorial team to guarantee accuracy and membership of our standards. For more information, see the complete Coindesk AI policy.