Even Coin Doge extended its slide on Monday, falling thanks to the support levels and triggering a new interest in sales as the wider market risk appetite has collapsed.

What to know

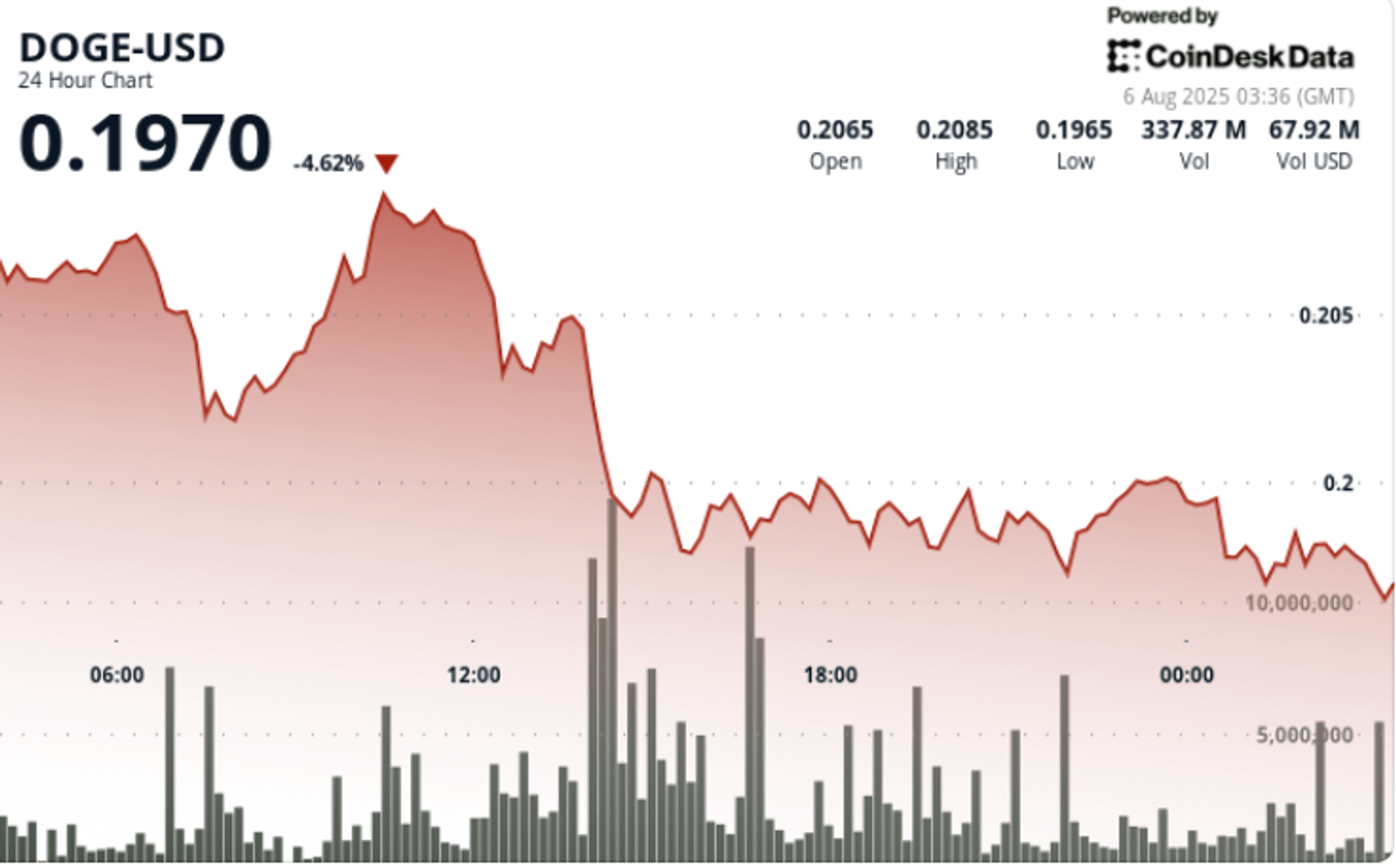

Dogecoin dropped 5% during the 24 -hour session from August 4 at 9 p.m. August 5 at 8:00 p.m., from $ 0.21 to $ 0.20. The token exchanged in a range of $ 0.013, with stockings of $ 0.198 and summits of $ 0.211. A key liquidation event occurred in 2:00 p.m. on August 5, with volumes reaching 877.9 million – almost 4x the average of 268.85 million – triggering ventilation less than $ 0.205.

DOGE put an end to the session at $ 0.1985 after failing to recover higher resistance areas, signaling the continuous institutional sale and confirming new momentum. This decision comes in the midst of a broader weakness in the cryptography market triggered by the feeling of risk through global actions.

New context

Doge’s decline coincided with the institutional outflows of ETFs linked to cryptography totaling $ 223 million in last week, according to Coinshares data. Honest federal reserve and renewed geopolitical concerns – including reprisals and disturbances in the flow of basic products – fueled risk aversion to traditional and cryptographic markets.

At the same time, the sector of the part even remains under pressure while the enthusiasm of the retail is fading and the large holders continue to turn in higher altcoins or in cash posts. DOGE had previously shown signs of accumulation last week, but non-compliance with the level of $ 0.205 invalidated the configuration.

Summary of price action

DOGE started the strong session, reaching $ 0.211 at 01:00, but overturned strongly throughout the day. The highest drop occurred at 2:00 p.m., when the price went from $ 0.205 to $ 0.199 in the middle of 877.9 million volumes. At 19:51, another rinsing at $ 0.1975 occurred on 19.04 million volumes – more than 70 times the hourly average – before a shallow rebound at $ 0.1985 at the end.

A new resistance formed almost $ 0.205, the price unable to maintain a higher recovery at this level after rupture. The token is currently exchanging near session and shows no confirmation of a reversal.

Technical analysis

- DOGE exchanged in a range of 6% between $ 0.198 and $ 0.211

- The volume increased to 877.9 million at 2:00 p.m., almost 4x above the daily average

- Rejection at $ 0.205 sparked ventilation in the middle of the session

- Support attempted $ 0.198 to $ 0.199, but the rebound volume remained low

- The last hour saw the volume of 19.04 million burst at $ 0.1975, creating local resistance at $ 0.1988

- The momentum remains downwards unless the price recovers $ 0.205 from a convincing volume

What traders look at

Traders look closely, that Doge can stabilize above $ 0.198 or cope with a drawback around $ 0.185. Failure to comply with $ 0.205 can extend liquidations. With dynamic volumes on downward movements and discoloration of overlaps, the sellers remain in control unless the feeling of macro-risk improves or the outputs of FNB are reversed.