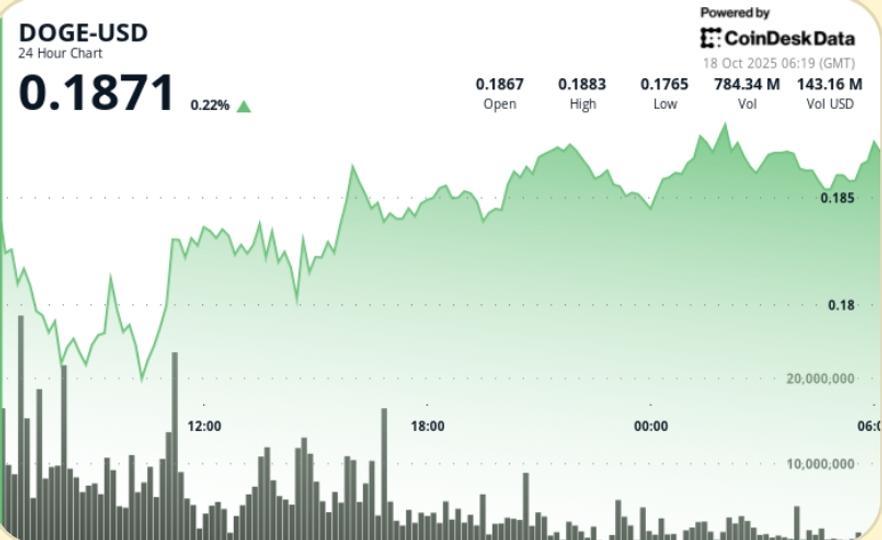

Dogecoin stabilized on Friday after initial volatility saw the price drop to $0.176 before returning to a tight range of $0.18 to $0.19. The session’s 7% rise came amid renewed macroeconomic nervousness and reports of large whale liquidations totaling more than $74 million.

What you need to know

• DOGE traded between $0.176 and $0.189 from October 17 at 6:00 a.m. to October 18 at 5:00 a.m., in a range of 6.7%.

• Trading volumes exceeded 1.4 billion during the 07:00-08:00 UTC sell-off, establishing strong support near $0.18.

• Large holders reportedly unloaded 360 million DOGE ($74 million) as broader crypto markets fell 6% on tariff headlines.

• The price rebounded steadily to close around $0.186, forming higher lows during the afternoon sessions.

• Futures positioning remained mixed as traders weighed policy signals from the Fed against inflation risks.

News context

The morning decline followed weak markets following the Trump administration’s declaration of 100% tariffs on Chinese imports – a move that sent risk assets across Asia lower. DOGE faced early liquidation pressure but found stability as whales and market makers absorbed a bid near $0.18. Analysts have noted a high concentration of bids around this level, suggesting accumulation rather than capitulation. Meanwhile, derivatives funding rates normalized after a brief rise in short positions, indicating sentiment is stabilizing.

Price Action Summary

• Sharp drop from $0.188 → $0.176 at 07:00 UTC on volume >1.4 billion — the capitulation move of the day.

• The rally through the middle of the session allowed DOGE to recover between $0.184 and $0.187, consolidating for the rest of the day.

• Last hour (04:22-05:21 UTC): Test of the low of $0.1853 encountered with a volume peak of 10.5 million, followed by a steady rebound up to $0.1862.

• Resistance persisted at the $0.188 to $0.189 area with several unsuccessful breakout attempts.

• A tight end of session range ($0.1860 – $0.1862) and a break down volume signal positioning ahead of the catalysts.

Technical analysis

• Support – $0.175 to $0.180 remains a critical accumulation zone; buyers defended the lows with strong conviction.

• Resistance – $0.188 to $0.190 marks the upper consolidation band; the breakout could target $0.20+.

• Volume – Maximum activity at 1.4 G; the compression of the volume at the end of the session promotes the training of balance.

• Pattern – A narrow band consolidation after the morning surge indicates a volatility coil.

• Momentum – Neutral RSI near 49; MACD flattening – neither trend dominant yet.

What traders are watching

• Confirmation of $0.18 as a short-term base ahead of weekend sessions.

• Renewal of whale flows — if accumulation continues after removal of $74 million.

• Potential rotation into meme assets amid optimism for ETFs next week.

• Comment from the Fed on customs tariffs and the impact of liquidity on speculative flows.

• A break above $0.19 as a trigger for a retest of the $0.20 to $0.21 zone.