Dogecoin pulls back from early session strength as Grayscale’s DOGE ETF debut fails to offset selling pressure and lingering resistance levels.

News context

Grayscale launched its DOGE ETF (GDOG) on the New York Stock Exchange, expanding institutional access to the meme coin. The debut follows the continued expansion of ETFs in the crypto industry, including XRP and broader altcoin products. However, the ETF launch comes during a period of structural weakness for DOGE.

The distribution of whales remains a major obstacle. On-chain data shows that wallets holding 10-100 million DOGE sold nearly 7 billion tokens between September 19 and November 23, forming a significant oversupply. These sales follow DOGE’s decline from its high of $0.27 and continue to dampen bullish momentum despite strengthening institutional infrastructure.

Technical analysis

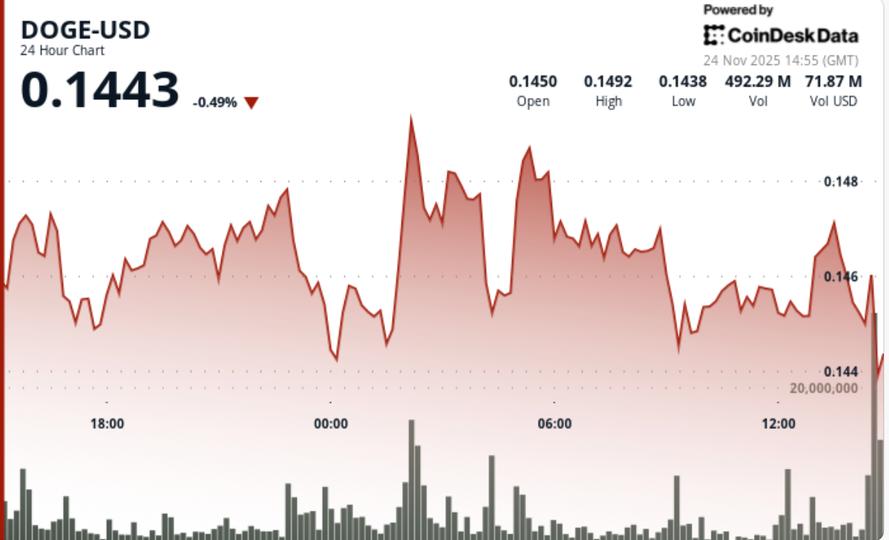

Dogecoin remains stuck in a tight consolidation range between $0.144 and $0.149. The range high at $0.1495 continues to serve as a hard ceiling, rejecting any attempt at a breakout. This matches the broader downtrend that began earlier in November.

The structure remains neutral to bearish, with lower highs forming below the $0.149 to $0.152 area. The $0.144 support has undergone several tests, forming the current bottom. Momentum indicators show no confirmed reversal signals, and diminishing volumes during recovery attempts highlight a lack of sustained buying pressure.

The ETF launch generated interest but not enough demand to overcome the broader technical deterioration, leaving DOGE vulnerable to further declines if support gives way.

Price Action Summary

DOGE traded between $0.1449 and $0.1495 during the session ending November 24, ultimately closing at $0.1456, a decline of 1.4%. The early session surge occurred during a major volume spike of 850 million at 02:00 UTC, approximately 180% above average, pushing the token to an intraday high.

However, repeated rejections at $0.1495 prevented further continuation and afternoon selling pushed the price lower. Multiple breakdown attempts confirmed weakness around $0.147, and the session ended with DOGE sitting just above its established support of $0.144.

Volume faded into the close, reinforcing the idea that buyers remain hesitant despite the ETF’s catalyst.

What Traders Should Know

• Support at $0.144 is the last significant short-term bottom; breakout exposes slide towards $0.138

• Resistance at $0.1495 needs to be reclaimed to signal any reversal in momentum.

• ETF flows over the next 48-72 hours will indicate whether institutional demand is significant or short-lived.

• Whale distribution remains the dominant downward force despite better access to the traditional market

• Broad market beta remains high; Bitcoin weakness continues to impact DOGE structure