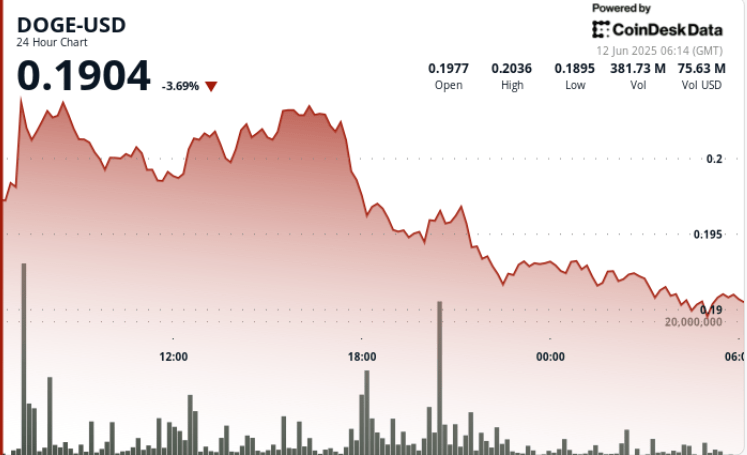

Dogecoin Doge has experienced net fluctuations in the last 24 hours, initially spent 20 cents before falling to 19.1 cents, representing a fork of 6.63%.

The same part formed a V recovery scheme at the end of the session, returned to $ 0.192 with an increase in volume, although the resistance remains firm around more than 20 cents.

New context

- The last action of the Dogecoin prices comes in the middle of the renewed interest in the tokens even after a series of upheavals of cryptographic markets.

- Speculation around a possible ETF DOGE has gained ground, Polymarket data indicating 51% chance of approval of the SEC in 2025 – a development that could inject institutional capital on the market.

- Meanwhile, the integration of Dogecoin with the basic Coinbase network adds a functional value, introducing Dogey for the first time in packaged in DEFI ecosystems.

- The capacity of the same corner to attract high volume support near the key levels suggests that institutional buyers can quietly constitute positions, even if retail merchants remain cautious.

Distribution of technical analysis

• DOGE went from $ 0.196 to $ 0.204 (4.08%), then inverted strongly to $ 0.191 (fork of 6.63%).

• Confirmed resistance at $ 0.203 at $ 0.204 after three refusals on a heavy volume (> 1B units at 07:00).

• The support trained at $ 0.192, with short rebounds of this level despite the weakness.

• The last hour increased from $ 0.192 to $ 0.190, followed by a quick V recovery at $ 0.192.

• The accumulation panels have emerged, the volume increasing beyond 2.3 m in the last minutes.