Dogecoin jumped more than 7% in the last 24 hours, fueled by more than $ 200 million in whale purchases and a strong increase in the positioning of derivatives. The samecoin crossed the level of resistance of $ 0.25, triggering a break led by a volume and sending open interests higher than $ 3 billion. The ownership of the great holder is now just under 50%, highlighting increasing institutional participation.

The technical models suggest more upwards to the $ 0.27 area, with an intact bullish feeling.

New context

- The accumulation of whales has crossed 1 billion DOGE tokens (worth 200 million dollars) in the last 24 hours.

- The ownership of the large holder has almost 50%, a threshold approached the last time during the summits of the previous market.

- Doge Futures Open Interest exceeded $ 3 billion, indicating a clear return of leverage.

- The broader force of the cryptography market supported the rally, with a feeling of risk stimulated by the gains in the equity market.

Summary of price action

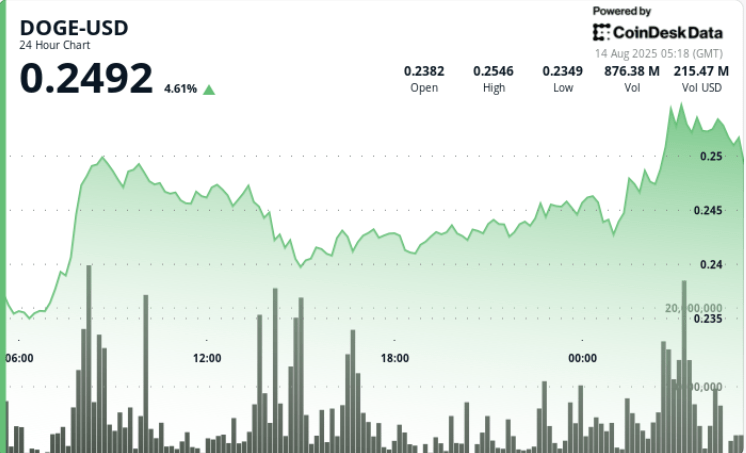

- DOGE joined $ 0.24 to $ 0.25 in the period 24 hours a day, August 13 05:00 to August 14 04:00 (+ 7%).

- The negotiation range extended from $ 0.24 to $ 0.26, reflecting 9% intra -day volatility.

- An escape greater than $ 0.25 occurred in the evening hours following the previous consolidation.

- The volume during the escape phases has considerably exceeded daily averages, culminating at 29.2 million in a single minute.

- The last hour showed stabilization at $ 0.25 after a brief decline.

Technical analysis

- The escape of the Haussier flag model projects a short -term goal close to $ 0.27.

- $ 0.25 now acting as a new medium after several successful repetitions.

- The resistance amounts to $ 0.26, with a clean movement above the opening path at $ 0.27.

- The volume profile indicates a strong accumulation rather than a speculative unsubscription.

- The oint -term and financing rates suggest long -term supporting long positioning.

What traders look at

- Capacity of a support of $ 0.25 to be kept for any perspective intraday.

- Discover $ 0.26 to confirm the continuation to $ 0.27.

- Whale portfolio flows for current accumulation signs.

- Funding rate peaks that could report long overcrowds.

- Correlation with broader risk movements in actions.