The same part grows through resistance on an accumulation of billions of tonnes before the withdrawal cuts at the end of the session.

Preview of technical analysis

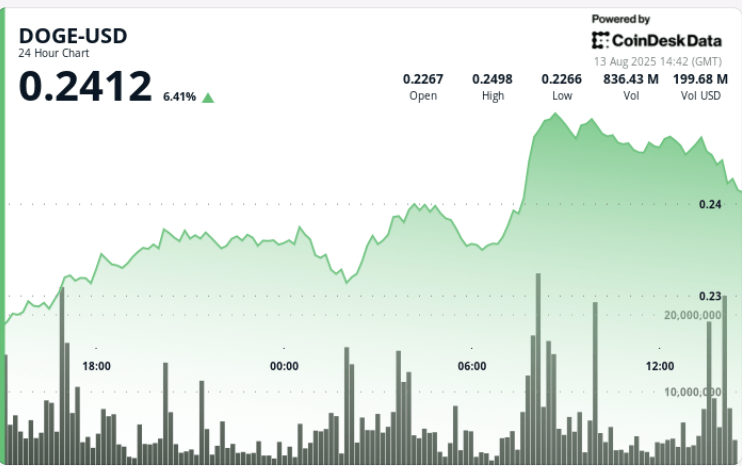

DOGE climbs 6.5% during the 23 -hour period ending on August 13, 2:00 p.m., from $ 0.23 to $ 0.24 in a range of $ 0.02 (9.58% volatility). Early trade confirms $ 0.23 as a key support on the volume above average, while the mid -session force between 07: 00-08: 00 sends the price through multiple resistance levels on a volume of 1.56 billion – the largest impression of the day – signaling a coordinated institutional accumulation.

Prices end almost $ 0.25 as a profit, capping the break. The support goes to $ 0.24 after several successful retratestage at the end.

New context

The accumulation of whales exceeded 1B DOGE (~ 200 million dollars) during the rally, which raises a property of large accusation almost half of the food in circulation. The overvoltage aligns with the bullish technical configurations on daily graphics, including a bull flag break and an emerging golden cross, with targets of pointing pointing to the $ 0.30 area.

Summary of price action

• DOGE gains 7% from $ 0.23 to $ 0.24 in August 12, 15: 00 – August 13:00

• 07: 00-08: 00 Breakout over a volume of 1.56b erases multiple resistance levels

• Prices peak almost $ 0.25 before being $ 0.24 on profit taking

• The support of $ 0.24 is due to repeated tests at the end of the session

Market analysis and economic factors

The combination of whale entrances and Haussier graphic structures supported Doge’s momentum, although the $ 0.25 offer remains a short -term ceiling. Consolidation greater than $ 0.24, associated with the increase in support levels, maintains positive technical biases. The institutional participation sustained will be the key for an escape of $ 0.25 and a race towards the technical target of $ 0.30.

Technical indicators analysis

• Support: $ 0.23 (early defense), $ 0.24 (floor at the end of the session)

• Resistance: $ 0.25 (profit zone)

• Volume: 1.56b during the time of rupture; Daily average 565.8 m

• escape of the Taure flag

• higher stockings indicate a persistent accumulation trend

What traders look at

• Escape confirmation greater than $ 0.25 to open the way to a target of $ 0.30

• Force of $ 0.24 support on any drop in profit

• Continuation of accumulated large accumulation trends

• Impact of the broader feeling of the market on memes currency flows