Dogecoin resisted early volatility before settling in a tight band, with institutional flows anchoring support of almost $ 0.251. Intermediate whales and portfolios have increased assets, signaling accumulation as technical models are compressed in an ascending triangle. Traders are now looking at if $ 0.25 can harden in a launch base to $ 0.27 to $ 0.30.

New context

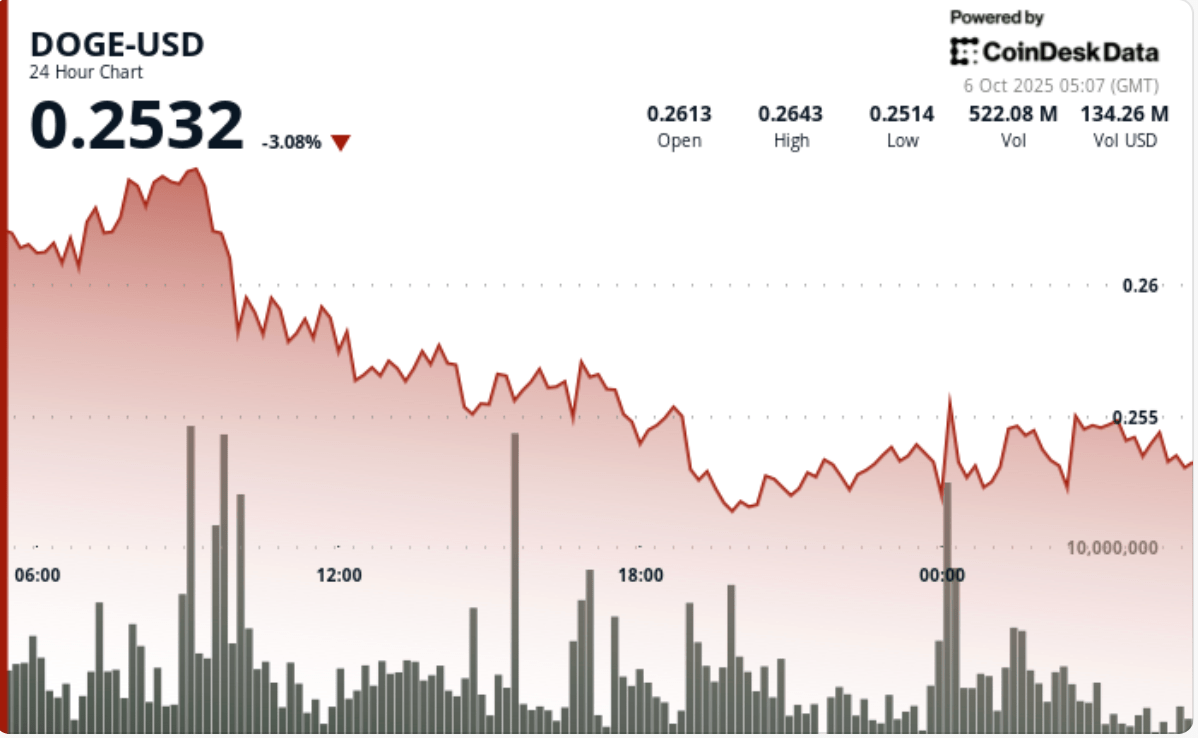

DOGE exchanged a range of 5.3% in October 24 to 6 at 3:00 am, moving between $ 0.265 and $ 0.251. The token opened at $ 0.258, joined $ 0.264 briefly, then faded in afternoon sales pressure.

At the end of the session, the support held a company in the area from $ 0.251 to $ 0.252, the stabilized purchase interest price almost $ 0.254. Channel data have shown that level midfield portfolios have added 30m Doge, raising their assets combined with tokens of 10.77 billion, while the TOP 1% of addresses now control more than 96% of the food.

Summary of price action

- DOGE tilted through a corridor of $ 0.014, culminating at $ 0.265 and bottom at $ 0.251.

- In the afternoon, the sale led to a lower price, but $ 0.251 to $ 0.252 of support held on supported purchases.

- The late price stabilized the price at $ 0.254, referring to soil formation.

- The last 60 minutes have seen a sale at $ 0.2540 followed by a modest rebound, with volumes on average 5.2 million and dilating to 33.1 m during the liquidation.

Technical analysis

- The key support is anchored at $ 0.251 at $ 0.252, where buyers have repeatedly defended the drops. The resistance is $ 0.265, with progress of for profit.

- The structure reflects close consolidation within an ascending triangle, confirmed by accumulation signals.

- The metrics on the chain suggest that positioning moves to large carriers, strengthening the bullish configuration. A decisive movement above $ 0.265 could trigger targets in the area from $ 0.27 to $ 0.30.

Which traders are looking at?

- If $ 0.25 continues to hold the structural soil in American hours.

- The question of whether the whales extend the accumulation beyond the 30-meter token added this session.

- An escape attempt greater than $ 0.265 to open the way around $ 0.27 to $ 0.30.

- The impact of the concentrated supply (96% with higher supports) on volatility around escape levels.