Memecoin breaks the critical $0.15 low on exceptional volume, establishing new support near $0.138 as bears strengthen their control over the major time frames.

News context

• Crypto markets remain extremely fearful, with Bitcoin slipping below $85,000.

• Total market capitalization loses $120 billion in 24 hours as risk aversion deepens.

• Meme coin industry is experiencing broad deleveraging; liquidity decreases on major exchanges

• Whale hoarding activity slows sharply after two-week buying frenzy

• Analysts note forced liquidations among altcoins as macroeconomic flows weaken

Price Action Summary

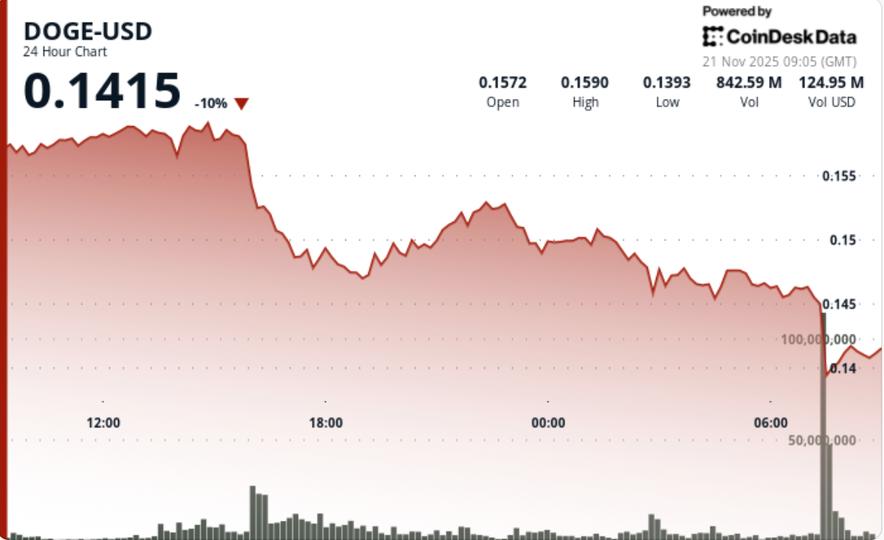

• DOGE crashes 11.2% from $0.1578 to $0.1401, breaking multiple layers of support.

• Total volume climbs to 2.52 billion, 263% above the 24-hour SMA.

• The breakdown ignites at 07:00 UTC, rejecting resistance at $0.1595 and entering a controlled descent.

• The capitulation event occurs between 07:33 and 07:36, with over 500 million turnover in price gaps ranging from $0.144 to $0.138.

• Stabilization attempts emerge near $0.140, forming a temporary structural bottom

• The session structure shows consecutive lower highs and lower lows, confirming the deterioration of the trend.

Technical analysis

Dogecoin chart suffered decisive structural damagedriven by a cascade of technical failures rather than fundamentals. The early rejection at $0.1595 created clear bearish momentum, which intensified as liquidity decreased in meme coin order books.

The cascade from $0.144 to $0.138 revealed algorithmic or institutional selling programs executing in rapid succession. These minute-to-minute gaps have created technical voids, indicating a liquidity shift that typically requires future filling before sustainable rallies occur.

The acceleration in volume – 2.52 billion in total, including 500 million during the crash window – confirms that this decision was driven by large-scale distribution rather than retail panic. Stabilization around $0.140 suggests initial exhaustion of selling pressure, but the structural trend remains decidedly bearish given the intact pattern of lower highs and lower lows.

Momentum indicators are now showing strong oversold, but without confirming divergences. DOGE is trading below its 50D and 200D moving averages, both of which are now falling – a classic sign of continued trend weakness.

What traders should watch out for

Dogecoin is in a high-risk inflection zone where volatility and liquidity conditions can change quickly:

• $0.138 is the line in the sand: failure results in a rapid run-up to $0.135, then $0.128.

• Stabilization at $0.140 must turn into sustained demand to avoid deeper structural collapse.

• Watch for refill attempts at the $0.144 gap zone: reclaiming this level would signal early recovery attempts.

• General crypto sentiment remains fragile; Further Bitcoin Weakness Will Disproportionately Impact DOGE

• Lack of accumulation of fresh whales after decline prompts caution in the short term

• If ETF news for DOGE resurfaces, expect volatility, but not necessarily directional relief.