What to know

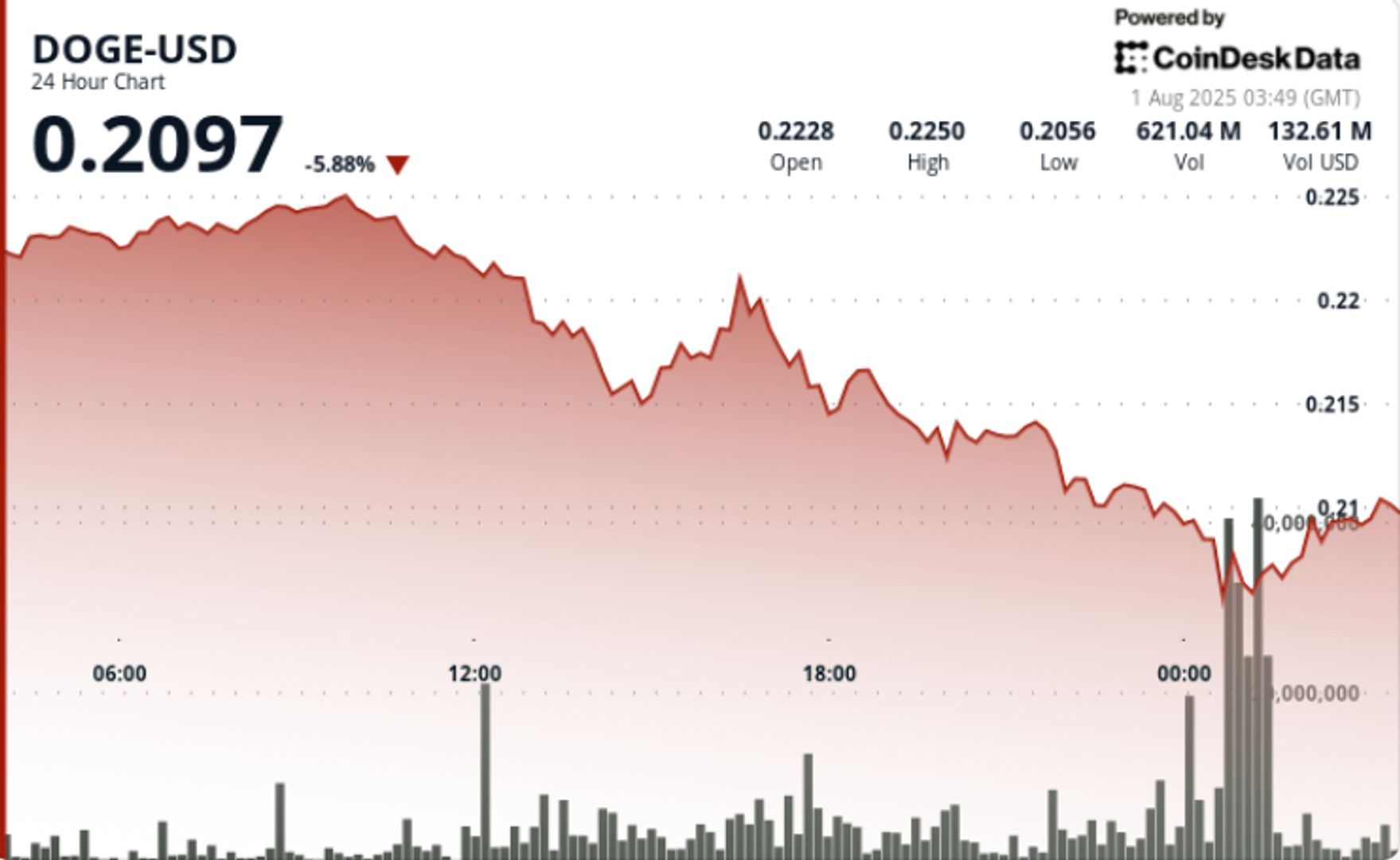

DOGE dropped from $ 0.22 to $ 0.22 to $ 0.21 between 3:00 a.m. on July 31 and 02:00 on August 1, marking one of the highest daily decreases this month. The price action took place in a range wide of $ 0.03 – between a peak of $ 0.23 and a minimum of $ 0.20 – high resistance to the upper limit and a capitulation near the session.

The volumes increased sharply during the last hours of the session, especially at midnight, where trading increased to 1.25 billion Doge – well above the average 24 hours a day of 365 million. This decision suggests an increased liquidation activity, probably triggering cascade sales orders on leverage.

New context

• DOGE dropped 8% over 24 hours while the volume jumped to 1.25 billion during the negotiation overnight.

• Resistance to $ 0.23 held firm despite the first upward attempts, while $ 0.21 has become short -term support.

• Institutional portfolios have acquired 310 million DOGE during correction, signaling accumulation during weakness.

• Bit Origin added 40 million DOGE to its treasure as part of a 500 million dollars company diversification program.

• The wider markets of cryptography remain under pressure by macroeconomic uncertainty, with the inflation and ambiguity of the path of the rates of ambiguity disturbs the feeling in the short term.

Summary of price action

DOGE tested $ 0.23 to 9: 00 to 10:00 am on July 31 but failed to support the momentum. The sale accelerated throughout the afternoon and in the evening, the largest fall of an hour occurring just after midnight. The price reached a hollow of $ 0.20 before stabilizing almost $ 0.21, where it found a repeated short -term support.

In the last 60 -minute session (01: 08–02: 07 on August 1), DOGE has slightly rebounded from $ 0.21 to $ 0.21, recording a modest gain of 1%. The movement, although limited, came on a relatively balanced volume and suggests short -term stabilization. Rejection nearly $ 0.21 of resistance and narrowing price strip indicates a potential exhaustion of sales pressure in the immediate term.

Technical analysis

• 8% decrease From $ 0.22 to $ 0.21 with a large Range of $ 0.03 Between up and down.

• Resistance at $ 0.23 Confirmed after failing the attempts to escape.

• Support nearly $ 0.21 Hold several times during the last hour, showing signs of accumulation.

• The volume peak at 1.25 billion Around midnight, an increase of almost 3x compared to the daily average.

• Reduced price action in a tight $ 0.21 strip to $ 0.21 Post-recovery, potential signaling base training.

What traders look at

• If Doge can maintain its sole over the support range from $ 0.21 to $ 0.20 in upcoming sessions.

• Signs of accumulation of monitoring of portfolios that have acquired during the sale.

• Macroeconomic signals – including comments from American inflation and the feeling of risk of Asian actions – which could influence a broader appetite for cryptography.

• Reaction to the inclusion of DOGE in the Bit Origin strategic allowance and the potential catalysts of potential cash demand.