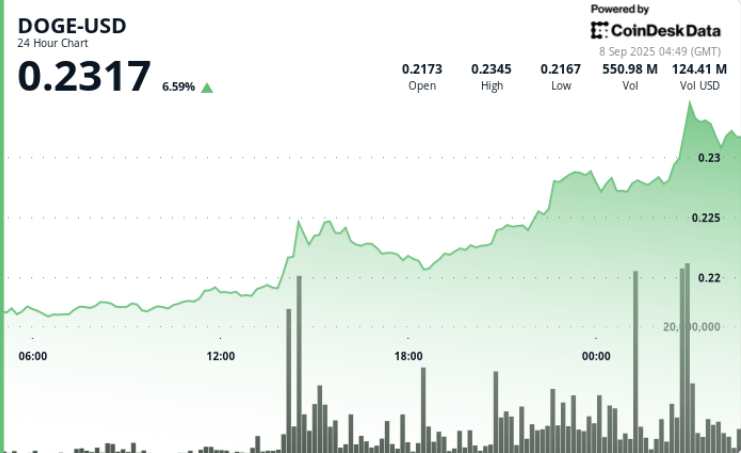

Dogecoin posted a controlled increase in a tight intraday strip, buyers repeatedly defending the area from $ 0.213 to $ 0.214 and sellers leaning in the area from $ 0.220 to $ 0.221. The momentum improved on the rebounds where the volume increased above session standards, but late pharmacies maintained the price pinned just below the end resistance.

New context

- No confirmed catalyst title has led the movement. The session was dominated by the dynamics of control flows around $ 0.21 support and $ 0.22 of resistance.

- References prior to “summits of all time”, FNB deposits or the Treasury announcements have been deleted due to the lack of verification. This reading focuses strictly on the observable price of prices and volume.

- Flows of wider even have been mixed, with an obvious intraday rotation but no escape at the sector confirmed by the closing resistance.

Summary of price action

- Exchanged a fork from ~ 0.008 $ to $ 0.010, approximately 3 to 4% swing, with Bas almost $ 0.213 to $ 0.214 And Highs probing $ 0.220 to $ 0.221.

- The most steep leg came in the middle of the session to $ 0.213, where The purchase intervened quicklyproducing a rebound in style V.

- Rebound attempts Curved under $ 0.22With several rejections that bring together the band from $ 0.220 to $ 0.221.

- Closing time has shown reopeningLeaving the price stabilized just under resistance and preserving the lower intraday structure.

Technical analysis

- Support: $ 0.213 to $ 0.214 is the intra -day application area. A break up under 0.210 $ 0.210 to $ 0.212 then $ 0.205.

- Resistance: $ 0,220 to $ 0.221 remains the immediate ceiling. Above this, the reference levels are $ 0.224 at $ 0.226 and $ 0.230.

- Momentum: RSI Holder of the mid -1950s reflected a neutral bias in Maleficent without overexaling.

- MacD: The histogram converges towards a potential bullish crossing, in accordance with the accumulation on DIP rather than the purchase of prosecution.

- Model: In progress lateral consolidation less than $ 0.22. Net rupture and maintenance above $ 0.221 on the expansion volume would confirm the continuation; Failure maintains the intact chop.

- Volume profile: Reversal Rebounds printed Relative volume overperformanceWhile tests in resistance saw the participation fades, signaling the need for stronger sponsorship to unravel.

What traders look at

- Can be closed above $ 0.221 with volume expansion. A decisive daily closure by the resistance would validate a passage from trade linked to the beach to continuation, opening $ 0.224 to $ 0.226 first, then $ 0.230. Repeated failures invite average reversion to $ 0.214.

- Depth and absorption at $ 0.213 to $ 0.214. Local rest offers and rapid recovery behavior support the case of a bull. Thin or slower rebounds would warn that the drop in decline is weakening.

- Quality of the break if it occurs. Traders will look for higher highs and higher stockings on intraday frames, narrowing the wicks at the heights and growing participation rather than a single peak that is reversed.

- Derived posture. Funding, open interest and long shorts should confirm the point of the point. Rising oi with stable funding is healthier than a long crowded construction with a bonus that invites pressure.

- Correlation with the BTC and the width of the same sector. A BTC pushes through a nearby resistance or a wider confirmation of memes of the follow -up. The divergence would temperature expectations.